Fundies look for value in the ‘Magnificent Seven’ as dust settles from tech stocks carnage

Last year’s tech darlings have been at the centre of the US sharemarket sell-off. But are any of them worthy of buying at the current price?

The technology stocks that propelled the US sharemarket higher last year have had a punishing fall from grace as recession fears rattle investors, but fund managers are split on whether the sharp sell-off is a buying opportunity or the beginning of a bigger hit to come.

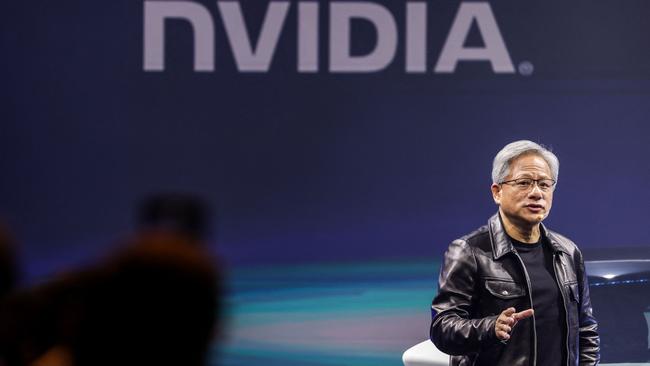

The “Magnificent Seven” stocks, last year’s tech darlings, have been at the centre of the US sharemarket meltdown sparked by President Donald Trump’s tariffs and growing fears of a recession in the world’s largest economy. These seven companies – Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla – lost more than $US750bn ($1.2 trillion) in market value on Monday alone, propelling the Nasdaq’s worst trading session since 2022.

Bell Asset Management has taken advantage of the sell-off to step in and start buying.

“We love buying high-quality names that are out of favour. We’ve been opportunistic. We’ve just initiated a small position in Meta … and we’ve been topping up a little bit in Nvidia,” chief investment officer Ned Bell told The Australian.

“Nvidia is trading on 23 times earnings. That’s not bad. Consensus is implying there’s 50 per cent earnings growth over the next 12 months, so at 23 times earnings, that’s pretty attractive at the best of times.”

Tesla has been the hardest hit of the tech mega stocks, crumbling 40 per cent since the start of January and shedding 15 per cent in Monday’s session as economic growth fears increased.

Artificial intelligence play Nvidia is down 28 per cent from its recent highs, while Meta, Amazon and Alphabet have all lost just shy of 20 per cent in a few short weeks. Microsoft is down 15 per cent since January, while Apple has performed the best of the lot, off 8 per cent from its February high.

The Magnificent Seven are the biggest holdings in Bell’s global equities fund. All up, about 22 per cent of the fund is invested in Alphabet, Microsoft, Nvidia, Amazon and Apple, though the fund pared back its exposure to Apple when it hit a high in late 2024.

“We’ve owned a lot of these names for a really long time but you’ve got to still be able to trade around them and be opportunistic,” Mr Bell said. “From a stockpicking perspective, this is a great environment. We love it because a lot of stocks get mispriced very quickly,” Mr Bell added.

“The sell-off is a reality check. We’re coming off two years of a very one-directional trade in the mega cap stocks.

“They’ve done all the heavy lifting, and now that’s starting to unravel.”

Mr Bell said he expected market volatility to continue through the year and saw the small and mid-cap sector benefiting from the shift away from the handful of megastocks.

Pella Funds Management managing director Steven Glass said the AI trade was “still on and very real”, with stocks such as Nvidia and Broadcom selling off despite positive earnings outlooks.

“Still, one has to be pragmatic. The market’s saying something loud and clear here,” Mr Glass said.

“We’ve got very healthy exposure to (Nvidia), but we’re not looking to increase our exposure quite yet. We’re waiting for things to settle down.”

Pella’s Global Generations Fund has positions in Amazon and Nvidia, but Mr Glass said he did not like most of the Magnificent Seven.

“We think Tesla is expensive, we think Alphabet has huge issues and we think Apple’s expensive,” he said.

“We like Amazon, though we think it’s very fully valued.

“And Meta we haven’t done a tonne of work on because it doesn’t pass our ESG requirements. But it’s doing a lot of very clever things that we think will actually benefit Nvidia.”

WAM Global lead portfolio manager Catriona Burns is also waiting on the sidelines during the tech sell-off.

Just 4 per cent of the fund is invested in the Magnificent Seven.

“Our view is there’s better value in other parts of the market, and that’s been the view for the life of the fund. We’ve owned Microsoft and Google but generally we’ve been massively underweight, just because we’ve seen better opportunities elsewhere,” Ms Burns said, as she pointed to the challenges facing each of the megastocks.

“There’s concerns there, whether it’s Apple and Tesla, around tariffs, or Microsoft, Meta, Alphabet and Nvidia around just AI capex, whether they’ve all overinvested and you’re going to see a pullback in capex. We prefer to play AI via the software names that are capitalising on rising AI adoption, rather than really capex-dependent names.”

Ms Burns is staying away from companies at risk from tariffs in favour of those that benefit from volatility, such as market exchanges, and that will keep trading on an even keel during any “noise”, such as pet health diagnostics firm IDEXX Laboratories.

“We’re taking advantage where we think earnings will hold up very well but the shares have been sold off along with everything else,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout