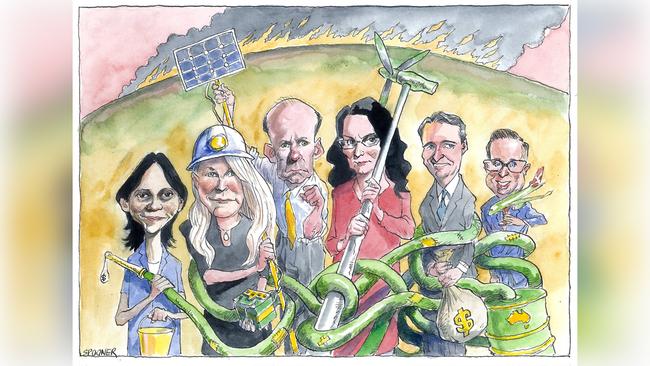

Chief executives of Australia cry out for clear energy policy in survey of top business bosses

Australia’s corporate leaders are almost unanimous in demanding a clear energy policy as the priority for the country heading into a year of expected slower economic growth and with faith in big business at a low ebb.

In over two decades polling big business leaders, there has not been a single issue so clearly enunciated as the call for action on climate change and energy policy to deliver affordable and reliable supply.

It comes amid the horrific bushfires and the battle many in business have faced in getting affordable energy supply and in stark contrast to the message Prime Minister Scott Morrison has attempted to sell that Australia is ahead of its targets and the issues are under control.

Big business doesn’t buy that line.

This year’s survey of 73 business leaders, exclusive to The Weekend Australian, is published online in full from today.

READ MORE: John Durie’s 2019 CEO Survey.

Action on productivity reform, skills training and tax reform are among the other key issues where business wants to see some action.

Seek boss Andrew Bassat said: “Our education and employment policy needs to continually evolve to help support the workforce that faces significant displacement due to automation and tech disruption.”

In terms of their own operations, business is well down the track on technological reform, turning the talk on artificial intelligence and data mining into action, while also upgrading supply chain systems.

Business has a way to go, as underlined by the widespread string of admissions on staff underpayment and the scandals in the banking industry caused by inadequate monitoring and overall governance.

Energy Australia boss Catherine Tanna said: “There is a need to restore confidence. It feels like trust in the political system, in business and our other institutions has never been tested as greatly as it is now.

“Good leaders must step up and do the right thing — the key word is ‘do’, and that means acting in ways that earn trust. That’s what it means to be trustworthy.”

NIB chief Mark Fitzgibbon warned on the cost of too much regulation, saying: “I sometimes feel as though prudential and corporate regulation is attempting to displace the function and responsibility of just good management.”

Tanna responded: “Our political system and our economy have stopped working the way they once did; that’s at least partly why investment is where it is.

“The best investment we might make is finding ways for business and government to work together once again. That might make all the other investments possible.

“When the economy is working as it should, business invests and takes on the risk, so taxpayers don’t have to.”

Macquarie Group boss Shemara Wikramanayake warned of the need to maintain global institutions at a time when geopolitical risks are threatening to undermine them: “As a small, open economy, engaging with global partners is key and we are very conscious of operating in a globally interdependent world.

“The one factor that has the greatest potential to impede our growth is our ability to attract very capable and diverse people and empower them to own stakeholder outcomes.”

Lack of economic growth is a major concern, but business believes action must come from fiscal policy and long-term productivity reforms with the unanimous view that the Reserve Bank of Australia (RBA) has done its bit.

Wesfarmers boss Rob Scott said: “One of the biggest drivers of productivity and prosperity is for Australia to aspire to be the healthiest country. This involves a focus on health and wellbeing, starting with kids at school, encouraging sport at all levels and a targeted focus on medical research and critical health issues.”

His view is backed by the Productivity Commission, which has called for urgent structural reform in health and education.

Coca-Cola Amatil chief Alison Watkins said: “It’s important to remember that Australia’s 29 years of continuous growth are a direct result of economic reforms. Our current loss of momentum on reform is a basic cause of poor productivity performance and low real wages growth.”

ANZ’s Shayne Elliott said: “While there is softness in some parts of the economy exposed to discretionary spending, there are also some very solid fundamentals, such as low unemployment and low loan default rates.”

BHP boss Andrew Mackenzie said there needed to be “fiscal policy reform, investment incentives and regulatory conditions that encourage business to invest in technology and create high paying jobs of the future across industry and across the country”.

Orica chief Alberto Calderon said: “Australia has the lowest ratio of private capital investment in 60 years. The government must incentivise private investment, for example, by increasing investment allowances like accelerated depreciation and research deductions.”

Visy boss Anthony Pratt was vociferous in his praise for the government: “ScoMo is doing a fantastic job and addressing the three great policy issues of today — well paying jobs/jobs/jobs.”

Australian Unity chief Rohan Mead was more circumspect, saying “household income growth is stagnating and anxiety is growing about the sustainability of the social safety net with specific concerns about the quality, accessibility and affordability of healthcare and aged care”.

Woolworths chief Brad Banducci cited mental health as a key issue, saying: “Within our business alone, we have lost 13 team members to suicide this year, which is absolutely tragic.

“The effects of mental health challenges are very real and happening across the community.”

The Smith Family’s Lisa O’Brien expressed the concerns of many about the lack of harmony in business regulations across the states.

“The Smith Family complies with government regulations including those relating to the Australian Charities and Not-for-profits Commission, ASIC, the Tax Office and a complex matrix of requirements across the state. This is inefficient for a national charity.”

Tanna said: “Markets can deliver, but not when governments cannot collectively say what they want.”

ASX chief Dominic Stevens spoke for many, saying the country needs “a clear and sustainable energy policy, which addresses climate change and includes a significant role for renewables”.

Elliott added: “There must finally be some movement on energy policy, which has been a complex issue for many years. If that is addressed, it could provide a great deal of certainty for many businesses to then confidently invest more.”

Qantas chief Alan Joyce said: “Climate change is an issue facing all businesses, and we know that airlines have a responsibility to cut emissions.”

This admission is shared by many of the respondents.

Magellan chair Hamish Douglass said: “Two things the government could do to boost confidence and the economy would be to improve our bilateral relationship with China, our most important economic and trading partner, and to develop a comprehensive infrastructure investment program and finance it with long-term borrowings in this low interest rate environment.

Major infrastructure improvements are a key to long-term productivity improvements.”

Iluka’s Tom O’Leary agreed: “Australian businesses and state governments should look to expand ties with their commercial and regional partners in China — not only as a fillip for occasional tensions between Canberra and Beijing, but as a means to grow and mature the relationship overall.”

QBE boss Pat Regan said: “We keep missing the boat on tax reform. Tweaks around the edges are good, but to ensure we remain competitive, to stimulate investment and growth and to attract foreign investment, I think we need to think seriously about our tax system and taxation.”

Paul Keating said leadership was about courage and imagination. “We do see flashes of courage from our leaders, but I’m not sure we’re seeing much imagination about where we’re headed, what sort of society we want, and what should we do with our wealth, which are all important questions.”

Stockland’s Mark Steinert said: “Cybersecurity is a real challenge given it can scale exponentially and requires co-ordinated industry and government actions to ensure we can limit vulnerabilities to digital crime.”