The best super funds of 2021: Chant West says risks on the horizon for returns

Super members enjoyed bumper returns last year but are being warned not to expect the same as the focus shifts to navigating 2022 and expectations of rate rises. List of top funds

Superannuation fund members are being warned to expect a reversion to more normal returns, after 2021 saw funds post bumper median returns of 13.4 per cent and notch up a tenth straight year of gains.

Super research house Chant West on Thursday released the performance data for calendar 2021 across the growth fund category, where the majority of Australians have their super invested.

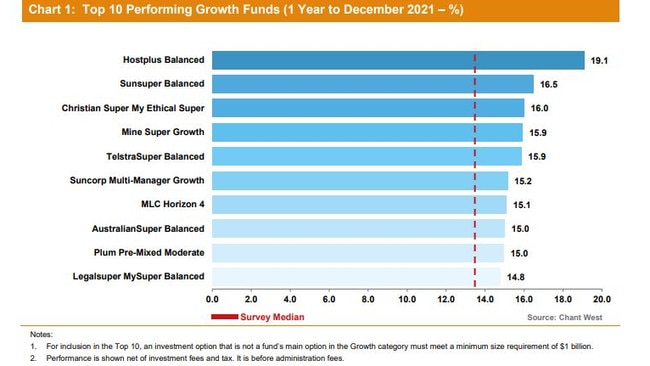

Hostplus topped the growth fund performance tables for 2021 with returns of 19.1 per cent, followed by Sunsuper with returns of 16.5 per cent and Christian Super’s My Ethical Super at 16 per cent. The report said even the worst performer in the growth category posted 10 per cent annual returns.

Chant West senior investment research manager Mano Mohankumar labelled the results “remarkable” against the disruption and health concerns caused by the latest wave of Covid-19.

“The experience over the past two years highlights the resilience of super funds’ portfolios and their ability to limit the damage when markets are weak but still capture substantial upside when markets perform strongly,” he said. “The 2021 result, in particular, is a continuing reward for those members who’ve remained patient throughout the Covid crisis.”

But as the focus shifts to how funds will navigate financial markets and other investments amid growing expectations of interest rate rises, Mr Mohankumar cautioned investors that returns had printed markedly lower over the longer terms.

“Super funds have had a tremendous year with a median return of 13.4 per cent but returns at that level shouldn’t be thought of as normal,” he said. “The typical long-term return objective for growth funds is to beat inflation by 3.5 per cent per annum, which translates to about 5.5 per cent to 6 per cent per annum.

“ We now have data going back 29½ years to July 1992, the start of compulsory super. Over that period, the annualised return is 8.2 per cent and the annual CPI (consumer price index) increase is 2.4 per cent, giving a real return of 5.8 per cent per annum – well above that 3.5 per cent target.”

Super funds posted a strong performance leading into the end of last year but leading into February’s profit reporting season for ASX companies, some industries are being hit by supply chain issues and extreme labour shortages.

The prospect of higher interest rates in the US in the near term and Australia over the medium term will also weigh on the returns of some sectors.

On the 2021 performance of growth funds, Mr Mohankumar said: “The better performing funds over the year were generally those that had higher allocations to listed shares, in particular international shares. “Australian shares gained 17.5 per cent while international shares surged 24.3 per cent in hedged terms. The traditional defensive sectors such as bonds and cash were the weakest performers over the year, so keeping a low allocation to those would have helped performance.”

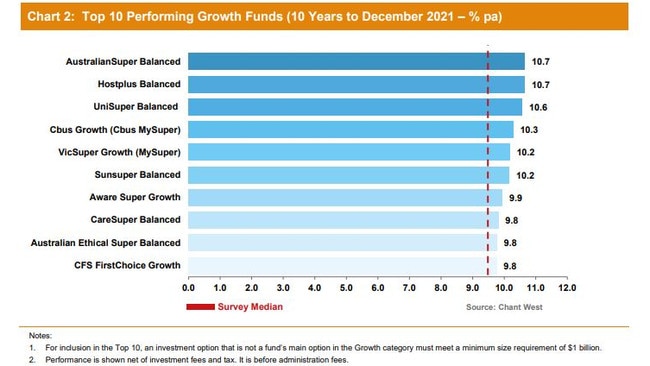

Performance over ten years saw AustralianSuper and Hostplus top the table with respective returns of 10.7 per cent per annum, followed by UniSuper with returns of 10.6 per cent per annum.