Gold Coast payday lender’s $78m fee bonanza

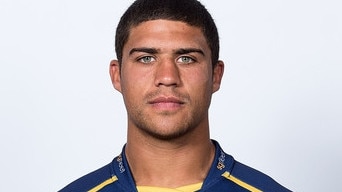

ASIC has launched Federal Court action against Cigno, whose director is former Super Rugby player Mark Swanepoel.

A Gold Coast payday lender reaped more than $78m in fees from Australian consumers despite never holding a credit licence, court documents allege.

The Australian Securities and Investments Commission has launched Federal Court action against Cigno, whose director is former Super Rugby player Mark Swanepoel, saying it has never been licenced nor authorised to sell lending products, which is required under the National Credit Act.

The court documents allege that Cigno operates a lending model that “provides small amounts of credit to a large number of consumers and charges substantial fees on the amounts borrowed”. It said Cigno’s fees totalled $78.4m from September 14 last year to August 7, including reaping $25.8m in default fees.

ASIC is seeking to ban Cigno from providing lending services, which include payday and unsecured travel loans, and partner financier BHF Solutions (BHFS), which the regulator also says has never held a credit licence.

“The National Credit Act requires firms who engage in specified credit activities to be licensed or authorised. The National Credit Act and National Credit Code impose important obligations on firms that provide protections for consumers including disclosure requirements, a cap on fees and interest rates and access to hardship and free and independent external dispute resolution services,” ASIC said.

“BHFS and Cigno should also be restrained from further engaging in the credit activities.”

In the court documents, ASIC said BHFS carries on a business that “consists exclusively in the provision of loans to consumers, who are referred to it by Cigno”, which markets itself as an “emergency cash specialist”.

“The arrangements between BHFS and Cigno are reflected in an agreement executed on 1 July 2019 and subsequently amended (Cigno/BHFS Agreement). Under that agreement, Cigno has guaranteed BHFS’s customers’ obligations to BHFS under their loans.”

Cigno’s fees included a financial supply fee - calculated as a base amount plus a sliding percentage of the loan - total account keeping fee, change of payment schedule fee and a default fee. It’s financial supply fee was the biggest earner in the past year, totalling $39.2m, while its change of payment schedule fee generated $5.4m.

Mr Swanepoel has defended the company in a submission about ASIC’s product intervention power, which allows ASIC to ban financial products and credit products when there is a “risk of significant consumer detriment.”

In his submission, published on Cigno’s website, he said ASIC has formed its view about his company based on a “very small percentage of our customers”.

“ASIC and the mainstream media claim we prey on the vulnerable and less sophisticated, charging all our customers exorbitant fees and exploiting the very people we claim to be helping,” Mr Swanepoel wrote.

“The reality is that ASIC, the government regulator, have formed their view based on a very small percentage of our customers. To meet their agenda, they have in most cases used clients that have paid back nothing, been charged for defaults and are looking for an easy way to get something for nothing.”

Mr Swanepoel doesn’t address the lack of a credit licence in the letter on his website, but says his company is fighting “a large group of hypocrites” and accuses ASIC of trying to control consumers’ decision making.

“We have a situation where a government regulator wants to control your decision making based on what they believe is best, and will skew information to reach that objective.

“We are fighting a large group of hypocrites – the leaches (sic) of society who steal more and more freedom and choices from everyday people behind the veil of good intentions.

“We do not hide away from what we charge for the service we provide and are extremely proud to have helped the many thousands of people we have. Our application process and contract are very clear and we regularly encourage any of our customers experiencing difficulty to contact us so that fees and terms can be adjusted and in many cases stopped or waived entirely.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout