Zip Co briefly surges after S&P adds it to ASX300 index

Zip shares briefly tapped an all-time-high after S&P flagged it would be added to the ASX300 index.

Shares in Afterpay Touch rival Zip Co surged more than 7 per cent to an all-time-high in early trade on Friday after the company announced this morning that it had acquired trans-Tasman SME lending business Spotcap ANZ.

It also came after the buy now, pay later operator was added to the ASX300 as part of S&P’s quarterly rebalance.

Zip said this morning that the acquisition would give it an accelerated strategy for the recently announced Zip Biz buy now, pay later product in both Australia and New Zealand.

Zip (Z1P) shares have lifted significantly this year, from around $1.08 in January to an all-time high of $4.17 on Friday morning, although they had dropped back to a flat $3.89 in afternoon trade.

Zip announced this morning that it had acquired trans-Tasman SME lending business Spotcap ANZ, giving it an accelerated strategy for the recently announced Zip Biz buy now, pay later product in both Australia and New Zealand.

“Extending our consumer BNPL product offering into the SME space is a natural evolution for Zip,” chief executive Larry Diamond said in a statement to the market.

“The strategic acquisition of Spotcap will fast-track the delivery of this product using a proven origination platform that is live in the Australian and New Zealand markets.”

Recent strength in the company’s shareprice come after the company announced it had acquired Auckland-based provider PartPay, giving it a footprint in Britain, the US, New Zealand and South Africa.

Last month, Zip revealed it had halved its loss in the 2019 financial year as revenue more than doubled to $84.2m.

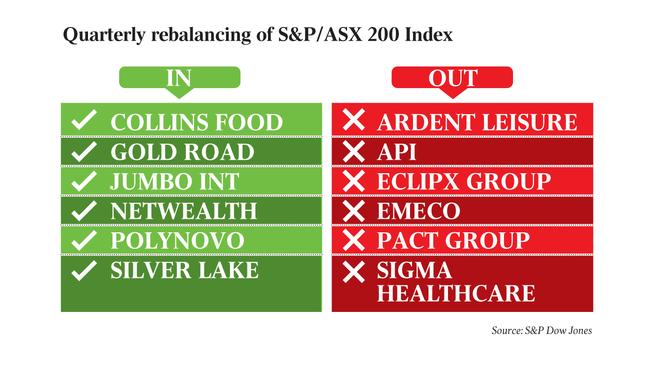

Other major moves in the latest S&P quarterly rebalance included health insurer NIB entering the ASX100, replacing Pendal Group which was booted. In May, the fund manager — formerly BT Investment Management — blamed lower performance fees and market volatility for a 13 per cent drop in first half net profit.

Meanwhile, under pressure Dreamworld owner Ardent Leisure was removed from ASX200 along with Priceline owner Australian Pharmaceutical Industries, Pact Group — the packaging company controlled by Melbourne billionaire Raphael Geminder and Sigma Healthcare.

On Thursday, Sigma unveiled a significant hit to its bottom line following the loss of a key contract with Chemist Warehouse last year.

Australia’s biggest KFC franchisee, Collins Foods was added to the ASX200, along with biotech company Polynovo and gold miners Gold Road Resources and Silver Lake Resources.