How to break bad investment habits

If you get hit by a financial tornado every festive season, now is a good time to reflect on – and change – the money mistakes you make year after year, says financial adviser Bruce Brammall.

Four days on from collectively the biggest and most stressful family catering event of any given year and … I take it you survived.

The stresses leading into Christmas for most families can be pretty intense on many fronts.

Scrambling through finishing up work for the year, social functions, shopping, preparing for the big day and heading off for holidays.

It’s a frantic time of year – personally, and professionally for most – and when we get to the big break, it often takes a few days to unwind into it.

I hope (if you’re getting a break) that you’ve finally hit the chill zone.

And what about this time of year and money? We seem to walk into the financial tornado that is Christmas every year and get smashed with twin high-pressure money systems called “presents” and “holidays”.

When it hits, for too many, the destruction hurts the household finances until after school resumes.

Habit means that we tend to make the same mistakes over and over again.

Do we promise we’ll make a better fist of things next year? Yes. But do we? Do we actually learn? Generally not. Most of us repeat the same mistakes.

Every. Single. Year.

I’m not just talking about Christmas and holiday preparations here. I’m talking about how people approach most aspects of their lives.

Planting a seed

Changing habits is hard. It takes reflection, understanding, a will to change and then actually fighting our natural instincts to do things a certain way.

With only a few days left of the year – and focus moving from Christmas Day itself to preparations for New Year’s Eve with family and friends – considering taking on any big-change decisions about your finances right now is, well, not likely to be high on your list!

At some stage over the break, we’ll all spend some time pondering what 2024 meant to us. So, consider this “planting a seed”.

What you lived, loved, survived, or went through, is unique to you. But here’s hoping you’ve ended this year on a higher note than you ended 2023.

The last two years have been very, very different in terms of what they served us as a population.

Remember the fear

Remember where we were at this time last year? We’d just got to the end (though we didn’t know it yet) of the interest rate hiking cycle.

Inflation was through the roof and the “cost of living crisis” was a daily headline. It wasn’t just mortgage-holders paying more for their house - rents were surging upwards.

Investment markets had been terrible for most of 2023, but had started to turn around in November and December.

This year? Inflation slowly came down, though not quickly enough to allow home buyers to get the interest rates reprieve we were assured would come and desperately wanted.

And markets absolutely roared. Shares and property prices had been on a 14-month run (with a bit of a wobble in recent weeks).

If you haven’t had a look at your super in recent months, but want or need a smile, take the time to do that today.

I know checking your super a few days after Christmas might seem a little down the list. And, if you have them, check your other investments too, so long as they’re invested in shares and property.

Average super balances (for balanced funds) are going to be up about 15 per cent or so on this time last year.

The more aggressive you’ve been this year, the better. Particularly if your super has a reasonable allocation to international shares.

Consider it “smile therapy”. The more you smile, the better. Particularly at this time of year.

Breaking habits

Everyone who has been invested should be pleased with themselves. Australian shares gained 23 per cent (including dividends, to the end of November), while international shares are up either 28-30 per cent, depending on whether your investments were hedged back into Australian dollars or not.

Property, until the last few months, had been on a cracking run.

The benefits of which mean nothing unless you were invested.

What’s happened to your investing habits this year? Made any changes?

How many of you who have never been investors – I don’t necessarily include super here, unless you are making active decisions to make extra contributions and make some active investment decisions – have changed that habit this year?

And for those who are investors, did you change any habits this year?

While 2024 will go down as a great year, to really win, you needed to have exposure to international stocks.

Heading offshore

Australians are, somewhat understandably, a little too parochial when it comes to investing. When starting to invest, too many decide to pick some direct shares themselves, or perhaps go into an Australian shares managed fund.

Often because they feel they understand what they are investing in, or want to invest in individual stocks they feel they know or related to, or have a specific interest in.

But over almost any mid- to long-term timeframe, the decision not to invest in global assets is going to be a drag on your investment returns.

Australia is extremely top heavy in two industries – banks and resources. When they’re not performing, our market will be held back.

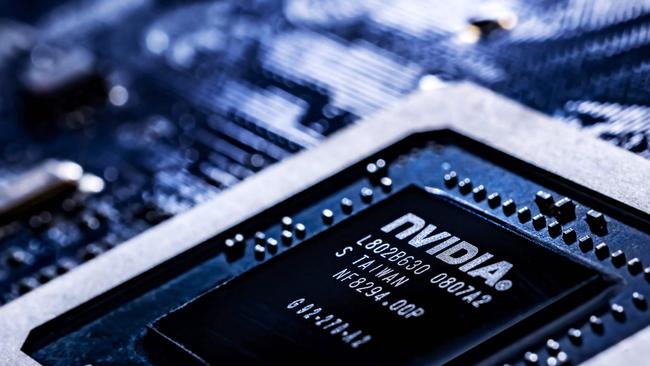

We’re underweight the sorts of technology stocks that are driving growth in world economies, particularly the United States. The “Magnificent Seven” US stocks of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla have largely roared this year and are responsible for monster returns on US markets.

For example, chip-maker and artificial intelligence leader Nvidia, to just before Xmas, was up 140 per cent plus for the 12 months. Microsoft was the worst performer of the seven, adding around 20 per cent.

I’m definitely not suggesting you go out and buy one or any of those seven!

But getting access to international shares, particularly US shares, will likely give you some exposure to them.

Easy as ETF

Getting into international shares can be fairly straight forward, by using either managed funds or exchange-traded funds.

Managed funds are most often purchased via a platform. But increasingly, investors wanting to do their own investing will purchase ETFs directly through the Australian Stock Exchange via a trading account.

While there are plenty of “active” international fund managers available in Australia, there’s a good reason that the low-cost index managers, such as Vanguard, Betashares and Ishares, are thriving.

Index-fund style investments are generally considerably cheaper, because they simply buy their investments according to the index they are trying to emulate.

Active managers charge higher fees because they are actively managing the portfolio of stocks, including research into existing holdings and potentially new holdings. On average, they don’t perform any better, studies show.

Watching the numbers

Apart from diversification and getting access to global opportunities that don’t exist in Australia, it should really also be about the numbers.

They are compelling over the medium to long term.

Vanguard’s Australian shares fund over periods of three, five and ten years have done 9.09 per cent, 8.22 per cent and 9.02 per cent to the end of November.

Vanguard’s international shares (hedged, which takes out the changes in the value of the Australian dollar), is 8.5 per cent 11.49 per cent and 10.42 per cent.

But their international shares unhedged version has done 11.98 per cent, 13.43 per cent and 13.25 per cent. On average, about 3-5 per cent better, each year, than Australian shares.

And one last one. The Vanguard US Total Markets Index ETF, which invests in around 4500 purely US stocks, has done 13.52 per cent, 16.02 per cent and 16.93 per cent.

The point is that international shares not only diversify but tend to increase returns over most periods of time.

With Betashares, those wanting to pick particular themes, such as ones around food, or technology or responsible investing, will be able to do so while also getting cheap diversification.

There’s a lot to be said for really simplifying investments and picking a fully diversified investment that manages your risk profile, get the investment started and adding to it every month, regardless of markets rising or falling.

Time for change

There is so much about Christmas habits that you’d never want to change. Even wish would never change.

But out of necessity, it changes over time, as we move from being kids to adults, to getting married, to having our own kids, to becoming grandparents.

And there are other events, including death and divorce, that force change.

Did you change any investing habits this year? End any bad ones? Start any good ones?

If not, don’t worry too much about today. I’m just planting the seed ...

I hope you had a wonderful Christmas. Enjoy this time with family and friends and I hope you’ve hit the chill zone.

Bruce Brammall is both a financial adviser and mortgage broker and author of books including Debt Man Walking. Email: bruce@brucebrammallfinancial.com.au.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.