Atlassian: from a $10,000 credit card debt to $50bn market giant

From a Sydney start-up launched with a $10,000 credit card debt, Atlassian emerges as a $50bn giant.

From a Sydney start-up launched with a $10,000 credit card debt, Mike Cannon-Brookes and Scott Farquhar’s technology play Atlassian has ridden the wave of a surging Wall Street to emerge as a $50 billion giant.

The growth is a boon for Cannon-Brookes and Farquhar, Atlassian’s co-CEOs who have much of their wealth tied up in the company, which builds specialist project management software for companies from ANZ to Twitter to NASA and allows staff to work together on projects.

The pair, who placed fourth and fifth on The List of Australia’s Richest 250 when it was published by The Australian in late March, could soon be richer than Anthony Pratt and Gina Rinehart if their company continues its current trajectory.

Such has been Atlassian’s surging share price that the duo’s wealth would now have surpassed that of Sydney apartments magnate Harry Triguboff, who was third on The List with a $12.31bn fortune in late March.

They are also a tantalising handful of dollars short in share price terms of surpassing Pratt and Rinehart as Australia’s richest people, which would be a remarkable achievement for a pair who do not celebrate their 40th birthdays until towards the end of the year.

At $50bn, Atlassian passed established Australian telco Telstra in market valuation earlier this year and is now ranked as the nation’s seventh-biggest listed company. It is now closing in on National Australia Bank, which is worth $77bn.

The present market capitalisation puts Atlassian ahead of household names such as Macquarie Group ($44bn), Woolworths ($43bn) and even mining giant Rio Tinto ($38bn).

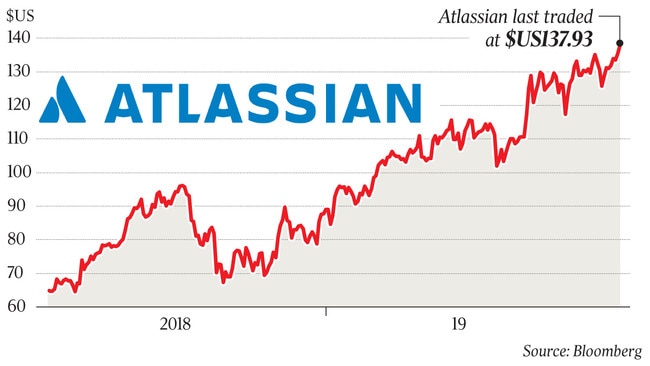

The software maker, which is headquartered in Sydney, but listed on New York’s Nasdaq exchange, more than doubled its valuation in the past 12 months with its shares climbing to $US138.80 ($200.15) yesterday.

If the share price reaches $US143, Cannon-Brookes and Farquhar’s wealth at current exchange rates will exceed that of Mr Pratt’s $13.14bn, although his private Visy and Pratt Industries are also growing quickly.

Some US-based analysts are tipping that will happen soon, with several having recently slapped “buy” recommendations and 12-month price targets of $US143 to $US145 on Atlassian stock.

With the tech-heavy Nasdaq index pushing record highs, Atlassian has been caught up in the momentum, lifting alongside technology names such as Apple, Microsoft and Google.

In May, Goldman Sachs upgraded Atlassian’s price target, noting the company was expanding beyond its initial use case of IT workers.

“We continue to believe that even after two years of price increases, Atlassian still offers a high value-to-price ratio for its customers,” the firm said.

Speaking to The Australian at the company’s Summit conference in Las Vegas earlier this year, Mr Cannon-Brookes said it was significant for Atlassian to overtake Telstra in total valuation.

“Growing up in Australia, obviously Telecom Australia was an industrial giant,” he said.

“It’s an interesting point on the journey and it’s mind-blowing that we’re joining these great Australian perspectives.

“From a global perspective it shows software and technology is the biggest industry in the world and continuing to grow really, really fast. Everything is becoming a technology problem now, and that’s something we’re right at the centre of.”

He told The Australian that wealth was “not a useful metric for judging anything”.

Mr Farquhar, who bought Sydney’s Elaine Point Piper estate in 2017 for more than $70 million, said that wealth hadn’t made much of a difference in his life.

“I’ve got everything you’d want, but for me the main benefit is it can give you is time,” he said.

“If you think about that, you’re relatively poor in money but you have all the time in the world, you can have a fantastic life.

“You can backpack across Asia on $5 a day, you can go camping for free, if you want to buy things cheaply at the supermarket you can go bargain hunting.

“If you have time but no money you can have a great life, and at the same time if you’ve got more wealth you can buy more time.”

Additional reporting: John Stensholt

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout