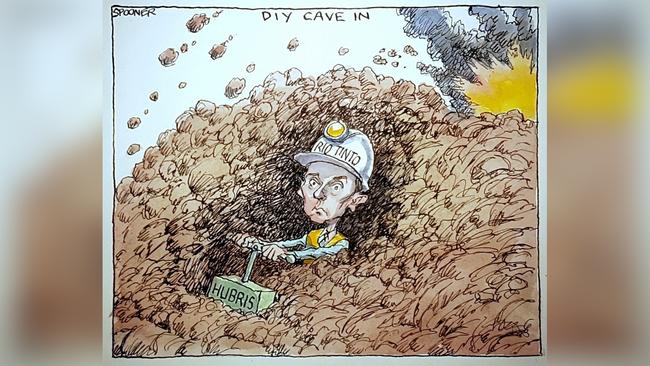

Running a public company requires three basics — the right people in management at the top, the right standards and the right systems to implement those standards, and Rio failed all three, both in terms of its initial tragic mistake and the way it has handled it since, including the attempted whitewash report from director and former Foreign Affairs department head Michael L’Estrange.

Queensland Liberal Warren Entsch, who leads a committee examining the Juukan Gorge disaster, said this week of the Rio evidence to his committee: “It is hard to argue that we have not been misled.”

Jacques will stay in the job until March pending the appointment of a replacement and will walk away with long-term entitlements including $35m worth of stock, having been paid $10.3m last year and already owning $9.7m worth of shares.

He is a lame duck for the next six months and presumably the 12-month notice period on his departure started on Friday.

Chairman Simon Thompson was at pains to say the departures were by mutual consent because to say otherwise would make the board look even more silly, having already completed its own review and deciding Jacques et all should stay.

Once again we are being treated with contempt by Rio, which is trying to present the departures as orderly by consent, when a matter of weeks ago the board said the very same people who are leaving should stay.

Simon McKeon’s appointment as the lead independent on the board is potentially significant, because it is recognition from the London-based board that it should take more notice of what Australian shareholders think. After all Australia, which accounts for just 33 per cent of Rio’s assets and 56 per cent of revenues, produced 81 per cent of earnings last year.

Trouble is Australians own just 15 per cent of the company, which is 11.5 per cent-owned by the Chinese government (Chinalco), 12 per cent by Europeans, 27 per cent by North Americans, and 28 per cent by English.

Based on earnings the company should be based in Perth, but based on its asset base and share register that isn’t going to happen any time soon.

McKeon has the job ahead being the Australian voice on the board. That said, the strident demands from Australian shareholders such as AustralianSuper, Hesta and the Future Fund forced a massive board retreat from its stated position for the simple reason that the local shareholders understood the magnitude of the disaster and the incompetence of the attempted board whitewash.

By all reports initially the UK shareholders were sitting on the fence and the US holders were less fussed, but by the end they too demanded action.

One of the dissident Australian funds that led the charge to force the sackings, Hesta, said in a statement: “While we welcome the steps taken by Rio today, changes in senior leadership should not distract from the need for an independent and transparent review of all current agreements between the company and traditional owners.

“The nature of these agreements and how they are negotiated represents a systemic risk for investors that will not be mitigated by executive changes.”

That underlines the challenge ahead for Thompson, with his biggest task being finding a suitable replacement, because as noted previously former Rio executives who left on or before Jacques’ appointment are spread throughout the mining world, from Tom Palmer at Newmont to Andrew Cole at OZ Minerals.

In press briefings, Thompson said the management changes were necessary because existing personnel were hampering efforts at restoring its social licence to operate. Trouble is on most counts there are few obvious CEO candidates in the existing management team and, in any case given the regime change involved, external management would work best.

Former boss Sam Walsh’s ill-fated entry into this battle declaring, to the surprise of everyone else around at the time, that when he was boss he said no to the gorge, simply highlighted the bad blood in the Rio ranks.

The company is still waiting on news from the UK Serious Fraud office on bribery allegations it made, just in case Thompson thought this tragedy was all he had on his plate.

Suffice to say the board and Jacques have failed in one of their key tasks, which is management succession.

Recent events at Rio, QBE and Westpac shows stuff happens and well managed companies are prepared for surprises, as shown by Westpac’s elevation of Peter King to the CEO role, while QBE and Rio have no obvious long-term successors in sight.

The iron ore market is running strong at the moment at around $US125 a tonne due to better than expected Chinese demand and supply shortages from Vale.

These are boom days for the iron ore oligopoly, but at some time, due to either supply or demand changes, the price could come down quickly to $US80 a tonne and $US60 is seen as a reasonable long-term price.

The tragedy and good fortune for Rio is the mismanagement that caused the tragedy has happened at a time when it is seemingly hard not to make money from iron ore.

As the banks have shown, that is also the time when you need the right systems and disciplines, like Rio’s old “the way we work” management book that guided Leon Davis et al in decades past.

Carbon farming

Carbon project developer Climate Friendly and Bush Heritage are hoping to use the regeneration of the 200,000ha Hamelin Station as the first step in an active landscape management pilot on the station.

This will build on work they are doing in Queensland with the CSIRO aimed at improving drought resilience, benefiting farmers and animals with the potential to deliver 300 million tonnes of carbon abatement over 10 years in Western Australia.

Step one is to regenerate the land by fixing fences to keep out feral goats, weeding to allow acacias and other natives to grow back on the station in the Shark Bay area some eight hours drive north of Perth.

The Climate Friendly, CSIRO and Bush Heritage pilot programs will extensively carbon farm through so-called stacking programs including regeneration, boosting carbon in the soil, reducing emissions from beef and using technology such as drones to measure the growth in carbon abatement to gain carbon credits.

The Landscape Regeneration Fund is looking nationally at 5000 projects on 65 million hectares to stack carbon pools removing 2.5 billion tonnes of carbon dioxide and potentially $40bn in revenue from carbon credits.

For farmers, it’s potentially a new source of income, but for the moment Bush Heritage is running a tourist accommodation facility on WA’s Hamelin Station as the not for profit works towards carbon managements also as a new source of revenue.

Four months after blowing up 46,000 years of cultural heritage, the Rio board has finally taken the first step towards restoring its social licence to operate in Australia by showing the door to three senior executives led by chief JS Jacques.