As it happened, the flood of lending by the locals to thwart the overseas banks almost sent the ANZ and Westpac to the wall in the 1988-91 crash. But it also hit the overseas entrants and none of them succeeded in the way they had planned. Some were very bruised.

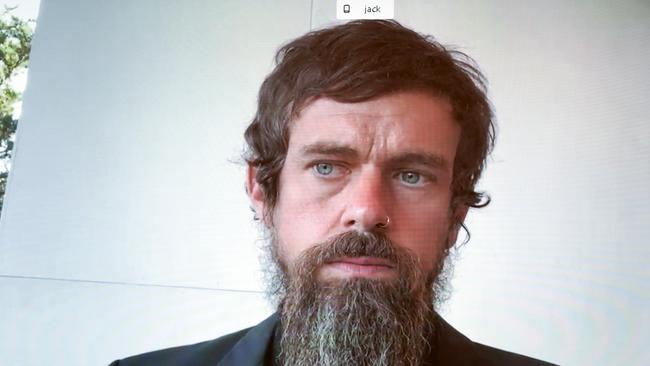

Fast forward to 2021 and this time it’s only one overseas bank that is coming and, having been started by a co-founder of Twitter, Square Inc thinks of itself as a technology company rather than a bank.

But Square’s US banking operations are an essential part of its operation, and, unlike 1985, the locals may not be ready for what is about to hit them.

There is a global flurry of activity in the “Afterpay” section of the consumer credit market, with many new entrants including Apple and the Commonwealth Bank. But prior to its bid for Afterpay, Square realised that in some ways gaining customers with products that replaced the cumbersome and high-cost credit cards issued by banks was merely the first step in the revolution.

The next step was to provide cash flow-based banking services to the retailers---- and also their suppliers----- based on the information created by the new consumer credit systems.

Given the competition that the Australian Afterpay company faces around the world it made great sense for the founders, Nick Molnar and Anthony Eisen, to merge with the company that would not only increase its US retail customer base but had already moved into banking. Square, with Afterpay on board, will take its banking services to wherever it goes, including Australia.

Whereas the big overseas banks which came to Australia in 1985 aimed to secure business from large Australian corporates, Square is aiming at a badly-served market ----small and medium-sized business.

The Square technology is aimed to enable this sector of the market to use the finance management techniques of the large corporates which make business more profitable and easier to manage.

For Australia this is a significant event because it combines the government’s intention to transform the landscape for small and medium business with banking competition for the sector.

Already fast payments are moving down the slipway; the end of unfair contracts is in the pipeline and it is highly likely that in its 2022 election campaign the government will set out a legislated program to end the long-established rapacious behaviour tradition of the Australian Taxation Office towards many sectors of the Australian small business community.

The combination of these events sets the stage for a very different small and medium business environment in this country.

Meanwhile the local banks will need to undertake some urgent strategic thinking about how to handle the combination of Square and Afterpay. The banks are about to lose even greater chunks of their lucrative credit card business and will have to get on their skateboards to meet the new banking competition.

Subject to Australian regulation it’s not hard to recognise what happens next because Square has already embraced banking services in the US. It’s fascinating that Square uses different terms to describe each service. It rarely uses the “turn-off” word “bank”.

Square can see the cash flow of their small and medium-sized enterprise customers so can make it very easy for customers to borrow at attractive rates based on cash flow.

The traditional Australian banking idea of a home mortgage to finance a small enterprise loan is simply not in the “Square dictionary” and it will diminish very quickly from the Australian landscape once Square gets over the regulatory hurdles.

In the US Square also found that a large number of smaller enterprises were having difficulty paying when they suddenly received a large bill. It was very often a tax office bill. To foster innovation and employment small enterprise taxpayers in the US have a bill of rights and a proper appeal systems but enterprises that don’t manage their cash properly can still get caught.

Sometimes entrepreneurs are forced to use personal savings pay those bills. Square offers enterprises a service whereby a percentage of their turnover going through the Square books is put aside in a deposit account. The idea is to make the management of cash for smaller and medium size business a much smoother task. Naturally the interest rate paid on these deposit accounts is above the current pittance handed out by traditional banks.

Because the high technology companies like Afterpay have had to struggle, they understand the difficulties faced by the small and medium size business operators. Australian banks have been enjoying the opiate of the housing loan bonanza. Not nearly enough of the rewards of housing have been ploughed into technology. The Afterpay technique should have been recognised as a major threat years ago and either taken over or its techniques embraced. But that would have hit credit card profits. The Commonwealth Bank is entering the field but it is very late to the game.

Businesses across a wide spectrum of activity are going to face challenges from new technology and have to be alert.

In the past the banks have had the cash flow data and customer bases on their own. Now the likes of Afterpay have that knowledge and are ready to use it in a way that the banks have never done.

Thirty-six years ago the then treasurer Paul Keating invited 16 overseas banks to come to Australia. But the locals were waiting for them and were well prepared. They increased their lending rate and did all they could to make life difficult for the newcomers.