George Frazis faces big challenges at BoQ

Bank of Queensland’s new chief executive George Frazis will need to make tough decisions when he takes the reins in September.

Bank of Queensland’s new chief executive George Frazis will need to make tough decisions when he takes the reins in September as earnings pressure continues and the regional lender explores strategic deals.

Mr Frazis, a Westpac executive, takes over BoQ about nine months after Jon Sutton stepped down. His contract terms give him the potential to earn almost $4.6 million annually.

A changing of the guard coincides with much slower housing credit growth, increased competition for mortgages and a need for the bank to ramp up its technology investment.

Mr Frazis flew back from a holiday in Italy yesterday to address the bank’s top 100 managers in Brisbane and via video link in other cities. Sources said Mr Frazis will travel to Sydney for meetings today before resuming his leave.

The challenging environment for regional banks has already spurred consolidation talk and BoQ chairman Roger Davis yesterday gave the strongest signal yet that the lender was considering getting in on any action.

“Those conversations continue all the time,” he told The Australian in an interview.

“No one knows what the future will hold. If you were writing this (CEO) contract 20 years ago you wouldn’t even consider this but the market’s changing, the business is changing and I think the leadership team needs to be protected.”

He was referring to a clause in Mr Frazis’ contract that offers some protection and a way out should the bank be taken over.

Mr Davis said BoQ’s board saw Mr Frazis as the right person to “reset” the bank but it was right to weigh up all strategic and growth options.

“There is no silo mentality here at the bank — we consider all and every option — we can only manage what we control,” he added.

“The success of a board today is to be adaptable, to be responsive, to consider all options and to not be surprised.”

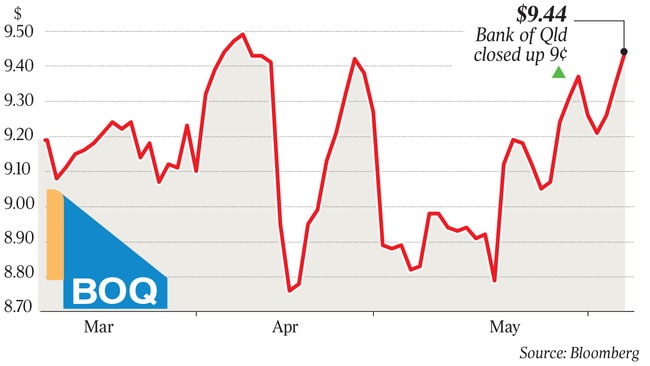

BoQ shares rallied almost 1 per cent to $9.44 yesterday, marking the highest close in about two months. The stock remains 2.7 per cent lower than where it started 2019.

“They’ve had a pretty long and exhaustive (CEO search) process so hopefully they’ve got someone that can get them back into the game,” Investors Mutual senior portfolio manager Simon Conn said.

“If they automate and move into the digital era I think they’ve got good opportunities. They started from behind.”

He also highlighted the potential for BoQ to participate in mergers and acquisitions or be targeted by an offshore player.

“There is definitely an M&A opportunity,” Mr Conn added.

Citigroup analyst Brendan Sproules said investors would receive Mr Frazis’ appointment “optimistically” given his retail and business banking experience.

Mr Sproules pointed to “strong growth in volumes” under Mr Frazis during his tenure as head of Westpac’s consumer banking operations alongside a focus on taking out costs.

Citigroup also took note of Mr Frazis’ executive contract which included a “fundamental change” clause in the event BoQ is the subject of a takeover or merger.

“This clause has been called out as a direct reference to potential industry consolidation and will likely stoke consolidation speculation.”

It is unclear if Mr Sutton had a similar clause in his contract but the employment contract of his predecessor Stuart Grimshaw included one.

Analysts have suggested that BoQ, Bendigo and Adelaide Bank and Suncorp would all be considering various tie-ups to deliver scale against the major four banks.

Mr Frazis was due to part ways with Westpac in July after an executive restructure led to his slated departure. At the time, investors said he was likely to be overlooked for the top job at Westpac when it was vacated by Brian Hartzer.

On the BoQ appointment, Mr Davis said Mr Frazis beat other candidates to the role due to his experience and digital and leadership skills.

“He (Mr Frazis) is growth-orientated, a transformational person, (and) he understands the need to reset a business so he can position it for that spring forward for future growth.”

Mr Davis — who is handing over the chairmanship in October to Patrick Allaway — also shrugged off concerns about two lots of succession happening in 2019.

“This is something we’d been working on for two years and it just happened to correspond with the time that we announced a replacement for Jon,” he said.

In the ASX statement Mr Frazis said: “Disruption across the industry is moving at pace. The BoQ board and I recognise the need to respond decisively to address the challenging environment facing BoQ, and indeed all banks. However, those circumstances present many opportunities for a bank which is customer-focused and can move quickly to deliver a point of difference. At the top of the list is to embrace digital innovation that recognises the future of banking lies in mobility and personalisation.”

The Australian flagged that Mr Frazis was a key contender for the role alongside other external candidates.

Mr Frazis’ base annual pay is $1.3m. But if he hits various performance criteria his salary, including deferred and long term incentives, will be much higher, at almost $4.6m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout