Super funds eye 10th year of gains as AustralianSuper and Aware Super warn on risks ahead

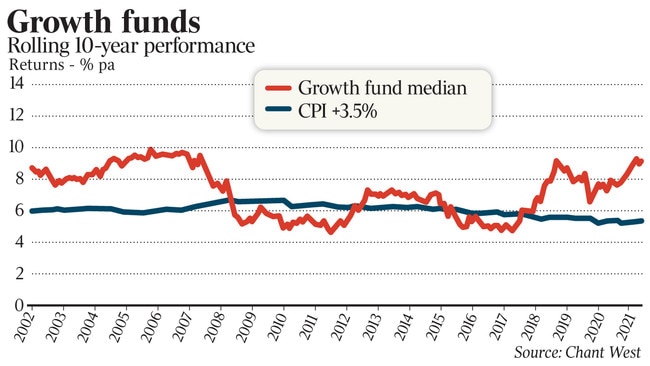

The nation’s super funds are on track to record a tenth successive year of gains, notching up a 12 per cent return according to super research house Chant West.

The nation’s super funds are on track to record a tenth successive year of gains, notching up a 12 per cent return with just two weeks to go.

But with the Omicron variant already resulting in fresh lockdowns in Europe and renewed investor jitters, Australia’s mega-funds are weighing in on the big risks for the year ahead, with Covid-19 front and centre. The median growth fund added 0.3 per cent to its yearly gains in November, bringing the return for the first 11 months of the year to 11.7 per cent. And with markets up in December so far, the calendar year return is now sitting above 12 per cent, according to super research house Chant West.

The boost comes amid a rush to safe haven assets as Europe imposes restrictions, while in the US rate hikes may be brought forward. These moves could send a shiver through markets in the final weeks of the year, putting the double-digit gains at risk.

But the so-called Santa rally, which has delivered sharemarket gains for the final two weeks of December in seven of the last 10 years, could see funds tip over the 13 per cent mark before the year is out.

The average gain in the last two weeks of December over the last 10 years has been 1.4 per cent. If that holds true this year, the median growth fund will see a return above 13.4 per cent, based on Chant West’s estimates.

“Barring a last-minute capitulation, we’re on track for yet another positive result for super fund members – the tenth in succession,” Chant West senior investment research manager Mano Mohankumar said.

“It’s a remarkable achievement when you consider that the past two years have been fraught with social and economic disruption as a result of the Covid pandemic.”

Super fund chiefs told The Australian’s CEO Survey they were nevertheless eyeing potential risks to returns in the year ahead.

AustralianSuper chief executive Paul Schroder said the fund was watching Covid-19 developments closely.

“Our most immediate concern is the combination of winter in the northern hemisphere and a potential upswing in Covid cases linked to the new Omicron strain that forces lockdowns, albeit more moderate, in Europe or the US,” Mr Schroder told The Australian’s CEO Survey.

“Uncertainty means that the possibilities cover the spectrum from minimal impact on economies to a severe impact. Central bankers and finance ministers will also be uncertain, and so judging the likely monetary or fiscal policy response in the key economies is very difficult.”

Aware Super boss Deanne Stewart, meanwhile, flagged aggressive rate hikes as a risk for Australia’s economic recovery.

“The RBA getting behind the curve on inflation and having to eventually become more aggressive on lifting rates (is a risk),” Ms Stewart told The Australian’s CEO survey.

“The pricing of long bonds suggests that economic growth is not overly robust or enduring with the recent strength driven by a rebound from the pandemic. This suggests that if the RBA needs to lift rates materially, the economic recovery will be reversed.”

Markets were starting to question whether the emergency policy settings in place through the pandemic remain appropriate given signs of higher price pressures, she said.

“The RBA has maintained that rate rises are at least two years away but investors are suggesting they may have to increase more quickly and sooner.”

Depending on the severity of the latest Omicron outbreak, the unprecedented fiscal and monetary stimulus of 2020 and 2021 may be nearing an end, Mr Schroder said.

“Exactly what impact this will have on the key global economies is uncertain and a significant risk,” he warned. “China’s attempt to slow property development and deleverage its economy is also a downside risk to global growth as well as a downside risk for Australian exports in particular.”

While the risks were many for 2022, the 2021 super fund returns provided further proof of the sector’s resilience and its ability to grow members’ savings regardless of economic disruptions, Chant West’s Mr Mohankumar said.

Growth funds nudged ahead in November despite falls in global sharemarkets, prompted by the emergence of the new Omicron variant of Covid-19.

Over the month, Australian shares gave up 0.5 per cent, while international shares dipped 1.5 per cent in hedged terms. On a positive note, the depreciation of the Australian dollar – down from US75c to US71c – saw that loss turned into a 3.7 per cent gain in unhedged terms.

“This year’s result represents a continuing reward for those members who’ve remained patient and trusted their funds to weather the crisis.

“Who would have thought, at the low point in late March 2020, that growth funds would have surged a staggering 30 per cent over the subsequent 20 months? That tremendous rally sees them sitting nearly 15 per cent higher than the pre-Covid crisis peak that was reached at the end of January 2020.”

Growth funds nudged ahead in November despite falls in global share markets, prompted by the emergence of the new Omicron variant of Covid-19.

Over the month, Australian shares gave up 0.5 per cent, while international shares dipped 1.5 per cent in hedged terms. On a positive note, the depreciation of the Australian dollar – down from US75c to US71c saw that loss turned into a 3.7 per cent gain in unhedged terms.

With a shift to safe assets during the month, government bond yields fell and, as a result, Australian and international bonds were up 2.1 per cent and 0.7 per cent, according to Chant West.

“US share markets fell in November, but less than most other countries. The heaviest declines were in the tech sector, which is highly sensitive to any signs of increasing inflation,” Mr Mohankumar said.

“Back at home, economic activity picked up in November but, as we head towards Christmas, Covid case numbers have begun to rise sharply. There are fears that the Omicron variant, which appears to be more transmissible even if possibly less severe, will result in an exponential growth in cases,” he warned.

“Despite that, most states are pressing ahead with plans to free up their communities and stimulate some economic revival.”