Flight Centre nosedives after turbulent year

Flight Centre boss Graham Turner expects it will take at least six months for its Australia-based leisure division to turn around.

Flight Centre boss Graham Turner expects it will take at least six months for the company’s Australia-based leisure division to turn around, after admitting its poor performance compared with a year ago.

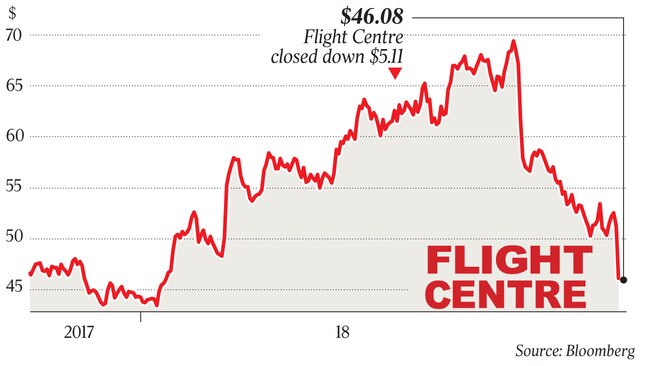

Shares in Flight Centre dived 12 per cent yesterday before closing down 10 per cent at $46.08 following the company’s annual general meeting. There, Mr Turner disclosed to shareholders that full-year underlying profit before tax would be $390 million-$420m, compared to $384.7m last year.

Flight Centre’s guidance for the first half of the 2019 financial year is an underlying before-tax net profit of $140m-$150m, up 0.4-7.6 per cent on the previous corresponding period, but below stockbroker Morgans’ forecast of $153.3m.

In a note Morgans said: “Australian profit is currently down on the previous corresponding period due to a subdued leisure result as employees have been distracted by the ongoing enterprise bargaining agreement negotiations”.

Morgans said the broad guidance range reflected the uncertainty surrounding the timing of the Australian leisure business’s recovery.

Mr Turner said his overseas businesses were driving profit increases, particularly the North American divisions. Almost half of Flight Centre’s 2018 sales were generated offshore, “and that percentage should reach or exceed 50 per cent for the first time this year”, he said.

“We now have scale internationally and we no longer rely solely on the Australian business — and the leisure business in particular — to drive overall growth.”

Speaking to The Australian yesterday, Mr Turner said the guidance was obviously a bit downbeat.

“We still have some disruption from the rebranding six months ago and with some of the things happening with the enterprise bargaining agreement,” he said.

“The EBA negotiations are all over bar the shouting. Basically it is agreed but has to be ratified with Fair Work.”

Mr Turner said the EBA — which will provide Flight Centre and Student Flights staff with higher retainers or base pay as well as incentives — would be in place by October 1, with 85 per cent of staff agreeing to it.

Mr Turner said other benefits introduced as a result of the EBA included extra leave for travel, leisure activities and personal development.

Flight Centre is also adding an in-house mentoring program as well as traineeships based on the model used by Flight Centre’s British operation.

He said the company had budgeted to spend an extra $10m on top of the $780m-$800m it had already pledged.

Flight Centre’s share price was still affected by a negative ABC TV report on its EBA negotiations, coupled with a poor result in its Australian leisure division.

“We have had a fair bit of disruption with [travel software] Sabre, the EBA, the ABC report, we would like to see things coming back in the leisure sector in Australia in the next six months,” Mr Turner said.

“The Australian dollar is weaker but that balances out. If the dollar is weaker there is an advantage for foreign exchange.”

He said there were also issues with uncertainty about Brexit.

Flight Centre was focused on improving the performance of some of its retail shops, which had been rebranded from the Escape Travel and Cruiseabout brands, as well as the potential relocation of about 35 stores. It is also working on a new low-cost self-service operation for customers.

Meanwhile, the Turner family’s Spicers resort arm will this week open its second Hunter Valley property, having refurbished a former Peppers property in the NSW wine region.