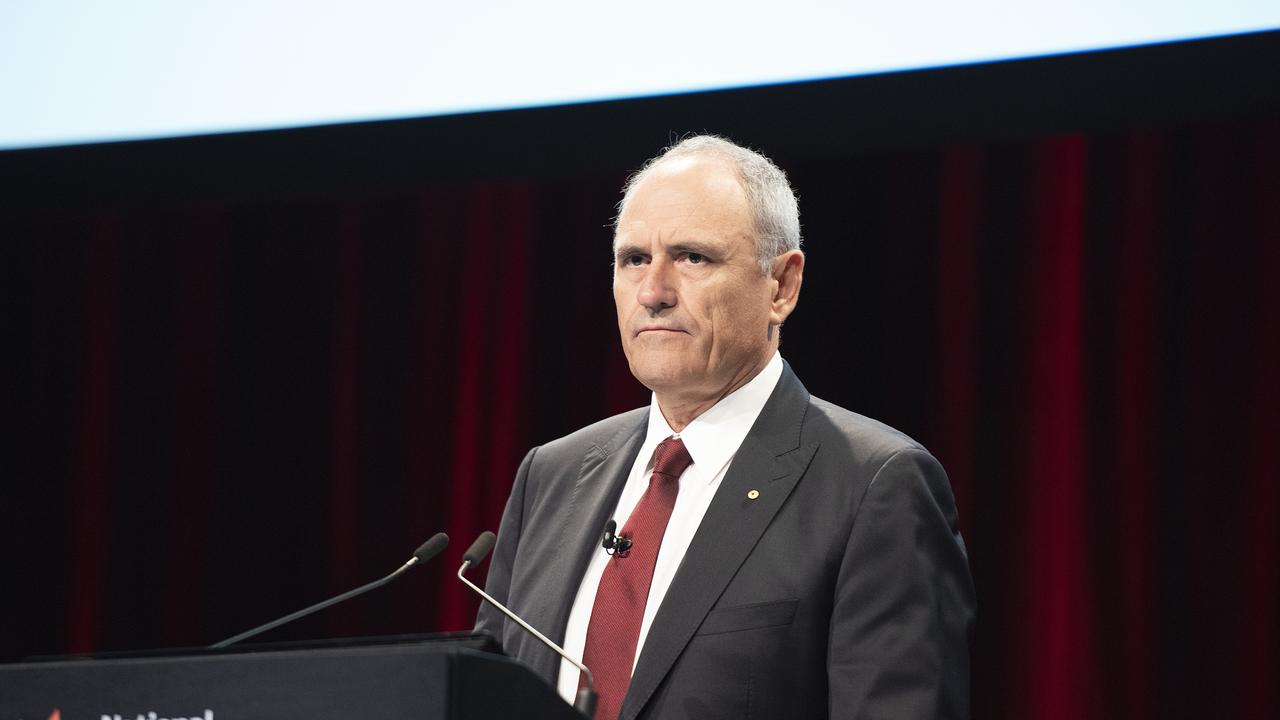

Capital rules limit cash rates, says BOE chief Carney

CASH rates will be very slow to rise and won’t return to pre-crisis levels, according to Bank of England governor Mark Carney.

CASH rates will be very slow to rise and won’t return to pre-crisis levels as central banks take account of the cost of new rules on the rates charged to customers, according to Bank of England governor Mark Carney.

Mr Carney warned that although the rate moves would be gradual, volatility was likely to increase in world financial markets as banks started placing a premium on liquidity.

He told The Australian that even with rates at zero and quantitative easing in many countries, monetary policy could not be described as “easy”.

“The ease or not of monetary policy is determined by where activity goes and where inflation goes,” Mr Carney said.

“The lesson of the last five years is that central banks have largely calibrated their monetary policies correctly in terms of their core mandates of achieving their inflation targets.

“The issue is not overshoot of the inflation target; the issue has been undershoot.”

He said that the slow eventual adjustment of interest rates partly reflected the fact that monetary policy was not loose now.

“How can it be that in the UK, where the economy has been growing at 3 per cent for the past year and a half years, that interest rates are at half a per cent?” he said. “There is still slack in the labour market in the UK.

“We’ve got downward pressure on inflation from past depreciation of sterling. We’ve got huge disinflationary forces coming from our trade partners, particularly in Europe, and commodity prices have gone down quite sharply.

“In fact, it takes us three years to get inflation back up to 2 per cent on our forecasts.”

Mr Carney said the central banks would set rates to take account of what banks ultimately charged their customers.

“The reforms we’ve made to capital and liquidity will mean that spreads in our view will be higher in the medium term,” he said.

At present banks were not charging customers for liquidity because with all the central bank action, it was plentiful, he said.

“That’s going to change when policy moves. Just through that dynamic, we think spreads are going to increase and volatility is going to increase.”

Mr Carney said an increase in volatility was more than just a possibility, it was likely.

“Now it is low because interest rates are as low as they can go, there’s a lot of excess reserves in the system and there are perceptions of central bank policy that may not be fully warranted.”

Mr Carney said it would be big news when rates started to lift and volatility spread, but it was part of the process of normalisation.

“We’re going to move to a world in the medium term where banks have to hold liquidity, hold more capital, do less proprietary trading and less market making.

“There will be more volatility in markets and more discipline around risk taking and liquidity management. As a central bank, when you get to that point, you take that into account.”