Slater and Gordon loss narrows but says more work needed

Law firm’s net loss after tax was a substantial improvement on the same period a year prior.

Slater and Gordon’s books have recovered further, as the law firm sharply narrowed its interim net loss, despite warning more work would be required to shore up its financial position.

The law firm’s net loss after tax of $561,000 for the six months to December 31 was a substantial improvement on its $10.3m loss of the same period a year prior.

It came on the back of an 18 per cent increase in total revenues to $89.2m and an improved net asset position.

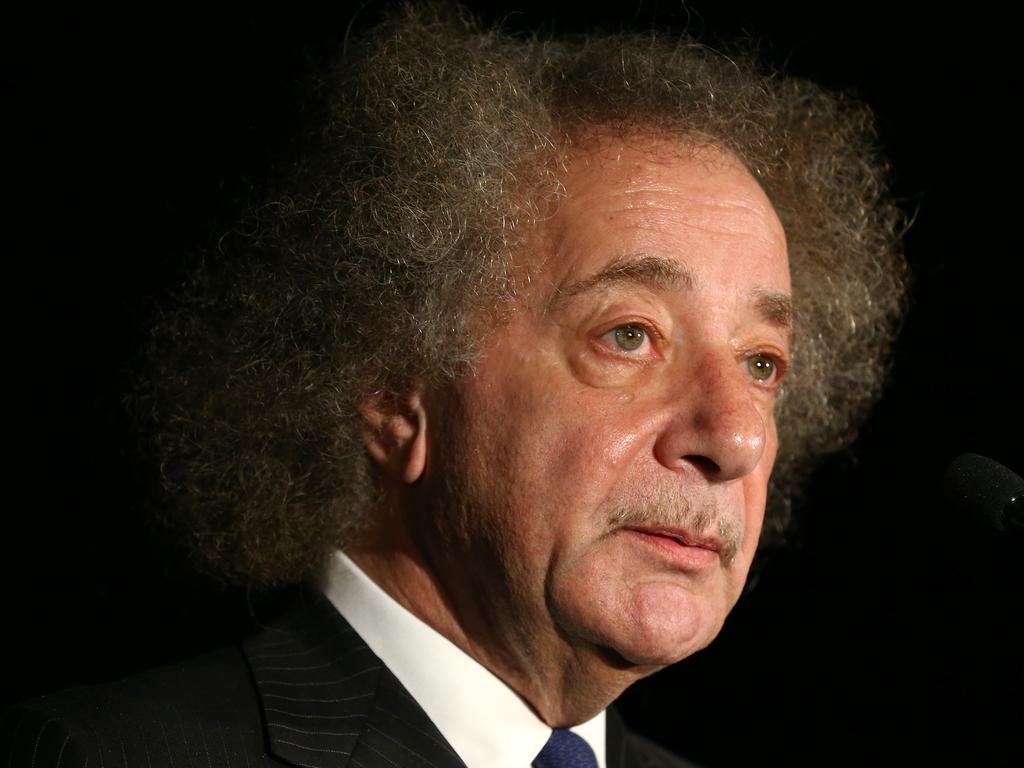

Chairman James McKenzie said the group’s progress was “pleasing”.

“Slater and Gordon has a clear strategy and a clear vision for the future and that is continuing to drive improvement,” Mr McKenzie said.

“While the first-half results are pleasing and are a result of the effort of all of our people, we still have more work to do.”

On an underlying basis, earnings before income tax, debt and amortisation (EBDITA) improved by over $10m over the previous corresponding half to $10.9m.

Cash inflows grew by $6m, to $7m and Slater and Gordon said the value of work in progress was rising, aided by an improved case mix, increasing inquiry levels and matter progression.

Net debt was significantly reduced by the completion of an entitlement offer.

In addition, four class actions with a total settlement value contributed over $156m over the period, which also saw the company initiate three new class actions.

Founded in 1935 to protect Victorian workers, Slater and Gordon’s precipitous fall five years ago destroyed billions of dollars and left shareholders furious. The company’s expansion, acquiring debt-laden Quindell, ended disastrously.

Despite telling shareholders the company would meet its full-year profit guidance in 2015, growing doubts about Slater and Gordon’s solvency were realised when the company reported a $1bn loss in 2016.

By 2017 the company had recapitalised, severing ties with its UK-based operation, and refocused on organic growth in Australia.

On Thursday, Slater and Gordon shares were trading at 0.96c, the lowest since January 2.

The company will not pay an interim dividend.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout