HomeCo’s convenience stores on new level

So intrigued was billionaire Marc Besen with HomeCo’s coming ASX float that the 95-year-old undertook his own due diligence.

So intrigued was billionaire Marc Besen with investing in HomeCo’s coming ASX float that the 95-year-old undertook his own due diligence on its portfolio of “hyper-convenience” retail and services centres.

Besen, according to another billionaire in Zac Fried, the co-owner of the huge Spotlight retail chain and investor and director of HomeCo, went so far as visiting two of the company’s centres himself to look at how HomeCo was successfully adapting to rapidly changing retail conditions.

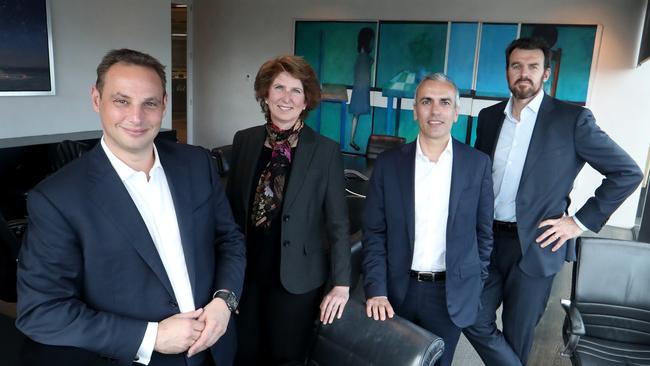

“He personally … went out and visited a couple of the sites (and) he was impressed and basically said this was the future,” Mr Fried tells The Weekend Australian, in a rare public interview alongside other members of the HomeCo board ahead of the start of it trading on the ASX next Monday.

“We went through a fairly long process with him to get the investment. He understands what we are trying to achieve.”

Besen says he we pleased to become a cornerstone shareholder in the business and says he had noted several factors that set it apart from other more traditional retail property offerings.

“I have had a very close look at the HomeCo strategy, it’s management and I am very impressed. I believe HomeCo’s unique strategy of focusing on convenience-based centres with a mix of retail and services such as childcare, gyms and healthcare will appeal to customers,” he says

For HomeCo founder and executive chairman David Di Pilla, a former UBS investment banker who will own about $100m worth of securities priced at $3.35 each in the company, it means the validation of a strategy of bringing together a group of investors in 2017 to pay $835m for 61 large hardware stores and 21 development sites of the failed Masters chain, before subsequently selling off some assets.

Masters was a humiliating and costly retreat for parent company Woolworths, which had high hopes to compete with Bunnings but ended up with a $2.7bn write-off as a discontinued business in 2016. But it left behind prime sites, with HomeCo now having 1.1 million square metres of land across 30 sites in high population growth areas around the country. With only 32 per cent of the sites currently developed there is also plenty of scope for extensions, refurbishments and even potentially residential projects.

“People knocked Masters … but they actually did a really good job in picking their locations. Because they were competing with Bunnings, it was about how do you get the maximum exposure, the best entrances and the best boxes (buildings),” Fried says.

Di Pilla has offered investors a 6 per cent dividend yield and there are fixed underlying rental escalations for tenants, 69 per cent of which are at 3.15 per cent a year. “In a low-interest environment where investors are searching for yield and growth, this resonates,” he says. “And that’s why I think we will get strong ongoing support in this market.

“We basically had close to $1bn of demand for the IPO and scaleback (of securities issued to each investor) was significant across the board. The offer period had to be closed after only three days such was the demand for it.”

By the end of the year, HomeCo’s $925m portfolio will span 21 retail and services centres around the country. A further nine centres will be redeveloped in Victoria, Queensland, NSW and Western Australia.

The centres join a crowded retail space that spans everything from big shopping malls to big box centres and smaller outlets. But for Di Pilla, the crucial aspect for each HomeCo is having a good portion of the stores and services for everyday needs such as supermarkets, chemists and childcare centres. “The proposition is built around hyper-convenience so we see that as very much a fundamental part of the future globally. People being able to get into a services environment or a retail environment — get in and get out quickly. Carparking, access, convenience,” Di Pilla says.

