Bespoke vehicles and an English Lord: Marco Ponzi scheme had everything except investments

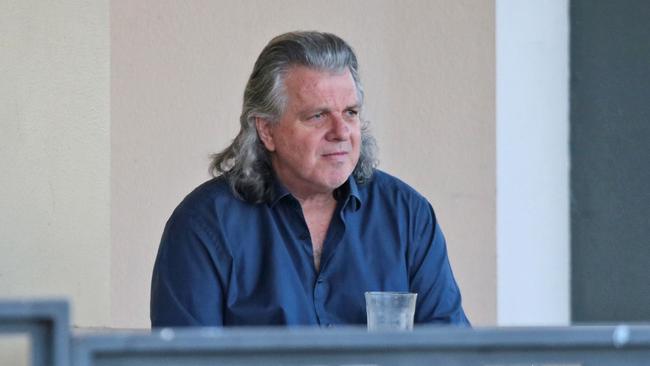

Vintage cars and an English Lord, Chris Marco’s Ponzi scheme had everything except investments.

Chris Marco’s Coastline Group was a seemingly attractive proposition for investors: high returns derived from esoteric foreign currency trading, with its success evidenced by Marco’s $3m car collection - including one of the rarest Ford vehicles ever made in Australia - and a bulging property portfolio.

The problem was, Federal Court judgments state, none of the foreign currency trades ever appear to have happened.

Now, more than two years on from the collapse of what federal court judges labelled a Ponzi scheme - and one of Australia’s largest at that, turning over more than $285m - dudded investors are finally looking at receiving a payout on the millions they are owed, following a court ruling on how the funds clawed back should be divided.

Liquidator Rob Brauer from McGrathNicol told The Australian on Friday, that the Marco scheme appeared to be one of the largest and most complex Ponzi schemes in Australian history, with the outstanding debts currently sitting at $103m owed to 187 investors.

The scheme’s spectacular collapse, which was all the fault of the corporate regulator ASIC according to Mr Marco at the time, precipitated at least one unlikely outcome - the purchase of an ultra-rare 1971 Ford XY Falcon GT-HO by Sydney-based philanthropist and art collector Judith Neilson.

Aside from that curiosity, the story since the scheme’s collapse in late 2020 has involved the complex unravelling of Mr Marco’s financial affairs - with little help from those he purported to invest money with, including a fake “Lord” - and a long wait for investors ranging from the sophisticated, to “mum and dad” types some of whom “have potentially lost the majority of their retirement assets’’, court documents state.

A statutory report to creditors, published by liquidators McGrathNicol in March 2021, says it appears that Mr Marco started taking on family members as investor clients, with non-family investors brought into the scheme in about 2010.

“The scheme purportedly engaged in bank instrument trading, known as private placement programs (PP), allegedly involving products such as bank guarantees, medium term notes and treasury strips,’’ the report says.

“Since the commencement of the scheme no successful PPPs had been achieved and the liquidators are yet to be provided with compelling evidence to support Mr Marco’s position that such investments exist.’’

The most recent court judgment also notes that Mr Brauer from McGrathNicol “found no evidence in the books and records of the scheme of any currency trading’’.

Mr Brauer confirmed that assessment this week, telling the Australian “Our previous reports have concluded that no legitimate investments or funds have been identified’’.

Mr Marco’s version of events, as told to The Australian shortly after ASIC stepped in to wind up the scheme and permanently restrain him from carrying on a financial services business, was that Coastline and his company AMS Holdings (WA), had traded successfully for two decades, and he’d be considering his own legal action, including a possible class action.

He told The Australian his scheme involved a very sophisticated investment process, based on arbitrage trading in instruments such as bonds.

He added that the only finding that had been made against him - at that time in late 2020 - was that he didn’t have an Australian Financial Services Licence, and he scoffed at the idea that he was running a Ponzi scheme.

Mr Marco said the figures in the Federal Court judgment - putting the turnover potentially as high as $380m at the time - were “not even close to being true’’.

“There’s no funds outstanding at all,’’ he said.

Mr Marco is now a bankrupt and last year was charged with 50 counts of fraud over $36.5m in missing funds, with that matter understood to remain before the courts.

In winding up the scheme, ASIC relied on the affidavits of four “sample” investors, including a 69 year old self-employed homoeopath, a 65 year old checkout operator and former teacher, a 67 year old council worker and a 53 year old cafe and restaurant owner.

Of the $285.6m deposited into the scheme by investors from September 2002 to November 2018, $205.9m was paid out to scheme members, the recent judgment states (with McGrathNicol providing updated figures to The Australian this week).

Such is the nature of a Ponzi scheme, wherein initial investors typically are paid the fantastic returns promised, in a bid to generate word of mouth buzz, in turn recruiting new members.

This week’s court judgment says that $72.6m held by the scheme was used to buy about $20m worth of property or for property development, $18.3m went into largely undocumented loans to third parties, $11.6m went into failed attempts to participate in private placement projects, $5.7m was racked up on credit cards, and $2.7m went towards the purchase and restoration of motor vehicles.

And they weren’t just any motor vehicles.

The administrators - later liquidators - of the scheme moved quickly in early 2021 to realise funds from Mr Marco’s car collection, which was housed in a purpose-built facility in Western Australia.

Among the cars were classics such as a 1971 Holden Monaro GTS HQ Coupe, a 1972 Holden Torana “Bathurst” LJ GTR, and the pièce de résistance - a Ford Falcon XY GTHO Phase III, long considered the most collectable, and by the time it was snapped up at auction, the most expensive Australian-built classic car ever sold.

Only about 300 Ford GTHO Phase IIIs were ever made, and the car, famously driven to victory at the Bathurst 500 in 1971 by Allan Moffat, is a true collectors’ item.

So much so that the first attempt by Slattery Auctions to sell it off, along with the rest of the Marco collection, led to their website crashing and the auction being pushed back a day.

Potential buyers might have been less confident of their chances of snaring the GTHO if they knew who was in the mix of bidders however.

Having caught a segment on the evening television news profiling the vehicle, wealthy philanthropist and art collector Judith Neilson was intrigued.

“I was watching TV, and I’d wanted to collect a beautiful artwork that was Australian, that was very contemporary,’’ Neilson told The Australian months later.

“It came up, and I just looked at it and connected. My father had a business making car radiators. In very humble times he’d been a mechanic.

“Cars were simple and anybody could fix them and they lasted for years.

“And this just looked like everything that anybody could have possibly imagined.

“It looked so contemporary that had I walked through a gallery and seen it I wouldn’t have questioned it. It fitted in.’’

Her identity kept secret at the time, Ms Neilson picked up the car for a then-record $1.15m, a far cry from the $5250 they went for in 1971, and it now sits in her Dangrove storage facility in the Sydney suburb of Alexandria.

Sadly for Mr Marco’s investors, some of his other investments have been less easy to pin down.

READ MORE:Chris Marco charged with massive fraud

The liquidators have been successful in tracking down several million dollars worth of investments, such as $1.1m worth of Australian-listed shares, a $600,000 stake in a shopping centre, and $7.9m from the sale of various properties.

Money invested with CFXT Hedge Fund, based out of Mauritius, has proven so far impossible to recover, largely because the liquidators suspect it doesn’t exist.

A creditors’ report indicates that when contacted, a representative of the fund indicated the liquidator would have to go through a complex and expensive process involving setting up a new entity in Mauritius with a bank account and engaging a local law firm to press its claim.

The fund - apparently a “cell fund” overseen by an umbrella fund, invested on half of sophisticated investors, with a Russian entity trading commodities on its behalf in Russia, the report says.

An attempt to get a hold of the now-wound up fund’s books from its purported administrator was fruitless, with the Mauritius-based administrator telling McGrathNicol they were not the management company of the associated company or trust.

Another recipient of investment funds, a “Lord Stephen Carrington”, the self-described chairman and chief investment officer of CFXT, advised that Mr Marco was a friend but never had any financial dealings with him’’.

Companies House in the UK has a listing for CFXT Corporation, with Lord Carrington as a director however the company, registered to a modest row house in Kent, was dissolved in 2018.

The Australian attempted to contact Lord Carrington without success. Mr Brauer said their investigations indicate he was not actually a Lord.

The judgment this week dealt with what formula should be applied to divide up the remaining funds among investors, which can be complex in the case of Ponzi schemes, where funds and typically pooled, and some investors are paid out in full or in part.

With a way forward for distributions to be made, McGrathNicol’s Mr Brauer said it was welcome news for the scheme’s investors.

“The Court’s judgment confirms that this was a large and extensive Ponzi scheme that was doomed to fail from its inception,’’ he said.

“The findings will be welcomed by investors who have been waiting over four years for an outcome and unlocks the next steps in the liquidation and the preparation of a first interim dividend to be paid shortly”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout