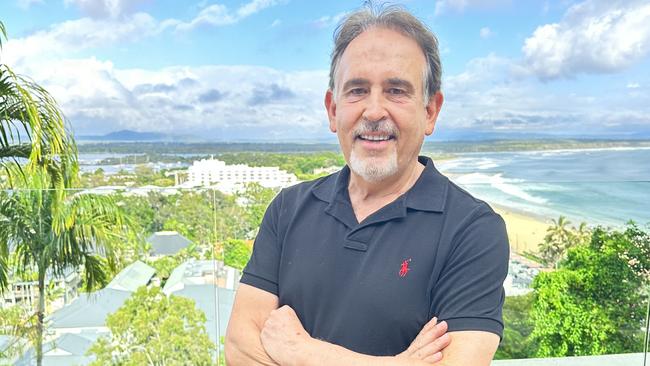

TechnologyOne founder Adrian Di Marco is excited by the coming intersection of robotics and AI

There is lot of money to be lost in AI, warns tech rich lister Adrian Di Marco, but the next ‘quantum leap’ in the sector will see people paid very differently.

Over four decades, Adrian Di Marco turned one of Australia’s first software start-ups into a $5bn ASX 100 company, competing against the international might of Oracle and SAP.

Now, 18 months after stepping away from TechnologyOne, he is spending a quarter of his year at his holiday home at Noosa and investing in fast growing start-ups in Australia and overseas through his family office known as the Di Marco Group.

While the focus of its venture capital (VC) arm is investing in SaaS (software as a service) companies which are building a global solution and targeting one sector, the entrepreneur is most excited about the future combination of artificial intelligence and robotics.

“There is a lot of froth, a lot of money to be lost in AI. I think the NASDAQ reflects that today, it is way overvalued,” he says.

“AI will reach its potential when it is combined with robotics, where robotics become part of everyday life. That will be a true game changer. That is an area we are looking at very closely.”

His family office is investing in AI-powered firms that can deliver important – but what he stresses are still “incremental” – productivity improvements.

One, Comtrac, is involved in the digitisation of evidence using AI.

“The value gain of that is 5 to 10 per cent. It isn’t a game changer,” Di Marco says.

More importantly he believes we are now only a decade away from having robots in the workplace, which he says will be the next “quantum leap” in the evolution of AI technology, opening up opportunities for the best and brightest.

“The future is about less people doing more and it is about recognising that the best people in the future are going to be very mobile,” he says.

“You are better off to put those people on a retainer and have more of a contractual relationship with them. That is really the way of the future for very smart people. They are going to be harder to bring in internally.”

With a portfolio of more than 40 businesses and a minimum seven-year view on all of his investments, Di Marco sees an opportunity to mentor and support the next generation of tech entrepreneurs and has taken a significant equity position in a VC called Tribe Global Ventures.

Companies he’s invested in include Factory, Kanopi, Petboost, Respondent, Restoplus, Zipline and Ezycollect.

But rather than being a director he is playing the role of adviser to these firms, helping them assemble boards and executive teams. Most significantly, he is holding them to account.

When he first gets involved with a start-up, he hands the CEO a piece of paper and asks them to list forecast earnings numbers for the next five years.

“So every time we meet, we look at that page of numbers and specifically the number for this year and ask, ‘Are you on track to meet it? And what is the number for this quarter’?” he says. “So it starts a whole different set of conversations, because suddenly they are accountable.

“They have their numbers and they share them with the staff. We can start tracking the numbers of how they are going, what they are forecasting, and it just changes the whole conversation.”

Di Marco and his wife Kristina have been married for more than 40 years and their daughter, Emma and son Joshua now work in the family office.

It is a big change from the TechnologyOne era, where the family and the business were kept completely separate.

“This is about creating something for the future generations, so they have to be part of it,” he says.

“It is theirs in the end. So I let them back their judgment. If they are going make a few mistakes, you would rather they made them when I was around.”

Di Marco spends most of his time on VC investing. The family’s investments in public equity markets and alternatives are largely run by his children and their advisers.

“It is a very large portfolio and putting in place the systems and processes was something that we all needed to be part of. My son was very good at that. He pointed me to the big institutions like Harvard and those sort of places in the US and how they operate,” DiMarco says.

“He said, ‘You know, we really want to be patient capital, we don’t want to be looking for short term returns’.

“I found a side of him I never knew he had. I actually didn’t even know he studied finance at university. I knew he studied computer science. But he actually did a double degree in computer science and finance.”

Joshua Di Marco undertook extensive research on the Chinese technology sector and the family office now has a strategic exposure to the asset class.

“He put together a pretty compelling case for that,” his father says. “So it is wonderful to work with your kids and to see that side of them. But you do also have to let them run with things.”

The family’s alternative investments include water rights, fishing quotas, and litigation funding.

Di Marco says water rights secures a vital resource, fishing quotas tap into maritime potential, and litigation funding aligns investment with legal cases.

In philanthropy, the family supports charities such as The Fred Hollows Foundation, The School of St Jude, Sunrise Cambodia and the Saint James School Endowment Fund. Di Marco is a famed old boy of the Brisbane school.

“A lot of it is about children, where you can make a good impact. If you can set them up for the future, you make a big difference,” he says.

Accepting the ups and downs

Di Marco understands the founder’s journey better than most, having lived it personally.

But in his new life, he has also been on a different journey – as a passive 6 per cent shareholder in TechnologyOne.

He smoothly transitioned out of the firm he founded in 2022, although it was a 10-year process, starting with the appointment of Edward Chung into the role of CFO in 2007.

Chung then took various roles in research and development, consulting and finally became CEO in 2017.

The board appointed Pat O’Sullivan as chairman in 2022, when Di Marco stepped down. O’Sullivan was a board member for many years and worked with other founder-led businesses, including CarSales.com.

Di Marco says there are two types of founders: those who will “leave in a box”, and those who choose to transition out of the business to a different chapter of their life.

“You have to consciously make that decision to leave and remember that,” he says.

“Now my relationship with TechnologyOne is very much one of just an investor. Like all investors, I meet with the CEO twice a year. But in the end, it now has its own life, its own direction. I think that’s healthy, that’s the way it should be.”

Some meetings with Chung, he says, can be heated.

“Sometimes I say, ‘I have a different view on this’. We discuss it. In the end, he walks away and he is his own person. He does what he thinks and I love that. I think it’s great because it’s the right balance,” he says.

“That’s why I was comfortable to hand over to Ed, because I felt he could do that.”

In April TechnologyOne faces a High Court-ordered retrial of a six-year, now $60m bullying and unfair dismissal claim brought by former Victorian manager Behnam Roohizadegan, who says he was bullied, marginalised and undermined by two senior executives.

Other cases have also been launched.

Asked if he feels the litigation has tarnished his legacy at the group, Di Marco replies: “That is an interesting question.

“To be honest, a lot of it stems from the Behnam case, which was the big one. The company becomes a little bit of a target from that. Until that gets resolved, a lot of the blemish won’t go away. So I think the company is keen to get that resolved.

“We are seeing similar things that are happening with other public companies. I think a lot of it comes back to the industrial relations laws we have these days. They are problematic. It has become a bit of a minefield.”

He was devastated by some of the findings of the initial trial judge in the Behnam case, which were then rebuked by the Full Federal Court.

But his biggest concern is for the TechnologyOne staff who he says have been unwittingly “dragged into the cases”.

“That is the saddest thing of all. You see really great people being dragged into this stuff and there’s no winner or loser at the end of it,” he says.

He and Kristina now spend 25 per cent of the year in Noosa – from where he is doing this interview – 25 per cent overseas and 50 per cent in Brisbane, where their children live.

“When I was young I used to hitchhike from Brisbane to Coolum. If you did a shift at the lifesaving club, you’d get a bunk bed for the night. So I’ve always had this huge affinity for the location and I still just love it up here,” he says.

Di Marco’s daily routine is morning coffee with his wife and then mostly conversations with VC founders and executives, before a hard stop at lunchtime.

“We have a hard rule that come 12.30pm, that is close off. What doesn’t get done doesn’t get done. Then the afternoons are mine, so I’ll go for a surf and then maybe catch up with someone,” he says.

TechnologyOne was founded in 1987 as a joint venture between Di Marco and Brisbane’s Mactaggart family.

The latter, led by patriarch Dugald Mactaggart, was best known for its hide-processing business and rural landholdings, but Mactaggart also knew the value of clever software so went into business with Di Marco.

They were partners in TechnololgyOne for 35 years and Di Marco remains close to the next generation of the family led by Dugald’s eldest son, John.

“Dugald was the one who said a lot of things that really resonated with me – particularly the way he dealt with me,” Di Marco says.

“His philosophy was back the founders, you are there to help them, and that has resonated enormously with me, especially the level of trust and openness there was between us. If there’s bad news, put it on the table, don’t hide it in the back of the board papers. Be upfront and be honest and everyone can work together.”

Dugald Mactaggart died on November 13, 2011 at the age of 82.

His death hit Di Marco hard. But it also inspired him to look at the bigger picture in life.

He now lives it every day, especially during the many hours he spends with his two grandchildren.

“It was very, very sad day … It is a defining moment when your partner, the person who provided the capital and was with you through all the ups and the downs, dies,” he says softly.

“To see this huge man who was larger than life, a man who was very wealthy – who I was actually scared off at first – to see him at the end, he was very old.

“You learn a lesson from that. In the end, we will all come to that point. So you’ve got to continually find a balance. You’ve got to enjoy your life.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout