Google Australia profit plunges on tax hit

But the tech giant still scooped up a bigger slice of the local advertising market.

Google Australia was slapped with more than $50 million in back taxes last year, which along with higher wages bill slashed the technology giant’s local profit by 74 per cent.

Accounts filed with the regulator on Thursday also show the search giant is scooping up a bigger slice of the local advertising market, with revenue surging to $4.3bn, up from $3.7bn a year ago.

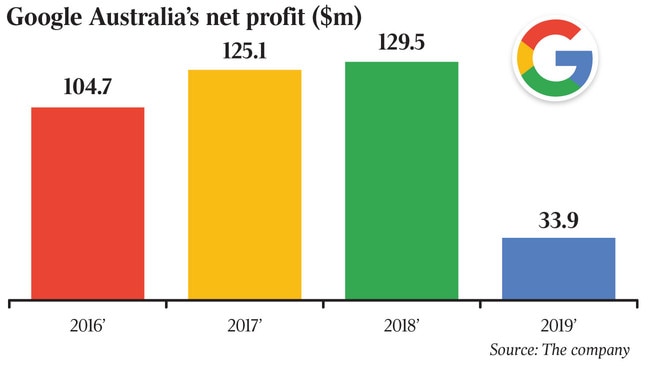

The group’s full-year accounts for its Australian arm for the year to end-December, revealed a net profit of $33.9m, down from $129.5m last year.

While the company reported a lift in total revenue to $5.2bn, increasing staff payments and a growing tax bill pulled its overall profits lower.

The tech giant which has come under pressure from authorities around the world for its efforts to shift its tax obligations to lower tax countries, was hit last year with a $50.6m charge for “prior period current tax”. This was in addition to its current tax charge of $58.7m, taking total taxes paid for the past year to $99.7m, the accounts show.

Revenue from its advertising and other reseller arm sold directly in Australia lifted 28 per cent to $719m, but hardware sales slipped 17 per cent to $179.1m.

Including advertising revenue raised in Australia but resold under a service agreement with Singapore-based Google Asia Pacific, local advertising sales pushed $4.3bn, the accounts show.

The accounts also reveal that Google’s parent company injected $310m into the Australian arm of the company in early January “to support investment in our Australian operations and workspaces”.

A Google spokeswoman said the company was continuing to invest – and pay taxes – into the company’s local operations, but that it pays the majority of its global corporate income tax in the US, where it also performs the majority of its R&D work.

The company now has more than 1,700 workers in Australia, more than double the number five years ago.

“In the 2019 calendar year Google Australia made a pre-tax profit of $134m, resulting in $59m of corporate income taxes payable, and invested almost $1bn in our Australian operation,” a Google spokeswoman said.

The company also said the future impact of the current economic situation due to the COVID-19 outbreak is “uncertain and difficult to predict” but would not affect the company’s reported financials.

Google is also still reeling from a mammoth deal it reached with the Australian Taxation office late last year.

In December 2019 Google settled a decade-long dispute with the ATO, paying almost $500m to the ATO as part of an audit process dating back to 2008.

The ATO said at the time its result with Google brings its total collections made from the e-commerce industry to around $1.25bn in back tax assessments, with the ATO also settling with Facebook, Apple and Microsoft.

“[The Google tax settlement] adds to the significant success of the ATO in positively changing the behaviour of digital taxpayers and significantly increasing the tax they pay in Australia,” ATO deputy commissioner Mark Konza said.

“The extension of the Tax Avoidance Taskforce until 2023 will ensure that the ATO is able to continue to pursue these issues and provide assurance to the community that we are doing everything in our power to protect Australia’s tax base.”

Eyes will now turn to the federal government's plan to force Google to pay millions for news content in Australia, under a planned mandatory code of conduct to be finalised by July.

The recent ACCC digital platforms inquiry found 19.2 million Australians use Google every month.