James and Gretel Packer renegotiate split of family empire

James and Gretel Packer’s secret renegotiations and fresh billion-dollar deal simplifies financial relationship.

Billionaire siblings James and Gretel Packer have secretly renegotiated their split of the family empire in a fresh billion-dollar deal that simplifies their financial relationship, as Mr Packer works on a potential $8.5 billion privatisation of the listed Crown Resorts casino group.

Ms Packer, who turns 50 in August, has emerged from the difficult negotiations with stakes in the listed Crown Resorts, American listed online real estate business Zillow, cash holdings and some interest in Mr Packer’s private Consolidated Press Holdings.

Overnight in the US, Zillow told the market that Mr Packer, 48, cut his stake in the company in half to 2.3 per cent, with his sister now believed to hold what is the balance of his previous holding. Those shares were worth about $200 million when the new deal was completed on Christmas Eve last year.

That was almost 10 years to the day since their father Kerry Packer passed away from kidney failure on Boxing Day 2005.

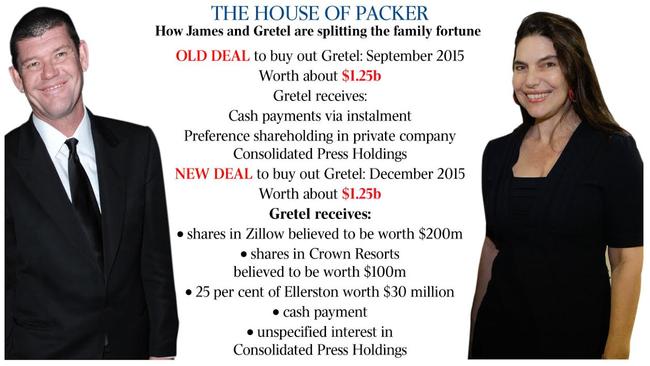

Ms Packer’s combined settlement with her brother is believed to be worth about $1.25 billion, the same amount negotiated in an original settlement between the siblings mid-last year.

Ms Packer has also emerged from the secret deal with a quarter share of what was her father’s beloved Ellerston property in the NSW Hunter Valley.

At the end of December, Ms Packer and her mother Ros Packer were appointed as directors of Ellerston, while Mr Packer retains 25 per cent and the listed Crown has 50 per cent. At last valuation, the property was worth $120 million.

Crown Resorts executive chairman Rob Rankin, who also runs Mr Packer’s private ConsPress (CPH), has also joined the Ellerston board to oversee the casino billionaire’s remaining quarter interest.

Mr Rankin is believed to have been integral to the new agreement between the Packer siblings, enjoying a good working relationship with Ms Packer.

Under the original 2015 deal, Ms Packer, who has three children, had been entitled to a series of large cash payments from her brother, as well as retaining a residual interest in Mr Packer’s CPH, which holds his 53 per cent Crown stake and a range of other investments.

One substantial cash payment had already flowed to Ms Packer, which now forms part of the new agreement which has a simpler and more streamlined structure.

Ms Packer is also believed to have emerged from the fresh deal with $100 million worth of Crown shares, as well as future cash payments and some interest in CPH. The new deal runs over a shorter time frame that the previous agreement between the pair and so offers each more certainty around asset valuations.

The new agreement comes as Mr Packer continues discussions with potential parties to a Crown minorities mop-up. The deal with his sister streamlines his own private empire and helps preserve cash towards any privatisation Mr Packer may launch.

This week Crown revealed it owed the local tax office $362 million relating to its ill-fated foray into the US casino market before the global financial crisis. Mr Packer has said he will fight the bill, but the claim has the potential to further drag on precious cash reserves.

Ms Packer was once again advised in the delicate talks by Caledonia Investments’ Will Vicars as well as Michael Triguboff, nephew of billionaire property developer Harry Triguboff.

Caledonia is a major investor in Zillow with 24.26 per cent, with Mr Vicars instrumental in Mr Packer’s original $300 million investment in the US stock in 2013.

In the fresh negotiations Ms Packer had originally sought the family’s remaining half share of Ellerston after the other half was sold to Crown last year.

Mr Packer is believed to have initially agreed to this but then changed his mind at the last moment.

Mr Packer was again advised in the deal by Matthew Grounds at UBS. David Gonski and Lloyd Williams were executers of Kerry Packer’s will.

Ms Packer appears to enacted the new agreement via a newly created corporate vehicle, RPSCO Pty Ltd, of which she is the sole director and secretary.

Via a nominee company, Ms Packer controls all the ordinary shares of the RPSCO entity, while $388 million worth of fully-paid redeemable preference shares are controlled by another Australian company, Manoc Developments.

Mr Packer’s right-hand man and old mate from his Cranbrook school days Matthew Csidei is listed as Manoc’s shareholder, but holds the stake on trust. That was the vehicle that Mr Packer used to first purchase the extensive property in Vaucluse that he went onto redevelop with now ex-wife Erica Baxter. The pair share three children, Indigo, seven, Jackson, five and Emmanuelle, three.

Mr Csidei, who now lives in London with his wife and two children and still works closely with Mr Packer, oversaw the rebuild of the home, which was sold last year for $70 million to a Chinese investor.

Ms Baxter is now in a relationship with entertainer Seal, while Mr Packer is engaged to pop singer Mariah Carey.

Ben Butler contributed to this story