While he downplays the comparison, HomeCo is trying to carve out a considerable niche in a retail market where large shopping malls in particular are suffering declining sales as consumer habits shift to online spending. Consumers don’t necessarily have the time to spend hours at the mall and when they do go shopping, they want to get in and out relatively quickly and easily.

“You’re generally talking about a turnaround time of 30 to 45 minutes (for HomeCo visitors). You drive up, there’s 400-odd carparking spaces, you get what you need at the supermarket and what other stores you need to go to. It isn’t just retail though. If you need to go to the childcare centre and drop your child off before you go to work, you can pull up at the front door and you’re back in your car in five minutes.”

It has also attracted high-profile investors. Besen, the oldest billionaire on The List — Australia’s Richest 250, who once owned Highpoint Shopping Centre and a string of retail businesses, joins a star-studded register for HomeCo, alongside the likes of Fried — who will emerge with a stake of about 10 per cent in a company with an initial market capitalisation of $662m — and Chemist Warehouse billionaire duo Jack Gance and Mario Verrocchi.

Crucially for Chemist Warehouse and Spotlight and its sister chain Anaconda, both owned by Fried and his uncle Morry Fraid (the different spelling of Fried and Fraid is due to an error that was made by an immigration officer when Fraid and his late brother Ruben Fried arrived in Australia as children), the HomeCo expansion offers a steady source of potential new outlets.

Fried says there are now 15 Spotlight haberdashery outlets and Anaconda camping and outdoor stores situated in HomeCo (there are about 200 Spotlight Group stores in Australia and Asia, and another 30 planned), which has exceeded expectations.

“We have done twice as many stores in HomeCo than we originally planned to (and) they are definitely performing better than what we had budgeted for. We are looking at potentially doing more in the future. That’s not just me being on the board or the family saying we need to open another Spotlight or Anaconda. That’s the CEOs of our businesses saying actually they’re working and can we do more,” he says.

“Have a look where we play, Spotlight and Anaconda, they are hobbies. In good markets and bad markets people are always doing your hobbies. Whether you’re a fisherman or a sewer … people still like to do their hobbies. People tend to be happy to spend on that.”

Fried says larger shopping malls typically do 60-70 per cent of their trade on weekends, whereas the HomeCo outlets already have about 37 per cent of tenants classified as “daily needs and services”, such as Woolworths, Coles and Chemist Warehouse, that receive an average 25,000 visitors a week. Services such as government outlets, childcare, gyms, playcentres and medical outlets make up about 20 per cent of trade.

“The reality is that everyone is trying to move down this path. We saw this two years ago and embraced this, and what you see these businesses doing is they entrench and create a unique mix to the centres,” Di Pilla says.

He says having a cornerstone investor such as Fried on the board is validation of his strategy and “a competitive advantage”, and he points out HomeCo also has a strong collection of other major retailers opening with them in multiple locations.

Independent director Jane McAloon, who has joined the board along with Brendon Gale, the chief executive of AFL club Richmond, plays down conflict-of-interest concerns, saying: “The commitment of the foundation shareholders for the long term is really important and it sits well with an independent directors’ perspective, which is also long-term and value for all shareholders.”

McAloon says any governance issues have been gone over with a “fine-tooth comb” and any rental transactions or negotiations are undertaken at “arm’s length … via well-accepted mechanisms in the market”.

Otherwise, Di Pilla says he is concentrating on expansion opportunities, including on some well-positioned sites in western Sydney. Those include St Marys near a rail link to the new Badgerys Creek airport and Rouse Hill. — it could be childcare centres, aged care centres, it could be all sorts of other uses on those sites because the underlying value of the land is so strong — and also in Perth, where the state government is planning a $4bn rail link that includes the northern suburb of Ellenbrook. “Sometimes in life you get a bit of luck, and it just happens a train stop to that link is going to stop right outside a HomeCo,” says Di Pilla.

“And we will make acquisitions. That is definitely part of our future. We’ve worked very hard to position this IPO for success in terms of pricing and structure. We believe it is priced well for the market and should perform well.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout