Zip Co halves full-year loss, targets $2bn milestone

Zip is targeting more than $2bn in sales volume, as it presses ahead with global rollout.

Credit card disrupter Zip Co has set its sights on the lucrative SME market as it ramps up its expansion plans and targets a more than doubling of its transaction volumes in the coming year.

It comes just days after the “buy now, pay later” operator (Z1P) announced it had acquired Auckland-based provider PartPay in a scrip deal worth $NZ50.8m ($47.9m), giving it an instant footprint in Britain, the US, New Zealand and South Africa.

The new product, Zip Biz, will allow small and medium businesses to avail of an interest-free line of credit up to $25,000 which they can use with Zip’s existing merchants, such as Bunnings and Officeworks.

“Zip Biz is coming,” said Zip chief operating officer Peter Grey. “The small to medium business market is very large and it’s underserviced by the banks. We want to level the playing field and give them access to better financial products,” he said.

Zip has been aggressively chasing growth in the hotly contested “buy now, pay later” sector and is showing no sign of slowing. The company yesterday said it was exploring new market opportunities and expects to double its transaction volume to $2.2 billion this year on a near doubling of customer accounts, to 2.5 million.

“We’re still not in many places where customers transact every day — we’re not in the supermarkets, we’re not at the fuel pumps, we’re not in the telcos — so there’s a lot more to go in terms of acceptance,” chief executive Larry Diamond told The Australian.

“Without giving away too much of the pipeline, our view is that a lot of retailers and businesses have recognised that alternative payments are a really important part of their payment suite … We believe that we can bring on a number of big businesses in these new segments.”

Zip on today revealed it had halved its loss in the 2019 financial year as revenues more than doubled to $84.2m.

For the 12 months through June, the “buy-now, pay-later” operator posted a loss of $11.1m, down from a loss of $22.5m the year prior.

The volume of sales that went through its system more than doubled to $1.13bn as the number of customers on its platform surged to 1.3 million.

Customer receivables rose to $682.6m in the year, up from $316.7m the year prior, while both arrears and bad debts remained broadly static over the period.

The arrears rate was 1.89 per cent, the company said, while net bad debt write-offs were 1.63 per cent. This was materially better than industry benchmarks, and ahead of management’s guidance, it said.

“We are proud of these results, but are only just beginning and are now well positioned to drive more customers to transact at more places, more often,” Mr Diamond said.

Commenting on the prospect of increased competition from credit card providers, Mr Diamond said he wasn’t too concerned.

“If you look at the banks, whether it’s the Visa instalment option or the similar announcement Mastercard made a couple of years ago, our view is that solution doesn’t meet a customer need. It’s still predicated on the credit card, which has 20 per cent interest. The funding source for our Zip pay product is largely debit cards,” Mr Diamond said.

Electronic payments giant Visa in June announced its entry into the “buy now, pay later” space with the launch of an instalment option for some credit card holders.

“Merchants are looking for a holistic solution, not a fragmented one. Products like Zip aren’t issuer specific,” he said.

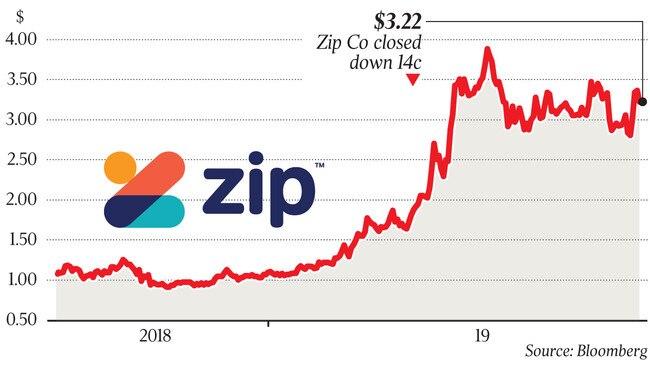

Zip shares jumped more than 6 per cent in intraday trade after the release of its full-year results before swinging into the red and ending the session down 4 per cent at $3.22.