If the Chinese owner of the 99-year lease to the Port of Darwin is looking to make any money from its initial $506m infrastructure investment, it might want to get its skates on.

As far as Margin Call can tell, things aren’t looking too flash for the port’s ultimate Chinese owner, the Shandong Landbridge Group, with the port’s Australian subsidiary making $151.1m in cumulative losses over the past five operating years since taking control of the north Australian port facility in November 2015.

Landbridge Infrastructure Australia, the vehicle the Chinese created to buy the port infrastructure from the Northern Territory government, is yet to turn an annual profit, with its biggest annual loss so far of $44.5m recorded last year in the 12 months to June 30.

The Aussie subsidiary of the Chinese giant, which is headquartered in the city of Rizhao in Shandong Province, is run by Sunshine Coast-based CEO Michael Hughes and chaired by the Chinese group’s billionaire owner Ye Cheng, who is said to have strong links to the Chinese Communist Party.

Ye, 59, is estimated by Forbes to be worth $US1.5bn ($1.94bn). His Shandong Landbridge Group is active in petrochemicals, logistics, trade and, of course, ports.

His wife Liu Jingxia owns a waterfront apartment in the Docklands in Melbourne that her billionaire husband cites as his address on local Landbridge company records.

She paid $4.7m in 2011 and in 2018 took out a second mortgage on the home.

Since taking over the Darwin port, Landbridge has managed to generate total revenue of $231.8m, or an average of $46.4m a year, but has not yet managed to get its investment into the black.

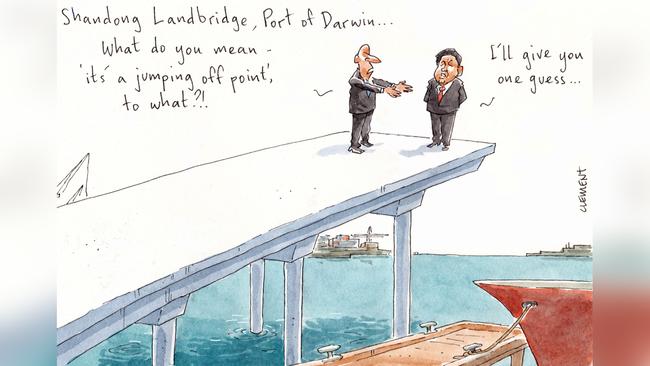

Analysis of the group’s PwC-audited accounts reveals Landbridge has made an annual average bottom-line loss of just over $30m. Seems a bit odd, buying an asset for more than $500m only to tolerate an annual loss. What strategic imperative could there possibly be other than profit?

The back-of-the-envelope assessment of the Chinese investment on our northern shores, which has been controversial since it was facilitated by the Tony Burgess-led Flagstaff Partners advising the NT government and waved through by the Foreign Investment Review Board in 2015, comes as Prime Minister Scott Morrison’s government embarks on a review into any security risks that may be associated with the Chinese group’s long-term lease of the port infrastructure.

The assessment is being conducted by Peter Dutton’s Department of Defence.

Maybe it should take a look at the numbers.

-

Timely dismount

Surely timing is key when you’re on the pommel horse punching out a series of circles, swings and flairs.

Just ask James Packer lieutenant and former Gymnastics Australia chairman Sam McKay, who looks to have timed his exit as chair of the troubled sports organisation to a tee.

Sex Discrimination Commissioner Kate Jenkins’ independent Australian Human Rights Commission report into gymnastics paints a damning picture at all levels of the sport, detailing the likes of sexual, physical and emotional abuse of young gymnasts through to issues around investigations and governance.

Dealing with the fallout of the report is new GA chairman and fintech venture capitalist Ben Heap, who took over running the board from McKay late last year.

Sydney-based McKay, who runs Packer’s consumer brand investments at Packer’s private Consolidated Press Holdings and is also chair of and a major shareholder in up-market stationery group kikki. K, has dodged a bullet that Heap is now taking.

“The review found that there are significant cultural challenges within the sport of gymnastics in Australia, cutting across coaching practices, the health, safety and wellbeing of gymnasts, complaints and investigations, and governance,” Jenkins’ report says.

Just weeks ago Heap, the businessman and former UBS exec from Sydney’s upper north shore, was appointed as independent, non-executive chair of Commonwealth Bank’s new fintech incubator X15 Ventures, but will now have his hands full responding fully to Jenkins’ report.

The human rights commission has called on GA, which operates as a not-for-profit, to admit to its failings and apologise to victims.

But the elephant in the room for Heap is the issue of whether victims are entitled to compensation.

At June 30 last year, when McKay was still chair, GA, which received more than $6.8m in government grants last year, had total liabilities ($4.3m) topping total assets ($3.9m), with about $2.2m cash in the bank and Heap not exactly flush with funds.

-

Fink’s time flies

Time is flying for Ray Finkelstein in his unfolding royal commission into the Helen Coonan-chaired Crown Resorts, with the former federal court judge now almost halfway through the time frame for his review.

Finkelstein must report his findings to the Dan Andrews government by August 1 — hopefully the recuperating Victorian Premier will be back at work by then — but is yet to even begin his public hearings into the listed group, of which billionaire James Packer is the biggest shareholder at 37 per cent.

The Fink has now extended the deadline by which he will accept submissions into his inquiry, which follows a similar probe conducted by former Supreme Court judge Patricia Bergin in NSW last year and a parallel inquiry now unfolding in the west, where Crown also has a casino.

Submissions in Victoria were set to close on April 26, but Fink is still accepting material from those who request an extension.

He will begin COVID-friendly public hearings on May 17 that are expected to run for about six weeks, giving Finkelstein and his team of counsel assisting Adrian Finanzio SC, Penny Neskovcin QC, Meg O’Sullivan and Geoffrey Kozminsky only another five or six weeks to get their doco to Spring Street by their tight deadline.

Bear in mind that Bergin’s report was more than 750 pages long.

It’ll be a long winter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout