And he is following that up with a similar attack on thousands of smaller high technology private companies delivering equally savage blows to our embryonic venture capital market.

When I understood the pending disasters my first reaction was that Jones was “doing his bit” by joining in the ruthless Anthony Albanese attack on family businesses which I have documented many times.

That initial conclusion might be right, but I now think it more likely that in this case Jones actually had good intentions but consulted the wrong people — the big end of town — who simply didn’t understand what would happen if the nation made it much harder to be classed as a “wholesale” investor.

Jones’ plan that Australia should have the toughest definition of “wholesale” investor in the developed world (outside Hong Kong) will result in the vast majority of the 1450 ASX-listed companies with a market capitalisation under $100m being starved of capital slowly squeezing them to death.

The same death sentence by capital starvation will apply to most small enterprises being backed by Australian venture capitalists.

Very few major stock exchanges provide a market for small enterprises like the ASX and because I am partly responsible for this unique Australian situation I should have realised the pending disaster much earlier.

Back in the early days of the internet (around 1997) I was in charge of BRW Media group. BRW had a unique Australian advantage because our large readership base had a huge number of medium to smaller enterprises and we knew the opportunities the internet would create.

So on a tentative basis, myself and Amanda Gome (congratulations Amanda on your AM on Australia Day along with along with another former colleague David Koch), started exploring whether we could create a “BRW market” for equity in smaller enterprises.

Our early feasibility work had not gone as far as telling the Fairfax top management and board but it reached the ASX who may have thought we were further advanced than we actually were.

They reacted swiftly to cut us off by opening their listing doors to much smaller enterprises. They were rushed and the numbers kept growing as the years passed. We were correct in seeing that there was a national need but there were also a lot of hazards to be explored before BRW entered such a field. We smiled because our objective was achieved.

What made the market so large was the development of a remarkable capital raising industry dominated by wholesale investors.

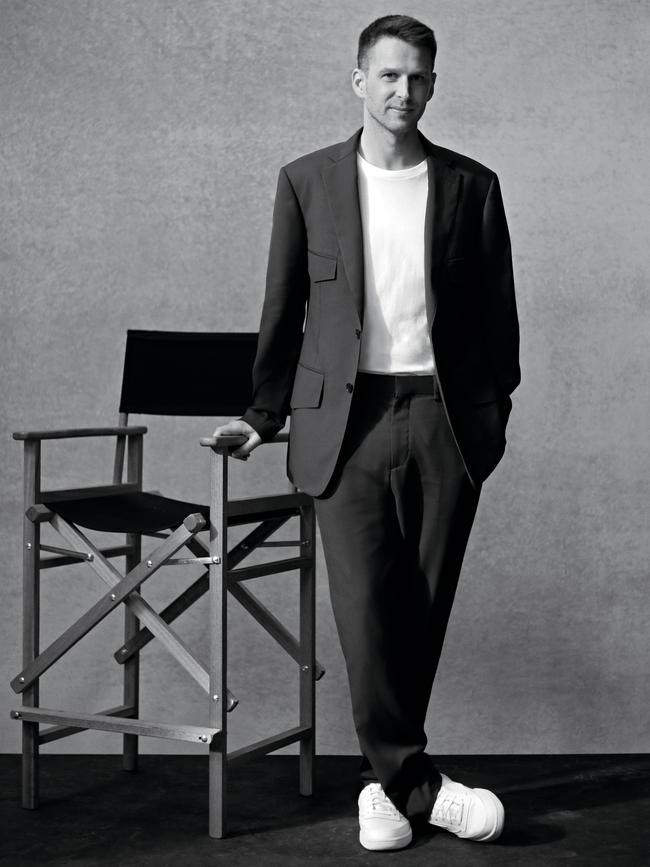

One of those involved is Ben Williamson, co-founder and chief executive of InvestorHub. It supports 80 listed companies helping them tell their story to a total of 250,000 shareholders/investors, almost all of whom are “wholesale” investors.

Non “wholesale” investors are called retail investors and they can buy and sell the small company shares on the ASX market every day, but when it comes to raising capital there are severe restrictions on their ability to subscribe — that’s why the money to keep the 1400 companies alive must come from “wholesale” investors.

It’s crazy that retail investors can buy any quantity of shares on the ASX without restrictions but are restricted in subscribing to essential new raisings. But that’s the way it is and companies are able to finance their activities because the wholesale investor market is strong, led by many enterprises like InvestorHub.

Naturally there have been failures and some of the listed companies are dormant but the ASX rules have protected investors

In the non-listed market, Startmate is one of a number of organisations that mobilise funds to invest in venture capital start-ups.

Startmate chief executive Michael Batko says his group has one pool of 441 investors and he believes 98 per cent of them would be knocked out by Jones’ proposed criteria.

Under the current rules, a person can be a wholesale investor if they have net assets of more than $2.5m including the family home or an income for two years at or above $250,000. That figure has not changed for many years and the rise in the value of the family home has greatly expanded the number of people who are eligible “wholesale” investors.

Accordingly, Jones asked the Financial Services Council, ASIC and Treasury to make recommendations. Clearly none of them had any idea of the extent and sophistication of the role of wholesale investors in capital raising for listed companies with capitalisations under $100m.

Given the absence of major scandals, the investigators were forced to go back six years to find what they thought was a good example where something went wrong.

It was actually a bad example but it illustrated how well this market is operating.

Australia’s corporate failures are currently dominated be the impact of inflation on building and Covid and not the operation of the wholesale investor.

But on the Assistant Treasurer's table is a recommendation to double the required assets, including the family home, to $5m and set up a $2.5m net assets trigger point without the family home. The alterative income test proposal is $450,000 annually for two consecutive years.

That takes us way out of line with the rest of the world. The Londoners recently looked at an appropriate level and decided on $A850,000 as the net assets minimum requirement. Williamson thinks $850,000 excluding the family home is workable but given that the rise in the value of the family home has substantially boosted the numbers of qualified wholesale investors there is no detailed data.

And I would add that it makes no sense to have any limit on a capital raising in a listed security where retail traders can buy the same security on the ASX without a limit on their finances.

I plead with the Assistant Treasurer to hold back and speak with Williamson and Batko and others who are leading this market and confirm for himself that making the proposed changes will cause havoc to an essential part of Australia’s future.

Assistant Treasurer Stephen Jones is planning a devastating attack on around 1400 listed Australian companies – around 60 per cent the companies listed on the ASX.