Australian-listed telecommunications provider Amaysim is believed to be back in the crosshairs of Optus.

There is talk in the market that Optus is in the data room conducting due diligence on the business for a potential acquisition.

Both Optus and Amaysim declined to comment.

The courtship between Amaysim and Optus is proving to be one of the longest involving two Australian corporates, with on-again, off-again discussions between both groups stretching back to at least 2016.

The talks were understood to have been reignited again in 2018 before ending.

Amaysim specialises in providing SIM-only mobile plans and has expanded into the home internet market.

It was founded in 2010 by the highly regarded Australian telco expert Peter O’Connell, who took over the reins of the business more than two years ago as chief executive and remains a shareholder.

His focus had been removing costs from the business in what was thought to have been preparation for a sale.

Optus acts as a wholesaler to service provider Amaysim and buying the business was seen as logical to protect it from falling into the hands of its competitors.

The dilemma for Optus is that Amaysim is a strong cash generator for the group and because it is responsible for much of its subscriber growth, it can’t let it fail.

But typically, Optus is not a keen buyer of assets.

It was thought that the $13bn merger between TPG Telecom and Vodafone Hutchison Australia two years ago could prompt groups such as Optus, which is the country’s second-largest telecommunications provider, to look at opportunities to bulk up.

The talk about renewed interest from Optus comes after Amaysim recently hired Luminis Partners to sell its Click Energy business which it bought in 2017 for $120m.

Apparently, parties such as Alinta and Origin Energy offered between $50m and $60m for the operation, but Amaysim had been holding out for more than $100m from a suitor.

Anchorage Capital Partners examined Click Energy for a potential acquisition but opted to walk away.

Amaysim’s market value is just over $191m, rallying since April on the back of the global COVID-19 pandemic.

However, shares are down from their 2016 highs of $2.65, trading at 59.6c.

Private equity firm Adamantem has previously run the ruler over Amaysim with adviser Gresham on hand.

James Spenceley was eager for the company that he cofounded, Vocus, to buy Amaysim when he was on the board about two years ago, but former Vocus managing director Geoff Horth was against the idea.

Advising Amaysim in the past has been Investec and Macquarie Capital.

Optus is owned by Singapore telco SingTel, and is engaged with Bank of America to sell its Australian telecommunications towers, estimated to be worth about $2bn.

The sale process is expected to begin after August.

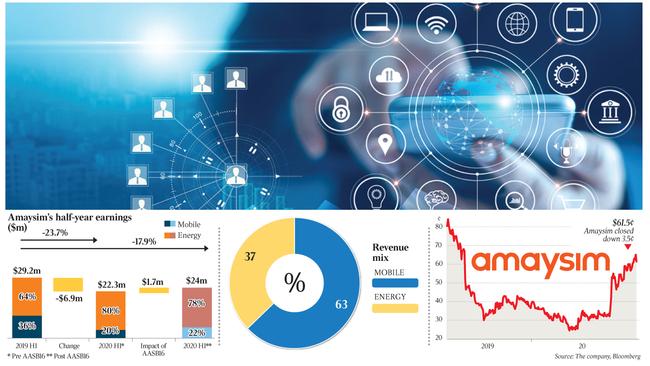

Amaysim, meanwhile, said in June it was on track to report annual underlying earnings before interest, tax, depreciation and amortisation of between $33m and $39m for the 2020 financial year on the back of growth in its mobile subscriber base.

It is due to report its full-year results on August 24.