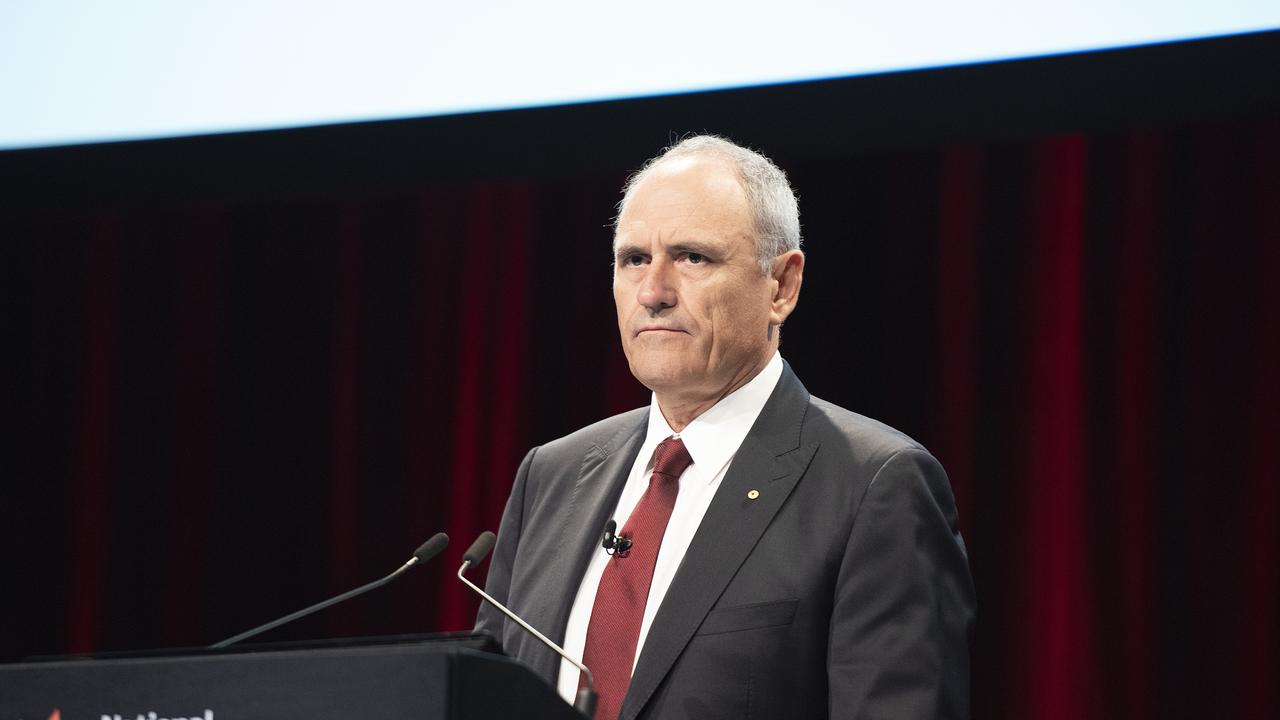

Private sector will lead the way, says Mark Birrell

THE Abbott government’s infrastructure tsar has declared the new G20 body should drive an upsurge of private-sector-led investment.

THE Abbott government’s infrastructure tsar has declared that a new body agreed to by G20 leaders should drive an upsurge of private-sector-led investment in economic and social projects.

Infrastructure Australia chairman Mark Birrell said that the infrastructure hub would be “transformational and very practical” and vowed his outfit “will back the hub 100 per cent”.

“For too long there’s been a shortage of comparable global data and case studies on infrastructure procurement and financing,” Mr Birrell said, adding that there would “only be real progress on the G20’s goals if we deepen the sources and reliability of project funding’’.

G20 leaders confirmed yesterday the establishment of a global infrastructure hub with a four-year mandate, and a review of its effectiveness after three years. Amid concerns on duplicating the work of other institutions, their communique said the World Bank Group’s global infrastructure facility “will complement our work”.

Australia will chair a seven-member board that will also include at least two directors from advanced G20 countries and at least two from developing or emerging G20 economies. The hub is expected to need US$10 million ($11.4m) to US$15m funding.

The new body will only take contributions from the private sector after the board has put in place policies to deal with real or perceived conflicts of interest. As well, the EU is poised to detail a plan for a massive stimulus package.

The growth strategies of many individual G20 countries have detailed plans to use public-public partnerships to cut the funding burden on governments, to directly and indirectly invest in public infrastructure, and to introduce tax incentives to raise investment.

Chairman of the WestConnex delivery authority Tony Shepherd backed the hub.

“An infrastructure hub based in Sydney makes great sense because Australia has been a pioneer in PPPs and innovative delivery models for public infrastructure,” Mr Shepherd said. “Australia has had significant experience as a country in delivering infrastructure to underdeveloped countries, particularly in Asia.”

Brett Himbury, the chief executive of the $50 billion IFM Investors global fund manager, said the G20 agreement was an “exciting development’’ that would speed the development of new infrastructure projects in Australia and around the world.

“I am pretty confident that it will see a strategic shift that will allow us to put more money to work,’’ he said. Mr Himbury said the retirement savings system was outgrowing Australian investment markets and needed more opportunities to invest in long-term, low-volatility assets such as roads and ports that match the return requirements of investors.

Mr Himbury was among Australian representatives that presented G20 finance ministers with details of Australian initiatives, including asset-recycling programs that allow governments to sell roads, ports and electricity and invest the proceeds in new assets.

He has also presented an inverted bid model that could help unlock more private investment in infrastructure.

Research by the B20 business summit found the hub could help add $2 trillion of extra infrastructure capacity and $600bn in GDP by 2030, while generating 10 million more jobs a year.