National Australia Bank leads compensation paid to customers for poor financial advice

The running total for compensation payments shows NAB ahead of Commonwealth Bank, AMP, Westpac, ANZ Bank and Macquarie.

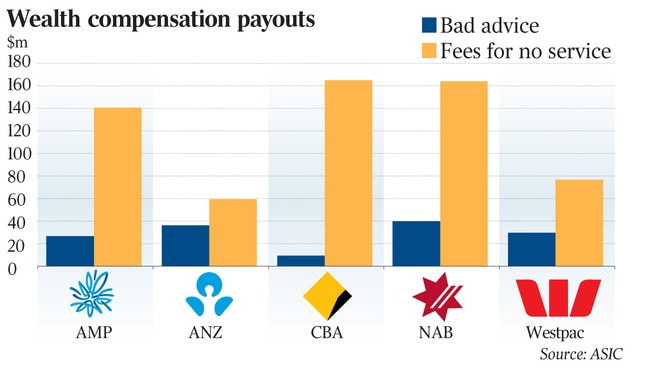

National Australia Bank has shot to the lead in compensation paid to customers for poor financial advice and fees for no service, accounting for 27 per cent of $749.7m in total industry payments.

An Australian Securities and Investments Commission update released on Tuesday said NAB had paid a total of $203.8m in compensation for misconduct in financial advice, ahead of Commonwealth Bank ($174.2m), AMP ($167.2m), Westpac ($106.4m), ANZ Bank ($95.6m) and Macquarie ($2.6m).

Fees-for-no-service misconduct dominated, generating $607.9m in compensation paid or offered to customers by the big six, with poor advice responsible for the remaining $141.9m.

The global figure of $749.7m is a fraction of the $10bn in estimated remediation provisions and program costs from the sale of consumer credit insurance, add-on insurance in car yards, and fees for no service.

The big six undertook review and remediation programs to compensate affected customers as a result of two major ASIC reviews.

The first related to how the institutions supervised their financial advisers to identify and deal with non-compliant or poor advice, while the second covered the failure to deliver agreed advice services to customers who continued to pay fees.

ASIC deputy chair Danielle Press blasted the institutions in March last year for long delays in completing further reviews to identify systemic failures in fees for no service, beyond those already identified and reported to the watchdog since 2013.

The Morrison government released draft legislation late last month to give ASIC a new directions power partly designed to speed up remediation programs.

The regulator will be able to use the power to ensure that any remediation program established by a licensee creates a suitable process for addressing the impact of a breach on customers.

Treasurer Josh Frydenberg is looking to introduce all royal commission-related legislation by the end of 2020.

Last December, ASIC took Federal Court action against NAB over fees for no service and shortcomings in fee disclosure statements.

From December 2013 to February 2019, the bank is alleged to have failed to provide financial planning services to a large number of customers while charging fees to them, and failed to issue proper fee disclosure statements.

NAB’s compliance systems were also alleged to have been deficient, with the bank contravening its obligations as a license holder to act efficiently, honestly and fairly.

While ASIC claimed NAB knew from at least May 2018 that it had not delivered the required services to its customers, the bank is alleged to have engaged in unconscionable conduct by continuing to charge fees until February last year.

The low figure for Macquarie in ASIC’s latest update reflects its exclusion from the poor advice category of misconduct, because ASIC accepted an enforceable undertaking from Macquarie Equities in January 2013.

Under the follow-up remediation program, Macquarie paid $24.7m in compensation to 263 clients by June 2017.

While IOOF failed to appear in the compensation table, it took ownership of ANZ’s aligned dealer groups in October 2018.

It will continue to undertake customer reviews and remediation for non-compliant advice in relation to the dealer groups using the same framework implemented by ANZ.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout