Struggling banks slash savings interest rates

Australia’s banks are quietly taking an axe to interest rates paid on savings accounts.

Australia’s banks are quietly taking an axe to interest rates paid on savings accounts in one of their last lines of defence against a COVID-19-induced economic recession, record low interest rates and an intensifying war for mortgage market share.

Deposit rate cuts accelerated in May and gathered further pace in June and July, with banks slashing their rates on 90 savings accounts in the past month, according to Rate City analysts. Just three savings accounts saw rates lifted in the period.

At least 70 per cent of savings accounts on the market are now paying an ongoing interest rate of less than 1 per cent, according to Rate City.

“Banks are continuing to grind down deposit rates to help balance their books,” RateCity research director Sally Tindall told The Australian.

“Strong competition in the home loan market is forcing the banks to offer cheap mortgage rates, putting pressure on their bottom line.

“Cutting rates for savers helps alleviate some of this pressure.”

The cuts to savings rates comes after the Reserve Bank lowered the official cash rate twice in March to 0.25 per cent in anticipation of serious economic fallout as a result of the COVID-19 pandemic, which has sent the Australian economy into its first recession in almost 30 years.

On Friday, the central bank flagged “extreme uncertainty” about the course of the pandemic and its effects, forecasting a baseline scenario of a 10 per cent unemployment rate by December, which it then expected would slowly fall to 7 per cent by the end of 2022.

The RBA’s August statement on monetary policy said the central forecast was for a “protracted and uneven” global recovery, even assuming no widespread resurgence in infections.

Meanwhile, UBS analyst Jonathan Mott has warned that the outlook for the economy and banks has “deteriorated sharply” in the wake of Melbourne’s move to stage 4 lockdowns until mid-September.

On Sunday, Victorian Premier Daniel Andrews confirmed the state had had its deadliest day of COVID-19 deaths to date, with 17 fatalities and 394 cases over the preceding 24 hours, underscoring the severity of the state’s health and economic crisis. Under COVID-19 assistance schemes Australian’s 20 largest banks had deferred repayments on loans worth $274bn — or more than 10 per cent of their collective loan book — at the end of June, according to the latest available APRA data.

As the focus on sustaining high liquidity levels puts further pressure on margins, Macquarie analysts suggest deposit accounts could turn out to be the last line of defence for the banks as they run out of other means to defend their profitability.

But their savings account rate cuts also come at a time when Australians are increasing their use of relatively cheaper at-call savings accounts, given declining spreads available to customers in term-deposit accounts.

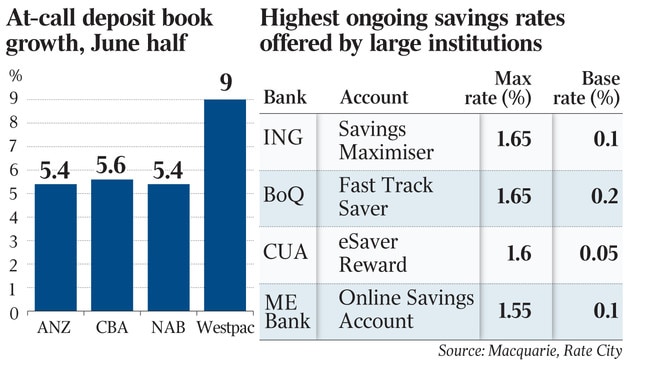

In the first half of this year, at-call account deposit growth for the big four banks ranged between 5 and 9 per cent, while term deposits declined, Macquarie analysts said.

“The increased money supply is likely to result in stronger medium-term deposit growth easing funding pressures for the banks and likely resulting in lower deposit spreads,” the analysts said in a note to clients.

Ms Tindall added that deposits have been growing since the start of coronavirus crisis as households put away extra cash, reducing banks’ incentive to offer attractive rates to savers at the moment.

“Banks are chasing new home loan customers, as opposed to savers, and this is reflected in the rates on offer,” she said.

Meanwhile the neobanks, which had been offering market-leading rates before the COVID-19 outbreak, have now pulled back their offers.

Xinja has frozen its savings account offering to new customers.

“Some of the neobanks have also been feeling the pinch,” Ms Tindall said.

“We’ve seen two rate cuts in March.

“It’s been difficult for them to sustain market-leading rates.”

Ms Tindall said many neobanks did not offer home loans or personal loans, so their business models were not set up to generate revenue.

“These banks have come onto the market at a very difficult time where the demand for deposits really isn’t strong,” she said.

“It’s disappointing to see savings rates fall at a time when families are proactively trying to get their finances in the best shape possible, but every dollar counts, so people shouldn’t just give up.

“There are still ongoing savings rates of up to 1.75 per cent and introductory rates as high as 2.2 per cent for anyone willing to jump from bank to bank to get a decent return.”

MyState Bank and Australian Unity currently have the highest ongoing savings rate on the market, according to RateCity data, offering savers 1.75 per cent if they meet certain conditions.

Bank of Queensland and ING both offer savings rates of 1.65 per cent, as long as you deposit $1000 a month and make five transactions on a linked account.

Westpac is currently offering the best rate on the market — 3 per cent for adults aged between 18 and 29 — on balances up to $30,000.

Ms Tindall said the savings rate on Westpac’s Life account was impressive given current economic conditions.

“This is a huge boost for young savers who bank with Westpac,” she said.

“Right now, the bank is offering a maximum ongoing rate of just 1 per cent on its standard savings account — but it has tripled that for customers aged 18 to 29.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout