Big tax dodgers are put on notice

THE world’s biggest economies expect to conclude the final stage of a major overhaul of international tax arrangements by 2015.

THE world’s biggest economies expect to conclude the final stage of a major overhaul of international tax arrangements by 2015 after signing off commitments on a series of measures to reduce avoidance by multinational companies and wealthy individuals.

Governments strapped for cash after the global financial crisis and under pressure from ordinary taxpayers to act on avoidance by multinationals have agreed to adopt a plan developed by the OECD aimed at improving the fairness of the system and shoring up their own budgets.

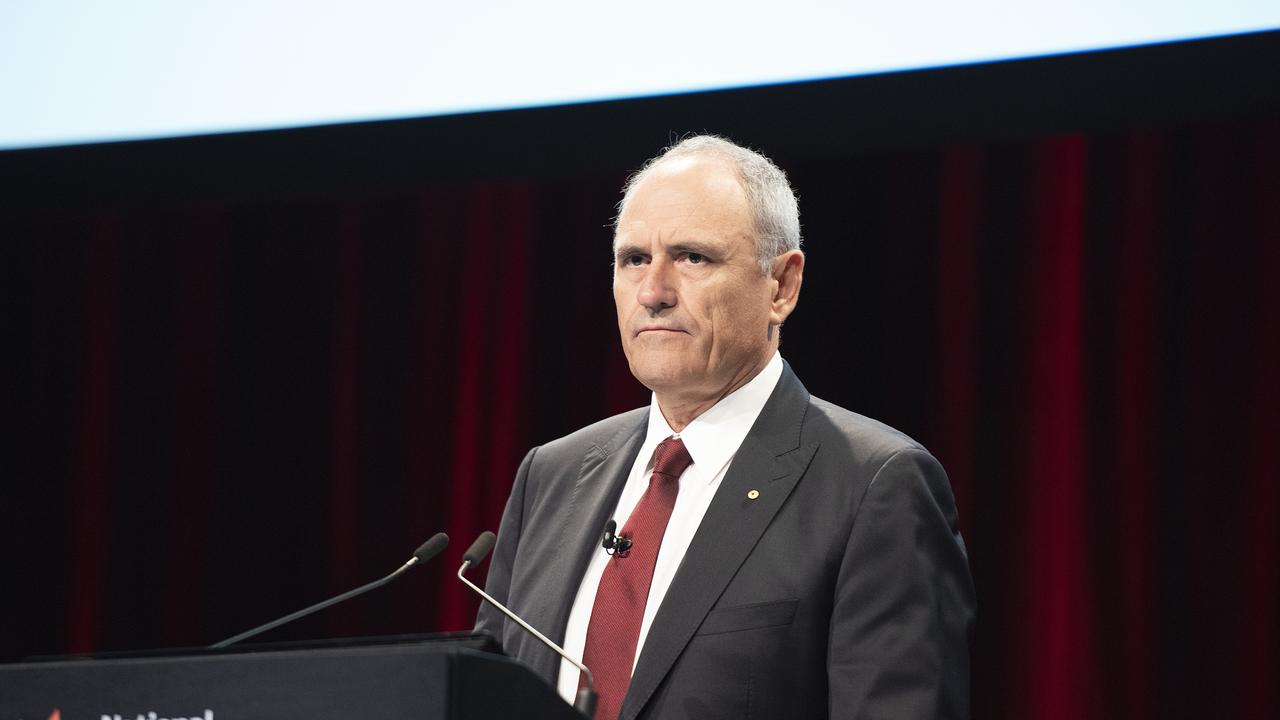

Announcing the measures yesterday, Tony Abbott said they were about ensuring that ordinary citizens received benefits and governments had the revenue to deliver them.

“Big business must pay its fair share of tax and it must pay its fair share of tax in the jurisdiction where it earns that profit,’’ the Prime Minister said.

The reforms come amid reports of major multinationals such as Apple and Google paying extraordinarily low rates of tax and shifting profits out of countries such as Australia to low-tax jurisdictions in Asia, Europe and Central America.

British Prime Minister David Cameron hailed the agreement as one of the key achievements of the G20 after years of neglect by major economies that failed to modernise their tax systems to keep pace with new multinational tax avoidance schemes.

The schemes are not illegal, but take advantage of tax competition and inconsistencies in the tax laws of different countries.