Melbourne developer Paul Chiodo’s phone, laptop seized in raids over probe into $480m fund

An ASIC investigation into Melbourne property developer Paul Chiodo and a ‘significant shortfall’ in investor funds has ramped up, with new documents revealed.

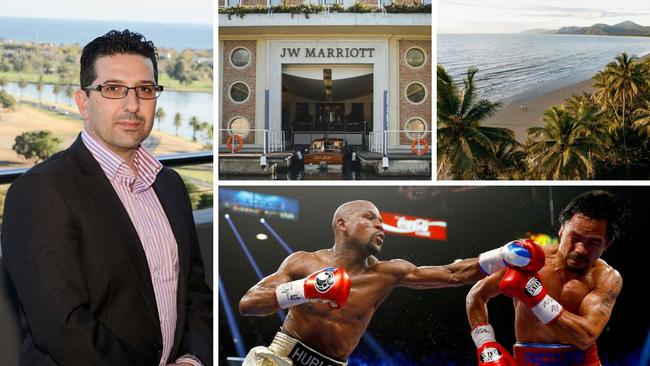

Federal police and the corporate regulator have raided the home and business of under-fire property developer Paul Chiodo as part of an investigation into the alleged mismanagement of investor money from the $480m Shield Master Fund.

The early morning raids on Mr Chiodo and Chiodo Corporation took place on February 18, with police officers and the Australian Securities and Investments Commission seizing property including Mr Chiodo’s laptop and phone, according to legal documents sighted by The Australian.

The raids form part of ASIC’s investigation into Mr Chiodo’s alleged involvement in a “significant shortfall” of investor cash from the Shield Master Fund, which was pumped up with superannuation money and is now in the process of being liquidated.

Mr Chiodo has strenuously denied any allegations made against him.

Chiodo Corporation is also facing allegations that $160m of investor money was paid to City Built or its director Robert Filippini for building work despite Mr Filippini, who did not hold a building licence until May last year, not tendering for any work or providing written contracts.

Documents lodged in a case brought by receivers Deloitte against Keystone Asset Management (Shield’s responsible entity) revealed the raids as the latest development in the saga that now spans at least eight separate matters in the Federal Court.

Velocity Legal’s Seamus Ryan, acting for Keystone, last month requested an extension to the deadline in filing a defence due to the raids.

“Our clients were the subject of an early morning raid by the Australian Securities and Investments Commission and the Australian Federal Police on Tuesday, 18 February 2025,” Mr Ryan wrote in a legal letter to Norton Rose Fulbright, who represent the receivers.

“A large number of documents and electronic devices were seized from Paul Chiodo’s residence and Chiodo Corporation Pty Ltd’s premises (including Mr Chiodo’s computer and phone),” he wrote in the letter obtained by The Australian.

“At present, our clients are unable to access documents which are relevant to the preparation of their defence and we are not in a position to file it this afternoon.

“We are liaising with the relevant case officers to regain access to the documents which have been seized, however do not yet know when access will be granted. We will communicate further with you about this early next week,” he wrote in the letter dated February 21.

Mr Chiodo and his company now have until March 26 to file their defence, according to the latest Federal Court orders.

The receivers launched the latest case in the Keystone debacle in a bid to recover money from a failed transaction, after the Chiodo Corporation attempted to buy shares in the Marriott Hotel in Venice, Italy.

Deloitte has also been appointed to liquidate the fund, while the regulator is probing how investor money was spent on luxury property developments in Queensland’s Port Douglas, Fiji and Italy in some cases without proper planning approvals.

The Federal Court has frozen assets belonging to Mr Chiodo and Mr Filippini.

At least 5,800 consumers accessed Shield primarily through superannuation platforms — the trustees for which were Macquarie and Equity Trustees — ASIC has said in a statement online.

Lawfirm the Banton Group last week revealed it was considering launching a class action against Macquarie and Equity Trustees.

The corporate cop’s investigation to date indicates potential investors were allegedly called by lead generators and referred to personal financial advice providers, who advised them to roll their superannuation assets into a retail choice superannuation fund and then to invest part or all of their superannuation into Shield, ASIC said.

Late last month, Federal Court judge Mark Moshinsky – who is presiding over all of the Keystone cases – also granted freezing orders over Falcon Capital, the First Guardian Master Fund and First Guardian co-founder David Anderson’s assets amid their alleged links with Mr Chiodo.

As well, Justice Moshinsky froze assets of two Melbourne men — Ferras Mehri of Venture Egg and Osama Saad of Aus Super Compre — in connection with ASIC’s probe into Shield.

The first court matter launched by ASIC in the Keystone saga came in June last year, when the corporate cop asked the court to appoint receivers and managers to Keystone’s property.

According to court documents lodged in that proceeding, obtained by The Australian, the corporate cop’s initial investigation indicated that “substantial investor funds have been misapplied”.

This included about $65 million allegedly paid to “lead generators” and concerns about the value of Shield’s assets, which were assessed as between $207m and $240m at the time.

“The value of the assets of the SMF (assessed by Deloitte as between $207.6 and $240.6 million) is substantially less than sums invested in the SMF (approximately $500 million), leaving a significant shortfall for unitholders and underlying investors,” ASIC’s court documents read.

ASIC alleged Shield failed to maintain proper records and that “substantial sums” were spent on construction projects using funds loaned from the Advantage Diversified Property Fund (a company Chiodo Corporation allegedly loaned investor money to) without evidence of feasibility studies or evidence of multiple contractor quotes.

The court documents alleged another entity 24Calibre Pty Ltd, received payments worth about $4.9m “apparently for celebrity appearance fees, agents fees, travel costs and operating costs for 24Calibre”.

The Federal Court was previously told $6.8m worth of investor funds had allegedly been paid to Mr Chiodo as “personal expenses” relating to travel, security and family expenses.