ASIC warns of ‘unscrupulous service providers’ as Suncorp claims surge

Corporate watchdog wants claims handled ‘efficiently and fairly’ as Suncorp counts the cost of disasters.

The corporate watchdog has put insurers on notice to deal fairly with those affected impacted by the nation’s devastating bushfires as it urged victims to be on the alert for dodgy service providers.

The warning came as Suncorp, which also operates the GIO brand, became the latest to update investors, saying it had so far received 2600 bushfire claims and that the recovery would take “a long time”.

Suncorp estimated its total bushfire claims costs so far at between $315m and $345m for the financial year to date.

Combined with payouts relating to a string of hailstorms in November, Suncorp’s natural hazard payouts for the first half have come in at $519m, some $109m above the insurer’s budget.

Suncorp said it had a broad reinsurance program in place with “enhanced natural hazard protection” for the remainder of financial 2020.

“This is important given the severe threat of bushfires ongoing,” said Suncorp chief executive Steve Johnston.

The bushfires raging across the east coast have ravaged some communities and prompted about 9000 insurance claims across NSW, Queensland, Victoria and South Australia since September.

Total insurance losses have hit $700m but are expect to rise as more claims are lodged over the coming weeks, according to the Insurance Council of Australia.

Daniel Crennan, the Australian Securities & Investments Commission’s deputy chairman, said the regulator was working with insurers and other stakeholders to ensure claims were handled “efficiently and fairly”.

“We expect those involved in handling these insurance claims to act with the utmost good faith,” Mr Crennan said.

ASIC also cautioned that consumers and businesses needed to watch for any “fictitious or unscrupulous tradespeople, repairers or firms” offering to assist with insurance claims.

The regulator also encouraged insurers and banks to “respond appropriately” to financial problems that may arise from the bushfire crisis.

Economists yesterday said the fires had raised the prospect of interest rate cuts when the Reserve Bank meets at the start of next month.

The bushfires, which have so far claimed 25 lives and burned more than 8 million hectares, could sap economic growth by 0.25 percentage points in each of the December and March quarters, according to analysis by UBS economist George Tharenou.

“The total economic impact of the bushfire crisis will be very difficult to measure, given much of it will be indirect — lost spending etc,” Mr Tharenou said, pointing to a slump in consumer confidence from the smoke haze in Sydney and Melbourne that could weigh on retail sales.

Mr Tharenou said while it is still too early to know the full impact, it was likely that the bushfire crisis would drag December quarter and March quarter GDP, potentially by as much as up to 0.25 per cent per quarter.

He said the bushfires’ effect on “makes a rate cut from the RBA in February more likely”.

Suncorp’s bushfire claims of more than 2600 since September is still below the 3700 claims that rival IAG confirmed it had received last week.

Suncorp said its reinsurance program provided “strong second-half 2020 earnings protection, including a $200m stop loss”.

The insurer recorded seven natural hazard events of more than $10m in the six months to December 31, with total natural hazard costs of $519m.

Earlier this week, Credit Suisse said it had pencilled in natural peril claims at Suncorp of $510m for the period.

Mr Johnston said Suncorp’s immediate focus was supporting customers with urgent assistance.

“Having visited some of the communities affected by these fires, it is difficult to describe the extent and indiscriminate nature of the damage that has been caused and how deeply traumatic and dangerous they have been for families, communities and emergency services personnel,” the Suncorp CEO said.

“We fully recognise that these bushfires are particularly significant in terms of their duration, the geographic breadth of the fire zones, the sheer destruction of property and the associated impacts on people’s lives, as well as local communities and economies.

“This recovery is going to take a long time — as one of Australia’s largest insurers we understand the role we need to play in that process.”

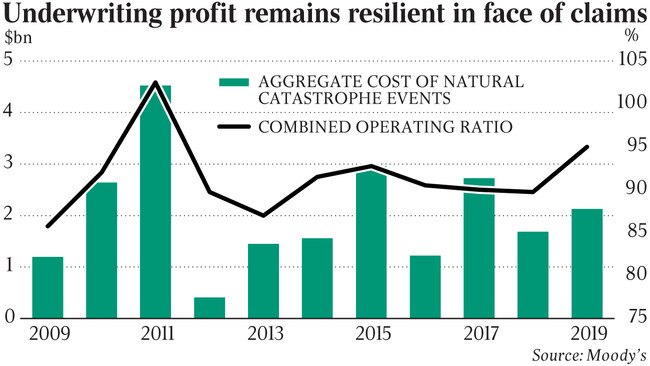

Ratings agency Moody’s warned profits of insurers would be hit as payouts mounted over the coming months.

“The insured losses of these natural catastrophes will be negative for profits of the Australian property and casualty insurance industry,” Moody’s said.

However, it expected the losses to be “manageable” because of the industry’s strong underwriting performance.

“Nonetheless, these catastrophic events highlight that the property and casualty insurance industry is at the forefront of environmental risk,” Moody’s said. The ratings agency said Suncorp and IAG would have the highest levels of claims because of their large share in personal insurance.

IAG last week outlined net natural peril claims costs of $400m, post its quota share arrangement, for the six months ended December 31, with bushfire events to contribute more than $160m.

The total will be higher than the perils allowance in the prior corresponding period of $320m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout