Pandemic clouds future for Crown and Virgin

Companies stuck between a pandemic and a hard place are pushing the eject button.

James Packer and the Crown casino group are headed for the divorce court. The only questions now are the timing, the terms and whether the divorce is consensual or forced.

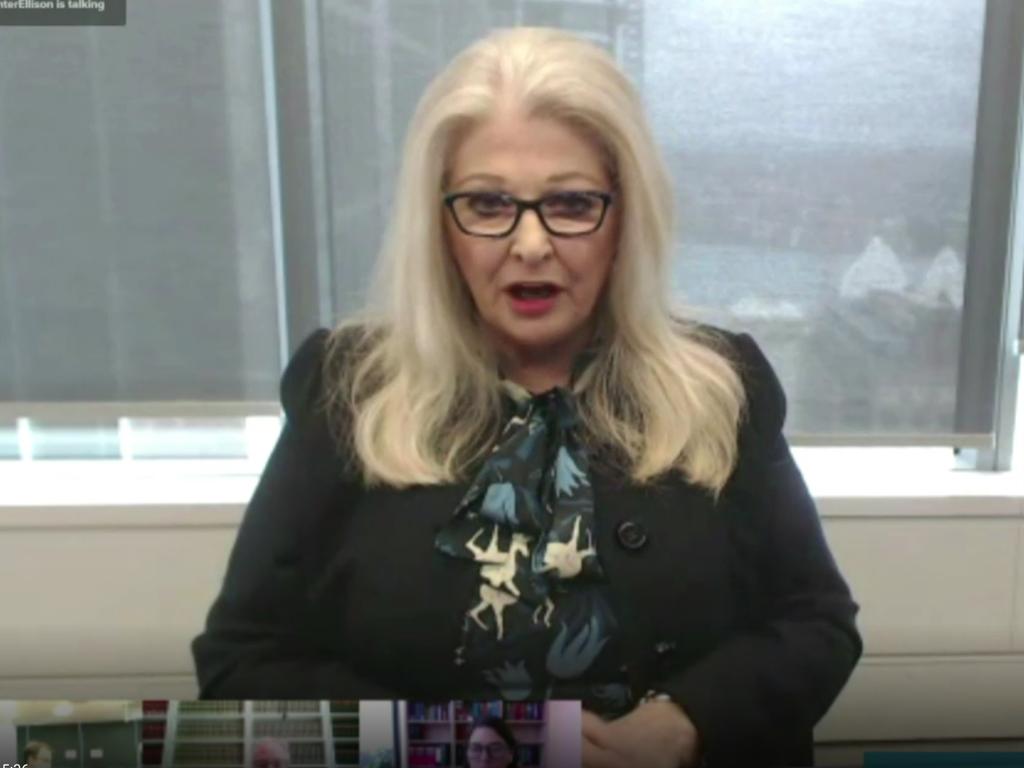

Commentary and speculation over how many directors and which ones should go, and how quickly, are interesting but ultimately irrelevant. They are all going to go, although depending on the process the chairman Helen Coonan could be the last to go and her departure could be delayed.

The second penny relates to Virgin 2.0, its new owner the vulture investor Bain, and its “new” CEO Jayne Hrdlicka.

It should have fallen long ago. Bain did not commit something like a billion dollars of real money and assume responsibility, if only indirect liability, for $2bn-plus of debt, just to play sugar daddy to (now, departing) CEO Paul Scurrah and (up to) 6000 Virgin staff.

Bain’s interest in Virgin is, for want of a better word, purely financial. It wants to make money and, surprise, surprise, it wants to make more than “bank interest”.

But the prospect of making even “bank interest” is looking increasingly problematic as the planes stay on the ground thanks to politicians around the country and that pesky virus to which they attribute so much cleverness and cunning.

I am of course not privy to Bain’s internal metrics, but the prospective — hoped-for — rate of return would be a lot lower now than back in those heady days of late June when Bain locked Virgin’s administrator Deloitte into a two-tier done deal.

Or, maybe Deloitte was smart enough to do the locking of Bain into the two-tier deal; I doubt that it would have got as much money in October.

The changed aviation horizon from blue sky to dark grey might seem to explain the shift from Scurrah to Hrdlicka; and from Virgin 2.0 being a downsized version of the mini-Qantas that John Borghetti had grown it into and Scurrah had continued, to something much closer to the ultra-low-cost original Virgin of Richard Branson and Brett Godfrey.

But that is to miss the entire point of the presence of Hrdlicka and the absence of the assorted foreign airline and tourism groups that found themselves unable to resist the lure of Borghetti’s full service Virgin offer with its international links and network ambitions.

Hrdlicka was not just — and this term is used not gender specifically — a “pretty face” in the Bain team; she was always going to play a very real, indeed the, role in driving not just the structure and strategy of Virgin 2.0 but actual implementation and delivery.

Now, back in June the Bain team might have thought it could be done with Hrdlicka as a sort of CEO-in-chief, with Scurrah continuing as CEO in form and flight officer in the “other seat” in practice.

But as both the medium-term and long-term prospects for aviation and most especially for the “second” airline went seriously dark, that became untenable. Hrdlicka has to be the only pilot in the cockpit.

I should note that it’s not because Qantas is getting it any easier; in fact precisely the opposite.

In June you might have been able to hope for — I would always have said, fantasised about — a post-virus future which had competitive space for a much-reduced Virgin 2.0 sitting somewhere between Borghetti’s Virgin 1.0 and the original “cheap and nice” Godfrey Virgin.

In October, it is clear that is not possible. And it is not possible precisely because life has also got that much bleaker for Qantas; it will come, it will have to come, after especially any full-service Virgin 2.0 that much harder.

This is also the key dynamic playing into Crown’s future.

Unless and until the planes are flying it’s got a problem. But even when they fly, unless they are filled with both mid-market Chinese tourists and Chinese billionaires or pretend billionaires, Crown will have a serious revenue problem.

Then add the serious and likely permanent problem with the local grunt market in Melbourne, thanks to social distancing.

But, just as the telling presence, from the very start, of Hrdlicka for Virgin 2.0’s future snuck under so much radar, both the operational difficulties at the casinos combined with the embarrassing and irresistibly punishing revelations of the inquiry, have obscured a more potent reality.

This is, very simply, Packer has wanted out since 2015, when the deal he tried to put together with former friend Ben Gray and TPG fell over.

It was a deal designed to replay what he did with Nine in 2006, when he emerged with $5bn in cash while keeping a 50 per cent stake in Nine, although that subsequently dribbled down to zero.

The Crown deal would have given him similar cash, a continuing controlling stake and the same optionality going forward. It fell over; then less than a year later, in mid-2016, Crown started exiting Macau — before Crown’s problems in China blew up.

Crown walking away from what is easily the biggest casino market in the world — and a key link in the whole China strategy — really signalled Packer was intent on walking away from Crown, even as he embarked on the $2bn Barangaroo project structured entirely on the China high-roller market.

He had wanted to build the biggest and best casino group in the world; retreating to Australia, even an Australia crowned by Barangaroo, made no long-term sense for Packer as owner and driver.

Early last year, he showed he was prepared to sell out completely, to Wynn Resorts, without any of the leverage, cash return and optionality of the Nine deal or the earlier TPG Crown plan.

In the wake of the virus, that sale would have been as brilliantly timed as the Nine deal was, barely a year ahead of the first Apple iPhone. Now, wanting out, he is stuck between the virus and the near-certainty of a selldown order from the inquiry.

Two pennies have finally begun to drop.