Singtel’s Optus appears to be paying a fair price for the Australian listed telecommunications company Amaysim with its $250m deal, according to market analysts.

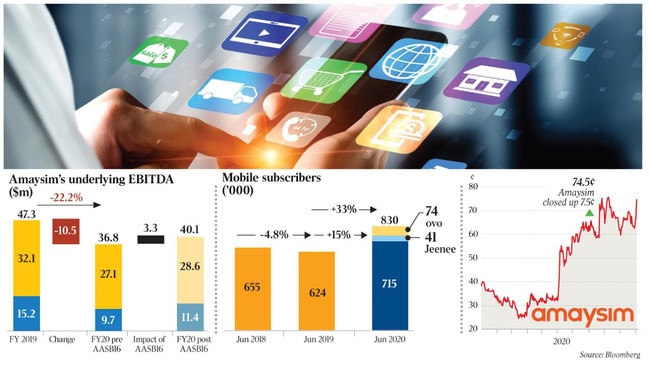

The pricing equates to 25 times its earnings before interest, tax, depreciation and amortisation for the 2020 financial year of $10m, which is considered a strong valuation.

But shareholders say one frustration is the longevity of the deal — they will not receive the proceeds until October.

Amaysim told the market on Monday that it would sell its operations to Singtel’s Optus for $250m, and as a result, there would be between $207.2m to $225.7m distributed to shareholders, including the Click Energy proceeds.

This equates to 67c to 73c per share, and there is additional value from franking credits worth up to 11c per share that are attached to the distribution.

It follows the August sale of Amaysim’s Click Energy business for $115m to AGL Energy and a strategic review of the mobile business.

Apparently, the gap between the $250m that Optus will offer and the amount that will be received by shareholders relates to the unwinding of working capital, costs associated with the winding up of Amaysim, such as lease contracts, restructure and delisting costs, and costs associated with closing its Manila operations.

In terms of the actual price paid by Optus it equates to about $210 per subscriber, of which the company has 1.19 million, or $296 per recurring subscriber, of which Amaysim has 844,000.

When Amaysim recently purchased competitor Ovo, it paid $205 per subscriber.

It is understood that the transaction was structured as a share sale, where the company’s assets were all sold rather than the corporate structure itself, to enable the shareholders to capitalise on the company’s franking credits.

Synergies will exist for Optus to embark on the transaction.

It comes ahead of a deadline next year to renegotiate its wholesale agreement with the telco.

Should Optus have allowed a competitor to gain control of Amaysim, it would have lost about $100m of revenue annually.

Amaysim specialises in providing SIM-only mobile plans and has expanded into the home internet market.

It was founded in 2010 by the highly regarded Australian telco expert Peter O’Connell, who took over the reins of the business more than two years ago as chief executive and remains a shareholder.

His focus had been removing costs from the business in what was thought to have been preparation for a sale.

The courtship between Amaysim, advised by Luminis Partners, and Optus, which is advised by Bank of America, dates back to at least 2016 and it was reignited again in 2018 before ending.

This column revealed on July 22 that Optus was back circling the business.

The dilemma for Optus has been that Amaysim is a strong cash generator for the group and because it is responsible for much of its subscriber growth, it can’t let it fail.

The Amaysim board has recommended the Optus offer, which is a 4.5 per cent premium to the closing price on October 29 at the mid point of 70c per share.