RBA, Scott Morrison’s economic dose of medicine

The RBA is set to cut interest rates to 0.25 per cent and shore up the markets, as the government prepares a revised stimulus package.

The Reserve Bank is ready to cut rates this week to a record low of 0.25 per cent and intervene in the bond market, as part of a co-ordinated global central bank effort to reduce the threat of the coronavirus crisis after another horror day on the sharemarket.

As Australian stocks plunged a further 10 per cent on Monday, RBA governor Philip Lowe said financial regulators and the government were working closely to ensure effective operation of the market and availability of credit to households and businesses.

The move came as the death toll from the virus escalated and fatalities and cases outside China overtook those recorded in the country where the contagion first emerged.

As of late on Monday, the global death toll stood at 6513, with 3222 of those recorded in China and 3291 in other countries.

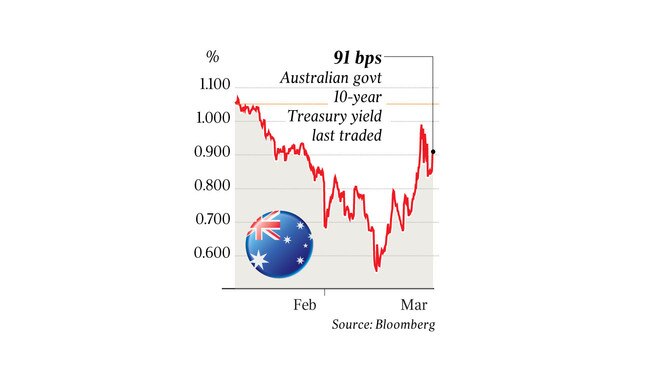

Dr Lowe said the central bank “stood ready to purchase Australian government bonds to support the smooth functioning of that market”, with further policy measures to support the economy to be revealed on Thursday.

The emergency statement was widely interpreted as a prelude to a likely final rate cut, out of the normal monthly cycle, and the commencement of an already flagged asset-buying program, known as quantitative easing, or QE.

Scott Morrison and senior cabinet ministers are working on fresh financial support measures to keep businesses and households afloat, ahead of potential social distancing restrictions that could decimate the hospitality sector.

The Prime Minister warned that the economic damage from the coronavirus had already gone “well beyond” that of the 2008-09 global financial crisis.

“This is going to have very significant economic impacts and we’re going to keep revisiting those (stimulus) issues as much as necessary,” Mr Morrison told Melbourne’s 3AW.

“This is nothing like the GFC. This has gone well beyond that now. I mean, in the GFC, we didn’t have to shut down the borders. In the GFC, we didn’t have to stop mass gathering of the public. I mean, this is of an order well beyond what we saw last time.”

The US Federal Reserve’s decision early on Monday to slash rates to zero, accompanied by a pledge to pump hundreds of billions of dollars into the economy, did little to cool the febrile mood among investors across the world.

In Australia, the benchmark S&P/ASX 200 sharemarket index crashed 9.7 per cent, extending the losses since the market’s February peak to 30 per cent.

Futures markets pointed to further heavy selling on Wall Street on Monday night, which was 20 per cent down despite a near 10 per cent bounce on Friday.

The Reserve Bank of New Zealand slashed its key cash rate by 0.75 percentage points to 0.25 per cent.

As policymakers scramble to keep up with the fast-moving virus, economists said the government’s $17.6bn stimulus package announced last week needed to be significantly expanded in coming days. ANZ head of Australian economics David Plank said the “shock washing over” the economy was “unprecedented in modern times” and required scaling up of stimulus measures and additional fiscal support.

“We had been assuming that the government would wait until the May 2020 budget to announce additional fiscal measures, but with events moving so quickly something sooner seems possible,” Mr Plank said. “During the GFC, we saw a range of policy measures implemented beyond rate cuts, fiscal stimulus and QE.

“These ranged from bank guarantees to the direct provision of financial support. It is too early to say these sorts of policies are definitely on the way, but they may eventually need to be considered.

“Unless, that is, we are wrong about the scale of the economic impact — which would be a good mistake to make.”

On Monday morning, the RBA pumped $5.9bn into the banking system as part of its daily operations — well above the $2.55bn anticipated — as banks moved to lock in short-term funding needs.

“As Australia’s financial system adjusts to the coronavirus, financial regulators and the government are working closely together to help ensure that Australia’s financial markets continue to operate effectively and that credit is available to households and businesses,” Dr Lowe said.

Westpac head of rates strategy Damien McColough said the RBA was focused on ensuring bank liquidity amid demands for cash. “When bank funding markets start to clog up, then you have a problem,” he said. “We already can see cash is king, with central banks trying to pump as much cash into the system as possible.”

Mr McColough said the cost of borrowing US dollars had “gone through the roof” as institutions rushed to dump assets and retreat to the safety of the greenback.

In co-ordinated statements on Sunday, the US Fed, Bank of Japan, European Central Bank, Swiss National Bank, Bank of Canada and Bank of England said they would work together to support international supply of the world’s reserve currency.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout