Jobs the key to economic recovery: Westpac chief executive Peter King

Westpac boss Peter King says employment and demand prospects were key to spurring activity.

Westpac chief executive Peter King says the health of the jobs market and consumer demand are more important to lifting domestic confidence and spending through the economy than another official rate cut.

While the Reserve Bank was doing a good job at managing the pandemic crisis and Australia’s first recession in almost 30 years, Mr King said employment and demand prospects were key to spurring activity.

“Lower interest rates is important to keep borrowing costs down, but in the end businesses invest because they see demand and to have demand you need people employed so that’s why the government’s focus on employment is actually so appropriate,” he told The Australian.

“Having a competitive currency is also very important … we can debate the merits of a potential (rate cut) move tomorrow (Tuesday) but if we step back the authorities are doing what they can to navigate the country through a pretty tricky time.”

The RBA is widely expected to reduce the cash rate to 0.1 per cent after its Melbourne Cup day meeting on Tuesday, a move that ANZ chief executive Shayne Elliott questioned the merit of last week given rates are already at historic lows.

Westpac’s base case economic scenario has the unemployment rate peaking at 7.8 per cent.

Mr King expected that consumers would eventually stop ploughing money into savings and spend half of the personal tax cuts that will flow through, helping to stimulate the economy.

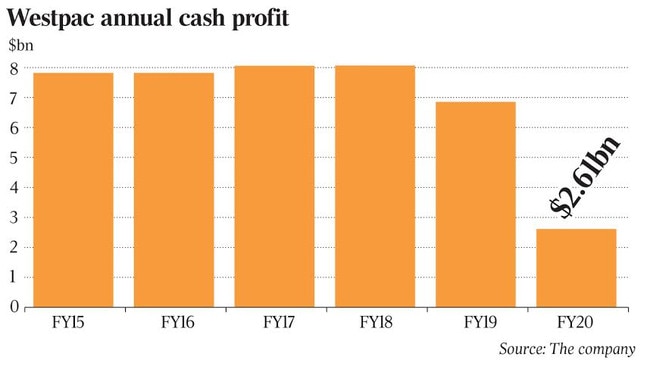

His comments came as Westpac resumed paying dividends but reported that annual cash earnings plunged 62 per cent to $2.61bn for the 12 months ended September 30.

The results, dubbed “disappointing” by Mr King, reflected tough conditions for banks in a low interest rate climate, higher expected COVID-19 loan losses, writedowns and Westpac’s record $1.3bn penalty to financial crimes regulator Austrac.

Mr King said while loan quality and losses were not deteriorating at the rate initially feared, there were still questions over 2021 when government stimulus and loan repayment pauses rolled off.

Westpac’s shares dipped 0.61 per cent to $17.80 on Monday, as cash earnings printed lower than analyst expectations.

“Operationally the (Westpac) numbers looked a bit weak,” said Jun Bei Liu, Tribeca Investment Partners’ portfolio manager.

She noted, though, that the Australian economy was faring better than expected from COVID-19, boding well for banks.

“In macro terms, things are looking better. It seems they (the major banks) are on that trajectory to return to some level of normalisation.”

Citigroup analyst Brendan Sproules highlighted Westpac’s lower net interest income and a rise in expenses as soft spots in the results.

“We expect there is an element of rebasing in the cost base and capital to set up a smoother financial year 2021,” he said. “While FY20 core earnings were soft the business enters FY21 on a much stronger footing and with a number of legacy issues having been resolved, in order to regain lost momentum.”

All of Westpac’s divisions — including consumer, business and institutional banking — had lower annual cash earnings. Mortgage lending in the consumer bank fell 2 per cent, with Mr King blaming a blowout in loan processing times.

He said the bank was targeting improvement in that area early next year. Westpac wants to match home loan industry growth rates by the second half of its 2021 year.

The net interest margin — what Westpac earns on loans minus funding and other costs — fell to 2.03 per cent in the second half from 2.13 per cent six months earlier.

Stressed loan exposures rose 71 basis points to 1.91 per cent, compared to 2019, and the amount the bank set aside for expected loan losses swelled by $2.2bn to $6.2bn. But the rise in expected credit losses in the second half was just 20 per cent of what was booked in the prior six months.

Mr King — who now has an open-ended rather than two-year contract — is embarking on a multi-year strategy to lift Westpac’s compliance efforts, simplify the bank and upgrade systems and processes.

“We’ve set our clear priorities,” he said, adding the planks of the strategy had different time frames including for fixing risk management, culture and technology.

“We’ll make big strides on it next year but again that (fix) will take a few years. It is probably the one that comes a little bit later.”

Westpac last month partnered with buy now pay later giant Afterpay to offer savings accounts and cashflow tools for the latter’s customers.

Mr King said parts of the market were changing and Westpac wanted a seat at the table.

“This has the potential to change some of the way people bank and it’s a part of the market we need to be represented in,” he added. “I can see us having more partners on that banking-as-a- service platform.”

Westpac’s common equity tier one capital printed at 11.1 per cent as at September 30.

The bank declared a final dividend of 31c per share, representing a 49 per cent payout of full-year statutory profit. The most recent guidance from the banking regulator capped dividends during COVID-19 to as much as 50 per cent of statutory profit.

Westpac’s expenses, excluding notable items, rose 6 per cent, reflecting higher risk and compliance and headcount spend.

The bank declared a final dividend of 31c per share after not making an interim payment as the pandemic gripped the economy. The payment was accompanied by a dividend reinvestment plan

Westpac’s final dividend represents a 49 per cent payout of full-year statutory profit.

The most recent guidance from the banking regulator capped dividend payments during COVID-19 to as much as 50 per cent of statutory profit.

Westpac’s expenses, excluding notable items, rose 6 per cent in the 12 months ended September 30, reflecting higher risk and compliance and headcount spend. The bank will outline a new cost cutting plan at its first-half results.

Last week, ANZ reported a 42 per cent slump in full year cash earnings and cut its final dividend to 35c a share. National Australia Bank reports its profits on Thursday.