Non-bank Resimac defers securised debt issue

Resimac was gauging interest on up to $1bn securitisation issuance of prime home loans over the coming quarter.

Leading Australian non-bank Resimac is negotiating with major lenders to extend its warehouse facilities in a bid for extra headroom and has deferred a securitisation transaction as the lender stares down the possibility of “restrictive or unduly expensive” capital markets.

The move comes as Australian capital markets freeze in an environment of volatility. Analysts are predicting lenders will not raise debt from securitisation markets until calm returns and there are warnings that the government’s bond manager might have to step in to the market to keep it functioning.

Until the recent market panic, Resimac was seeking out investors on a roadshow, gauging interest on a $750m to $1bn securitisation issuance of prime home loans over the coming quarter.

“That transaction has been deferred,” Resimac general manager of securitisation and treasury Andrew Marsden told The Australian on Tuesday.

“It hasn’t been pulled. We’re playing it by ear. We’re in constant contact with investors,” Mr Marsden said.

In securitisation markets - where lenders package up tranches of loans and sell securities to investors - issuers are revisiting pricing expectations and industry participants are keeping close tabs on global developments as markets whipsaw.

Resimac shares have plunged by almost 60 per cent from their February peak as the coronavirus pandemic escalates. In a statement on Tuesday, Resimac said it had “deployed a series of operational and funding contingencies” in response to the significant market disruption and had told investors it is working with advisers to “sustain its lending program”.

Resimac, which specialises in residential mortgage-backed securitisation, said it had “multiple warehouse lines” to sustain the company over the medium term “in the event term capital markets are restrictive or unduly expensive”.

Westpac head of securitisation Martin Jacques said the primary issuance market would probably remain restricted “until some stability returns”.

“The situation is fluid with a continuous flow of headlines around the impact of the COVID-19 virus and a slew of central-bank responses whipsawing credit and equity markets,” he said.

The Australian iTraxx index, a proxy for credit spreads in the Australian market, widened 60 basis points over the last week and by 100 bps over the last fortnight.

The spread on five-year senior unsecured major bank notes has widened to 160 basis points, up from 68 basis points a month ago, which Mr Jacques said indicated “very low levels of confidence”.

“Given the current flux in global markets it is not inconceivable to suggest that the Australian Office of Financial Management is tasked to re-establish a RMBS purchasing program to assist smaller originators, with particular regard to non-banks that cannot benefit from the RBA’s liquidity measures,” Mr Jacques said.

“Before the market turmoil kicked-in, there was a solid pipeline of mandates outstanding,” Mr Jacques said. “There have been no further public updates as to the status of these deals, though we imagine that unless there is a necessary issuance required to take, the primary market will be closed until some stability returns,” he said.

Mr Marsden said the unusual sell-off in the fixed income market needed to be understood before credit spreads would return to a more normal level.

“On the buy side and the debt investor market, there’s a lot of volatility in terms of valuation, or spreads,” he said. “Last week, we saw some credit markets being sold off, now that needs to be understood and digested before securitisation markets can operate again.”

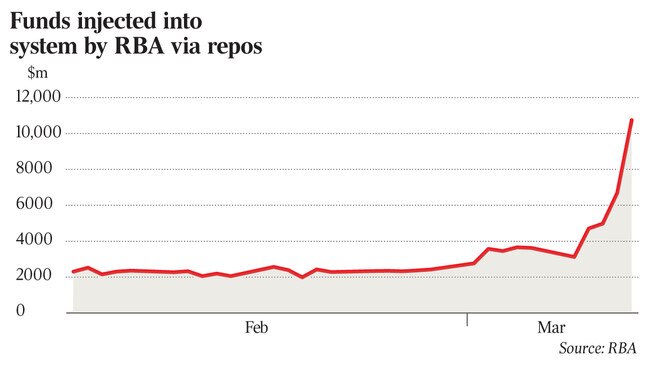

Australia’s financial regulators on Monday signalled the central bank would start a quantitative easing-style bond buying program after investors last week began dumping risk-free government bonds at the same time the stockmarket was getting hammered, when in normal circumstances the two markets go in opposite directions.

“This isn’t a credit issue,” Mr Marsden said. “A lot of the fear and the uncertainty that is driving the equity markets has spilled over into credit markets. There is still a lot of liquidity sitting in funds.”

The contingencies that we are making are to ensure we have additional headroom in our banking facilities and augmenting the limit capacity. The banks have been very supportive,” he said.

“The non-bank sector is in fairly good shape. The big difference between 2020 and 2008 is that the quality of the credit in portfolios is vastly different. In theory, we can sustain changes in the operating cycle. From a corporate perspective we’re in very good shape.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout