Accused ‘money trap’ lenders charged 900pc interest: court

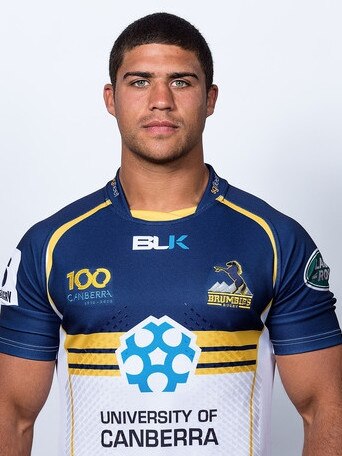

Former Super Rugby player Mark Swanepoel and Brenton Harrison are in court again, with the corporate cop chasing them over allegations of a second money trap scheme.

A woman was set to pay late fees on a personal loan worth more than 900 per cent of the original amount she borrowed, a court has heard, as the corporate cop chases alleged loan sharks Cigno, BSF and their directors over accusations they breached credit rules for a second time.

Having already made two payments worth $208 in total on time, she was charged $1170 plus another $180 after she failed to pay a third instalment.

Her fees were ultimately slashed by $640, but the barrister for ASIC, Luke Livingston SC, told the NSW division of the Federal Court on Monday this was an example of “harm” caused to consumers by Cigno and BSF’s business model operated between July 2022 and October 2023.

The woman, along with several others who were allegedly caught in the money trap, are expected to give evidence from Tuesday.

By October 2023 ASIC alleged more than 100,000 consumers borrowed $35m for small loans but were charged more than $70m in late fees by Cigno, BSF and their directors, former Super Rugby player Mark Swanepoel and Brenton Harrison.

ASIC accused Cigno and BSF of avoiding regulation and offering credit without a licence. The regulator is seeking declarations, fines, adverse publicity orders and injunctions to restrain the companies from engaging in credit activities or accepting fees relating to loan agreements under a “no upfront charge loan model”.

Mr Livingston said customers were being charged fees in the amount of 300 per cent, 400 per cent and “even 900 per cent” of their loan amount. “(This) illustrates the consumer harm.”

Cigno marketed the loans, processed applications and managed repayments and. BSF advanced the loans, ASIC claimed. A “major” source of revenue for BSF was the loan application worth $19.95, which it received regardless of its success the court heard. It also received default fees worth $20 if a payment was late.

Consumers had to pay a weekly account keeping fee, a default fee of $67 and a change of schedule fee worth $15 if they asked for a change to their payments, court documents said.

Mr Livingston said Cigno and BSF “shared in the economic benefits” of this model.

For the defendants, Lachlan Gyles SC told the court individual claims against Mr Swanepoel and Mr Harrison could be thrown out and said ASIC has failed to prove BSF received service fees charged by Cigno. And out of the more than 100,000 consumers who secured loans, 67 complained to ASIC. “It’s a very low level of complaint,” he said.

Mr Harrison and Mr Swanepoel last year lost a case in which the Federal Court ruled in favour of ASIC, which claimed Cigno and BHF Solutions (of whom Mr Harrison is the sole director) previously engaged in credit activities without a licence. They launched the business model now being scrutinised in court shortly after the decision was delivered.