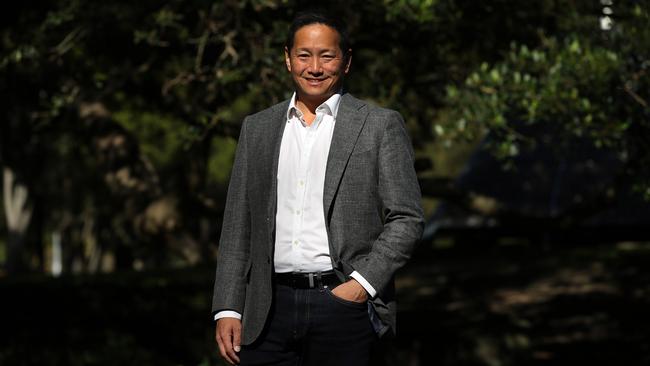

Ex-pilot has skin in the game as leader of hip hemp business

Eric Wang is so invested in Ecofibre’s future that he’s even got a tattoo of the company’s brand on his chest.

Eric Wang remembers clearly when he decided he wanted to pursue a business career: while flying Apache helicopter missions in the US Army during the Balkans War in the 1990s.

Wang was told by a superior he had a bright future in the military, but those words, he says, came while “in the middle of nowhere late on a Friday night while we were freezing around a campfire.”

Fast forward the best part of two decades and Wang is suddenly at the helm of the one of the hottest stocks on the ASX, hemp industrial company Ecofibre.

Wang’s company has made a big mark on the ASX in only four months, with shareholders particularly intrigued with it growing hemp in the US state of Kentucky, where the plant is booming after moves to allow it to be grown as an agricultural product.

Ecofibre products are being supplied as a “superfood” in thousands of US pharmacies and Hemp Black — its hi-tech fibre textile brand — could be used in clothes and other textiles.

Wang was pursued and convinced to take the chief executive role by Ecofibre’s biggest shareholder, Barry Lambert, a member of The List — Australia’s Richest 250, who is at the forefront of the push to legalise medicinal cannabis and hemp.

Ecofibre shares have tripled in value for shareholders — including Sydney investor and The List member Will Vicars — since its late March float, and this week the company’s market capitalisation burst past the $1 billion mark.

So invested is Wang now in Ecofibre’s future that he’s even got a tattoo of the company’s brand on his chest — and convinced at least one supplier to the company and also won a bet with a fund manager after the IPO to do likewise.

“We have a wonderful business partner in North Carolina with our Hemp Black business and we were having dinner one night and she said ‘well, how committed are to it are you really,” Wang explains to The Weekend Australian.

“We talked about tattoos and said ‘well if you get one I’ll get one’. So I went back to Philadelphia, the tattoo guy is marking me up, I changed my mind but then thought, okay I’ll do it. So I did, and sure enough she got one a week later.”

The enthusiasm to get inked has extended to its backers. Ecofibre issued shares at $1.00 each, and Shane Coster, an investment adviser at Wilsons Advisory in Brisbane, told Wang he would get a tattoo if the share price hit $1.50 by Christmas.

The shares would close at $1.70 on their first day of trading, March 29, and Coster has since got a tattoo on his leg. Ecofibre shares have traded as high as $3.60 earlier in July and were higher than $3 this week.

Ecofibre is set to announce its maiden financial results as a listed company on June 29, having last week announced a full-year revenue of $35.6 million in a June 2019 quarterly update to the market and also gave guidance of an expected net profit of about $4.5m.

Wang jokes he’s started getting more friends now he’s running a hemp company worth about $1bn, but it has been quite a ride from that night in Bosnia next to a fire in a kerosene drum to a stint as a management consultant, an executive in the finance sector to the boss of a fledgling hemp business with a freshly inked tattoo.

With a chuckle, Wang blames Lambert for where he has ended up. Wang served eight years in the US as a captain and Apache helicopter pilot, including serving on active duty in the US, Germany and Bosnia before completing an MBA at Dartmouth University in 2000.

He says he learnt all the obvious lessons about leadership in the Army but also “that you have to make sure to be very fair to everyone and treat things on their merit, give credit to everybody else and not just take it all yourself”.

He was headhunted from Dartmouth by consultancy Bain — Wang says A2 Milk chief executive Jayne Hrdlicka led the recruiting — and offered role with the global company in Sydney, which he was convinced to take after being put up in a hotel with a view of the Harbour Bridge for a week.

Wang would specialise in the financial services sector and later go on to be chief operating officer at Perpetual and then AMP, by which time he had come across Lambert, then chairman of Count Financial.

Lambert says in 2009 he had suggested Wang as a potential CEO of Count, only for the nominations committee to select another candidate. “While that was embarrassing personally I had never promised Eric the job. Nevertheless I always felt that I ‘owed’ Eric. So when I financially rescued Ecofibre with a large investment I needed someone to make the investment work.”

But it was with some surprise, Wang says, that he got an unsolicited email from Lambert one day with an investment suggestion.

“This was classic Barry — he sent me something with one line in the email, ‘this has your name written all over it’. I had a quick look and replied, ‘I think you have sent this to the wrong email address, Barry’,” Wang says.

It was information about a fledgling hemp company called Ecofibre, and for Lambert it was an investment with a personal touch, having been convinced of its medicinal merits after hemp helped stop the seizures being suffered by granddaughter Katelyn, who has a rare form of epilepsy called Dravet Syndrome.

Lambert was determined for hemp to become a mainstream product and put $10m of his own money in and after some due diligence was able to convince Wang to make a leap of faith and jump on board to run the company in November 2015.

Wang travelled back to the US — he now spends about eight months there and four in Australia, where just about all of Ecofibre’s investors are — and started to put in foundations to a company that is growing hemp mostly in Kentucky and has a joint venture with Philadelphia’s Jefferson University regarding potential Hemp Black applications.

Hemp Black could end up helping embed technology in clothing in the athleisure wear category and may also be used for military and healthcare applications, and is one that excites management and investors — hence the tattoo spree.

After the recent share price rise, Lambert’s stake in the business is worth more than $90m and Vicars, the chief investment officer of funds management firm Caledonia Investments, has a parcel worth at least $60m.

Ecofibre is using the proceeds of its $20m float to commercialise Hemp Black and expand its operations in Kentucky with the construction of premises as well as general working capital.

Wang says now the company is listed it is about achieving solid financial results for its investors, rather than chasing growth for the sake of it.

“We are very optimistic about all of our businesses. I’m very proud of our team, the infrastructure we have and our customers. The focus now is on profit and not just chasing revenue. Both are important, but you need to go after that revenue that you consider is good for you.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout