Fortescue chief scientist Bart Kolodziejczyk resigns, Step One’s Greg Taylor the new undie king

Saving Fortescue

As billionaire Andrew Forrest struts the world stage at COP26 on his self-appointed mission to save the world by making fresh billions by selling hydrogen, all is not quite well in Fortescue’s home camp.

Twiggy and his latest pet project, Fortescue Future Industries (FFI), may be capturing enough headlines to put even Elon Musk’s standing as the world’s most self-promoted billionaire under pressure.

But, while delivering Fortescue’s September quarter result last week, chief executive ElizabethGaines copped another serve from analysts who, while broadly in favour of the world being saved, are not quite sure they’re happy about Twiggy using Fortescue’s balance sheet to do it.

On the call, Gaines admitted that FFI’s headcount has jumped more than 40 per cent in the past three months, to about 550 people.

Margin Call understands that total is now one fewer than it was a week ago, however, after FFI chief scientist Bart Kolodziejczyk handed in his notice, taking his considerable hydrogen expertise to new pastures.

Kolodziejczyk joins a growing list on Fortescue’s executive exodus, after the recent departure of Pilbara operations boss Fernando Pereira, health and safety director Rob Watson, and long-term corporate affairs chief Tim Langmead – along with a slew of mid-level managers upset at the board’s decision to slash Fortescue’s bonus pool.

FFI is still recruiting at a frenetic pace, however.

Another 20 or so FFI positions are currently being advertised on Fortescue’s website, and sources say the true figure of Fortescue staff devoted to FFI and associated projects is closer to 700 than 550.

One of the roles FFI is looking to fill is that of a global mobility and remuneration adviser – shouldn’t be a tough gig, given FFI is said to be offering pay rises of 20-30 per cent to the technical staff of rival companies such as Woodside it has targeted in its poaching spree.

–

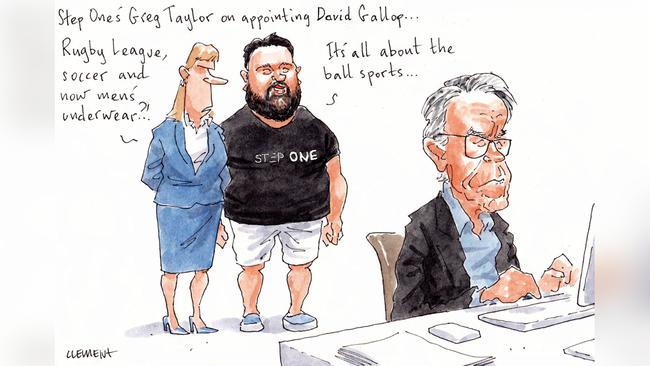

Australia’s new undies king

Forget Pat Rafter, Nick Kyrgios or the cavalcade of rugby league players that have donned the budgie smugglers in various ads over the years.

Step forward Greg Taylor, whose paper wealth was hoisted upwards at a remarkable speed on Monday when his Step One underwear business floated on the ASX on Monday in spectacular fashion.

Taylor was already looking at a $230m payday pre-float based on a $1.53-a-share issue price and also including the $41m cash heading his way from the $81m raised from investors for the IPO.

But Step One’s shares surged upon listing, ending up roughly 80 per cent for the day and leaving Taylor with a paper fortune of $340m. Add in the $41m cash and he’s now got plenty to splash out on some bamboo fabric jocks.

Just to make readers feel even better, the 40-year-old environmentally friendly male underwear entrepreneur only had the idea for his fast-growing business while hiking in New Zealand four years ago.

Taylor also has former rugby league and soccer boss David Gallop on board as Step One chairman. Word is Gallop may have donned a lucky pair for the ASX float on Monday.

Step One profit margins are not skimpy, with the e-commerce firm forecasting a $10.5m net profit from almost $74m revenue in the 2022 financial year, no doubt an attractive proposition for investors.

Other shareholders getting in on the action include the canny Robert Millner via his Washington H. Soul Pattinson investment group, and Corporate Travel Management boss Jamie Pherous. Both popped up in the top 20 shareholders list that is otherwise dominated by Taylor’s 66 per cent stake.

–

Start funding engines

Only days after private equity firm Archer Capital and Peter Wiggs exited – spun out? – the Supercars motor racing series at about $200m less than they bought in a decade ago, its new owners are quietly out in the market trying to raise money from investors.

The newly formed Racing Australia Consolidated Enterprises (RACE), a new consortium of owners that has taken Supercars off Archer’s hands, is attempting to raise $45m, according to documents sighted by Margin Call.

RACE, led by ex-Swimming Australia chairman Barclay Nettlefold, Collingwood champion turned agent Craig Kelly, and driving legend Mark Skaife, is shopping a new six-year bond issue that will pay investors a 6.25 per cent interest rate payable quarterly.

The senior secured high-yield bond will be used to pay for the recently announced acquisition from Archer and other working requirements such as a new “gen 3” car model costing $12.6m to develop.

Documents sent out by fixed income experts FIIG show that the Supercars broadcast deal with Seven West Media and Fox Sports accounts for 50 per cent of total revenue and that the iconic Bathurst 1000 race accounts for a good chunk of annual profits – making five times more EBITDA than any other event. In fact, one risk, the documents say, is that most other races generate little profit at all.

Supercars is forecasting EBITDA, after paying teams $12m-$22m annually, of $8.9m from $121m revenue next year in what is hopefully a return to post-Covid normality – rising to $12.1m from $151m revenue by 2027. By then, the optimistic forecasts say, Supercars will be running more races and will have a new lucrative TV deal.

–

Golden regret

There are times when, having opened your yap, you know that what you’ve just said is going to come back to haunt you.

That surely must be the case for former Northern Star Resources boss Bill Beament who, having made his reputation and fortune running a company that dug for gold, told the press at Kalgoorlie’s annual Diggers & Dealers conference this year that “gold is not green. I’m sorry but it’s not.”

At the time Beament was spruiking his new-found love of battery metals, the energy transition, through the lens of his new company Develop Global. But asked about how his former sector’s track record on carbon emissions stacked up against his new ambitions, Beament uttered his immortal words.

Develop has a mining project of its own – copper, zinc, base metals – all that good stuff needed for the energy transition and the rest of the buzzwords that currently fascinate the mining industry.

It also has a mining services arm.

A mining services arm that has been invited – as Beament proudly trumpeted on Monday – to tender for the underground mining contract at Bellevue Gold’s eponymously named erm … gold mine – an announcement that sent Beament’s Diggers’ quotes back on the rounds of West Perth on Monday.

Bellevue, to be fair, says it wants to be carbon neutral by 2026.

In light of Beament’s comments, though, they could – as one WA mining wag helpfully suggested – find an easy offset by hooking up a generator to capture some of the hot air coming out of their contractors at Diggers next year.

Additional reporting: John Stensholt

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout