Macquarie, Equity Trustees face potential class action

The companies face consumers who allege they lost nest eggs on a now-suspended private fund with links to under-fire property developer Paul Chiodo.

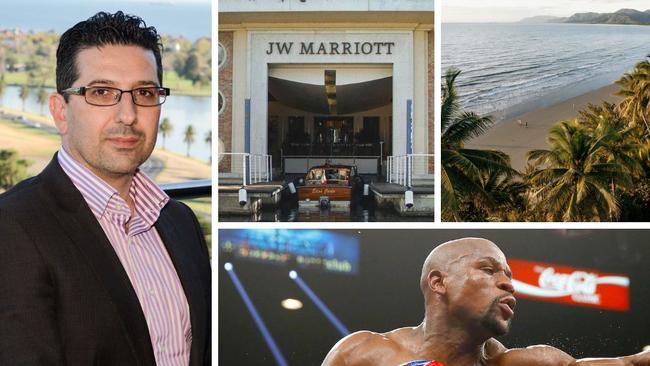

Investment bank Macquarie and ASX-listed financial services group Equity Trustees are facing a potential class action from consumers who allege they have lost money — including superannuation money — on a now-suspended private fund with links to under-fire property developer Paul Chiodo.

Law firm Banton Group published a “notice of prospective class action” to their website on Thursday to investors in Keystone Asset Management’s Shield Master Fund.

The Australian Securities and Investments Commission is investigating the fund and its former director Mr Chiodo over allegations of investor money being spent on developments without proper planning approval and personal expenses.

About 5800 consumers have invested $480m into Shield since February 2022, but since mid last year ASIC has been examining whether “significant investor funds may have dissipated”. Mr Chiodo has strenuously denied any allegations against him.

The bulk of money invested in projects linked with Keystone and Mr Chiodo come from Macquarie and Equity Trustees, who are creditors.

Deloitte’s Jason Tracy was appointed to liquidate the fund in December last year.

Banton Group partner Paul Smith told The Australian the firm is investigating a class action against Macquarie and Equity Trustees because they were the trustees of the superannuation funds and, in the case of Macquarie, the operator of the main platform through which investors accessed Shield.

“Investors are understandably distressed and uncertain about their ability to recover their hard-earned retirement savings. Based on Deloitte’s latest report, there is likely to be a significant shortfall which is currently estimated to be some $140 million,” he said.

“Banton Group is considering all potential claims against those responsible for investor losses and the investigation is ongoing. At this stage, we are reviewing the roles of all relevant individuals who were involved in the promotion and management of Shield.

“This case is significant because it raises serious questions about the oversight and governance of investment products offered through superannuation platforms into related superannuation funds. Ordinary Australians have been badly let down by what has occurred here.”

Mr Smith said the investigation is advanced and Banton Group “anticipates making an announcement regarding proceedings shortly”.

“(Investors) trusted these institutions to safeguard their retirement savings. If there has been a failure in due diligence or compliance with statutory obligations, it is crucial to hold those responsible to account and they should provide compensation to the investors,” he said.

A spokesman from Equity Trustees said: “We are working closely with ASIC and Deloitte and fully support their investigations and will take all necessary steps to protect investor interests.”

A Macquarie spokeswoman said Macquarie prudently closed new investments into Shield in June 2023.

“Macquarie’s actions as trustee reflect our commitment to the interests of investors in Shield – these investors were only able to access Macquarie’s investment platform via third-party licensed financial advisers who determined Shield to be suitable for each investor,“ she said.

“Each of the hundreds of investment options on Macquarie’s platform (including Shield) is governed by separately licensed responsible entities who are required to ensure the investment is carried out as promised.”

This week ASIC secured freezing orders against two Melbourne men — Ferras Mehri of Venture Egg and Osama Saad of Aus Super Compre — in connection with its probe into Shield.

Through a spokesman Mr Mehri said he has been co-operating with ASIC’s investigation.

“I believe I have always fulfilled my responsibilities and legal duties as a qualified Financial Planner,” he said.

“In recommending Shield I, at all times, relied on the due diligence of Macquarie Bank and recommendation of ratings agency SQM.”

On Thursday, ASIC also flagged it will ask the Federal Court to freeze assets belonging to businessman Rashid Alshakshir during a brief hearing.

ASIC has alleged payments totalling at least $65 million were paid to “lead generators” for the purpose of sourcing new investors into Shield.

News about the possible class action and freezing orders came after liquidators also secured freezing orders to lock about $100m in accounts linked with builder Robert Filippini over alleged links with investor money.

ASIC deputy chair Sara Court told Senate Estimates on Thursday the regulator had several teams investigating schemes linked with Shield.

She said the regulator has extensive concerns “relating to the mishandling of superannuation” noting more than 5800 investors and $480m in funds were affected.

Ms court said ASIC was keen to stress to investors the dangers of self managed superannuation fund investments in speculative property schemes, such as Mr Chiodo’s.

ASIC allege that Shield invested significant amounts of investor money into the Advantage Diversified Property Fund which made loans to companies linked with Mr Chiodo to fund property development projects in Fiji, Italy, Port Douglas and Melbourne.

“Substantial sums appear to have been spent on property developments without written contracts and in the case of the Port Douglas development, without the requisite development approvals to proceed,” ASIC alleges in a statement on its website.

“There is a substantial shortfall when comparing the moneys invested in the ADPF against the value of the assets of the ADPF,” the regulator says.

“Investor funds may have been misapplied.” Mr Chiodo disputes the allegations.

The Federal Court has previously been told $6.8m worth of investor funds had allegedly been paid to Mr Chiodo as “personal expenses” relating to travel, security and family expenses.

That included $302,000 which was allegedly used to pay for an appearance by celebrity boxer Floyd Mayweather.