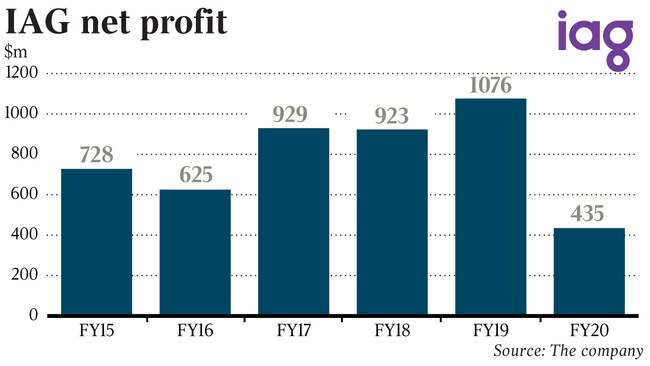

IAG boss Peter Harmer confident insurer can navigate challenges, profit slumps to eight-year low

IAG CEO Peter Harmer expresses confidence in outlook, despite the company reporting its lowest annual profits since 2012.

Insurance Australia Group chief Peter Harmer says the insurer is confident it can navigate earnings challenges and protect its position on potential COVID-19 business interruption claims, even after reporting its lowest annual profit since 2012.

IAG — which counts brands including NRMA, CGU and Swann Insurance in its stable — said net profit tumbled 59.6 per cent to $435m in 12 months ended June 30, compared to the year-earlier period. The result was hit by volatile investment markets, higher natural disaster claims and COVID-19 impacts, reflecting the lowest annual profit since the $207m reported in 2012.

As COVID-19 continues to cause havoc across the business community, the Insurance Council of Australia and the Australian Financial Complaints Authority have agreed to file a test case considering the application of infectious diseases cover in business interruption policies. It relates to references in the Quarantine Act.

IAG and the ICA are also laying the groundwork for a second test case for business interruption insurance covering the “prevention of access” under policies.

Mr Harmer said despite the test cases IAG expected any rise in business interruption claims would not be substantial and he expected policy exclusions would apply.

“If there is any confusion out there then it makes sense to get it tested through the courts earlier, so everyone has clarity,” he added.

“The best post-loss funder of an event, of course, is the government and that’s what’s happening in this pandemic.”

Analysts have been concerned about the potential for local insurers to be hit by a wave business interruption claims stemming from the COVID-19 fallout.

Mr Harmer — who handed down his last set of IAG results after flagging he would retire by calendar year end — said given the pandemic was a global issue, it required significant amounts of government capital and tax revenue rather than insurance claim payouts.

He is not a supporter of a pooled industry insurance fund for events like pandemics, even though they are used in some markets for specific terrorist incidents.

While COVID-19 would have only a marginally negative impact on IAG, the company outlined a provision of $100m for potential pandemic claim cost impacts. That is largely offset by factors such as lower motor claims during periods of less frequent travel.

IAG’s deputy CEO Nick Hawkins said the company considered different scenarios and government forecasts on unemployment as it looked to model the impact of COVID-19, which would also hinge on the prospect of future lockdowns.

IAG last month scrapped its final dividend and declined to provide any guidance for 2021 after an “immensely challenging” June half-year. At the time IAG provided details on its preliminary full-year results saying annual net profit would slump to $435m.

The results were marred by higher natural catastrophe claims costs which printed at $904m and exceeded guidance, choppy investment markets and higher customer refunds for a processing blunder.

IAG said it was maintaining a conservative capital position during the pandemic but did not back away from its dividend payout ratio of 60 per pent to 80 per cent payout policy.

Mr Harmer stressed that while the pandemic was throwing up challenges for insurers, it also created opportunities including to bring some offshore jobs back to Australia.

“The COVID-19 pandemic has accelerated customers’ adoption of digital channels and we are assessing the opportunities this presents to build on our existing strategy,” he said.

“We face the future with the confidence that we have a resilient business and we are well-equipped.”

When asked about the timing for the changeover of CEO, Mr Harmer said the search process was “on track”.

In a note to clients on the result, Bell Potter analyst TS Lim said: “Given upcoming CEO succession, IAG will likely play a conservative game in the next 12 months.”

IAG had gross written premium growth of 1.1 per cent to $12.1bn for the year ended June 30, but its reported insurance margin fell below guidance to print at 10.1 per cent. The underlying margin dipped to 16 per cent, with the company citing the impact of higher reinsurance costs, lower interest rates and a “poorer performance” from commercial long-tail insurance classes in Australia.

In July, IAG also added upped pre-tax provisions by $96m to $246m for customer refund programs where discounts were not properly applied.

Despite not making a final payment, IAG did declare and pay an interim dividend of 10c per share. Cash earnings printed at $279m for the year ended June 30.

IAG shares closed down 0.8 per cent at $5.03 each.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout