It is the single biggest investment from Woolworths and by a long stretch the biggest boost to James’s $2bn Moorebank facility, being the fish equivalent of a whale.

Given he is still working on plans to monetise the site, the entrant of a top-shelf tenant is timed superbly.

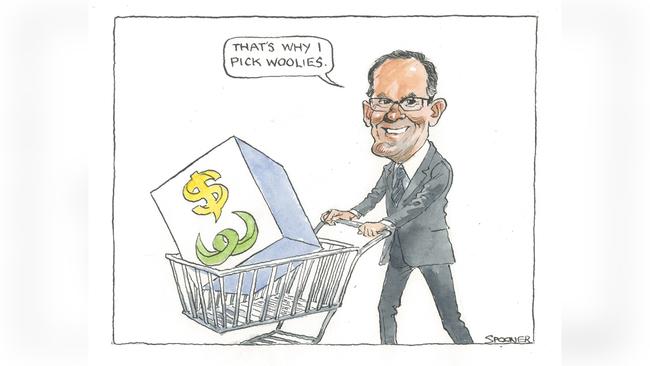

Woolworths took some fire on Tuesday for its big spending, but James wasn’t complaining because having Woolies on site should lead to a rush from its suppliers to join the site.

The hope is that with the big supermarket chain based at Moorebank, Unilever, Kellogg’s et al will see the merit in setting up shop next door.

One man’s trash is another’s treasure and, while Woolies stock price was down slightly, Qube’s jumped 7.8 per cent to $2.91.

All going to plan, the investment decision will also be a long-term boon to Woolworths’ shareholders via a more efficient supply chain delivering goods cheaper to customers.

Companies need to invest to improve returns and shareholders will be hoping Woolworths can deliver on the promised returns of 10 per cent a year.

The past few years have seen capital expenditure total $2bn or so a year, which is yet to show on the bottom line, with earnings before interest and tax (EBIT) up just $300m from 2016 year levels to $2.7bn in 2019, according to the 2019 annual report.

In 2015, Woolworths EBIT was $3.9bn when Banducci slashed margins to cut prices and boost sales. This financial year’s earnings are expected to be about $3.2bn for the group, which compares with $3.3bn last year when the impact of the fuel divisions earnings are knocked out.

Given sales increases reported this year for supermarkets of 11.3 per cent, for Big W of 9.5 per cent and Endeavour Liquor by 9.5 per cent, shareholders might have expected bigger profit gains.

But that was before the retailer loaded in the costs, including the move to Moorebank and accompanying staff losses.

COVID-19 did increase costs, with extra staff and cleaning, but Woolworths gold-plated them.

Woolworths boss Brad Banducci seems to have decided the 2020 financial year is a year to spend big and take his medicine with writedowns totalling $591m.

Given $185m will be used to pay back staff for past underpayments and executive bonuses for the financial year will be zero, it’s not a bad year to take big charges.

That sets the right base for a hoped-for earnings boost in the 2021 financial year when, hopefully, bonuses are back.

The Moorebank facility was on the drawing board back in Chris Corrigan’s days at Patrick in 2004, before the 2006 Toll takeover of Patrick.

When the Qube team regrouped in 2009, they soon took over land held by Stockland and later Aurizon in what was then controlled by the old Westpac Property trust.

The 100ha site is on old Australian Army land and ideally situated near the key link roads the Hume Highway and M5 and M7, and on a rail link to Port Botany.

This means products can be unloaded from ships onto a train to the terminal and from there to all the Woolies stores’ robotic-led warehouses, which will be set up to enable easy transfer to its stores.

Shareholders will be hoping the $750m targeted spend on the warehouse fitout will be the upper end in contrast to the overspend in its Melbourne distribution centre.

Coles by contrast selected German-based Witron as its adviser on its $950m warehouse upgrade last year, just as it partnered with Ocado for its online services.

Woolworths is using Dutch-based robots for Moorebank and US-based Dematic for its national centre, which will be based next door and distribute more slow-moving goods like kitchenware.

Investment is welcome, especially when it results in increased returns, and given Woolworths dividend payout ratio in the first half was 65 per cent against 85 per cent for Coles. While Qube’s Maurice James is popping champagne corks, the Woolies shareholders are waiting for their whale.

Di Pilla adds value

Home Consortium’s David Di Pilla has managed something others such as Stockland have failed to do with a 5.2 per cent increase in valuations to $1bn for his retail centres.

The group used Woolworths’ unwanted Masters sites in 2016 to develop a nationwide group of so-called hyper convenience outlets, including shareholders such as Spotlight and Chemist Warehouse with supermarkets and leisure-based services.

He hasn’t suffered the shutdowns faced by other centres because he doesn’t feature food and discretionary fashion goods so the stores have stayed open.

Di Pilla is developing some centres along themes such as a health and a wellness centre in Ballarat based around a Medicare office with childcare, medical centres and pharmacies.

ASX’s next Chess move

ASX boss Dominic Stevens will finally roll out his plans for the blockchain-based Chess replacement next week after sending out early guidelines to his listed companies on Tuesday.

The original April 2021 start date was delayed due to COVID-19, among other factors, so the discussion period starting next week will settle the new “go live” start.

ARA tries its luck

A proportional offer from problem shareholder ARA sent Cromwell’s stock price up 8 per cent on Tuesday to 94c, well north of the 90c offer for a third of shareholder stocks.

ARA owns 24 per cent of Cromwell and, having failed to win a shareholder vote to get nominated director Gary Weiss on the board, is trying its luck to increase its stake to a position at which the target’s chief Paul Weightman has no choice but to grant a directorship.

Corporate governance is not Weightman’s strong suit, but ARA’s blatant attempt to win control without paying a premium should be rejected by Cromwell shareholders.

Singapore-based ARA, controlled by US investor Warburg Pincus, rejects criticism of the bid as disingenuous, saying it doesn’t want to make a full bid and is simply making use of its legally entitled right to make a proportional bid. Watch this space.

Woolworths’ $1bn decision to base its NSW distribution centre at Qube’s Moorebank centre is a boon to Maurice James’s 16-plus-year plan to develop an intermodal terminal in Sydney’s southwest.