And he also set out a blueprint for how large companies are going to need to adapt strategies to cope with the new era of the widespread gluts that are set to cover so much of the business landscape.

In typical new CEO style, McEwan smashed NAB’s dividend and profit and announced a new issue of shares.

But the stunning revelation of NAB’s house price assumptions went way outside the “first year” CEO pattern, because at the same time he wants to have a substantial NAB mortgage business.

NAB’s base case is that on a year-on-year basis in 2020 house prices will fall 10 per cent and recover only 2.6 per cent in the 2021 calendar year. No need to rush and buy a house but not a disaster, although negatively-geared investors face a miserable time.

But then came NAB’s “severe downside” assumption---- that in 2020 house prices would fall by 20.9 per cent and then another 11.8 per cent in 2021 – a total fall of a staggering 32 per cent. That means a person buying a $2 million house on a $600,000 deposit would have negative equity by the end of 2021.

I can’t emphasise strongly enough that NAB is not forecasting such an outcome, although it has calculated its provisioning on an outcome that is slightly worse than the base case.

The last time Australia saw house price falls of NAB’s “severe downside” magnitude was in the early 1990s when expensive dwellings fell by between 30 and 50 per cent. Medium-range dwellings fared better.

Australia’s COVID-19 performance is world ranking and the share market believes that Reserve Bank Governor Philip Lowe is right in his forecast of a sharp rise in the Australian economy in 2021.

For that to happen we will need a cure/vaccine for COVID-19, or enormous success in the current planned relaxation strategies.

What McEwan has done is graphically illustrate what it will mean for the nation if COVID-19 is not brought under control. A house price fall of 30 per cent plus would devastate the nation and consumer spending.

There is little doubt that there will be a glut of many banking services in the coming years as new systems are introduced and a volley of new competitors carve out a stake in portions of the market.

To prepare NAB, McEwan’s first step as CEO was to go down and talk to bankers close to the coalface---that’s where the knowledge resides in most large enterprises. At NAB most at the coal face knew what was wrong with the bank - it had a bureaucracy and computer systems that made it very difficult to move quickly.

And so McEwan is planning to give more power to people on the coalface ---exactly what large enterprises that seek to succeed in an era of gluts will need to do. It’s not easy, and in the case of NAB, the bank will also need to simplify its products and assemble operations that have cost structures that can compete with the disrupters.

McEwan is talking about “a mortgage factory“ that can give answers quickly. Unfortunately NAB, along with the other major banks, lost control of its distribution to mortgage brokers so to be a major player in the game NAB must be a low-cost, efficient mortgage manufacturer.

In any company operating in this environment executive salaries have to come down and the easiest way to do that is to reduce short-term bonuses.

This trend is going to spread among a large number of big corporations, and it will make life difficult for many executives who have paid large sums for houses on the expectation of a continuation of big bonuses.

The big institutions led by superannuation funds pushed banks, Telstra and many other companies into paying dividends that were too high and reduced much-needed investment in the business.

Shareholders in many companies—not just NAB--- will need to understand that the business of investing in shares is about growth as well as income and to achieve growth it’s necessary to invest in the latest technologies and systems and be flexible.

When McEwen looks around NAB’s business loan portfolios he is particularly concerned at the tourism and retail sectors. Fortunately NAB does not have a large exposure to tourism. There is also a longer-term danger in the office area.

Working from home in response to COVID-19 has had very varied success but it has shown that employees travelling to the capital cities every single day makes no sense. Just as importantly, working from home has underlined the uselessness of office space-absorbing bureaucracies. They are neutralised when everyone is at home.

When business operations return to “normal” there is likely to be a decline in the use of capital city offices. They won’t disappear but they will be used less and replaced by a combination of more work at home or perhaps more use of decentralised offices.

COVID-19 has exploded the use of online shopping and we’re not going to go back to mass old-time mall shopping. It is likely that many of the malls will be redeveloped to include office and commercial activities as well as residential areas.

What McEwan did not canvass was the possible recasting of Australia’s population growth assumptions. If population growth is curbed then dwelling prices may not collapse, but they will decline slowly over time ends

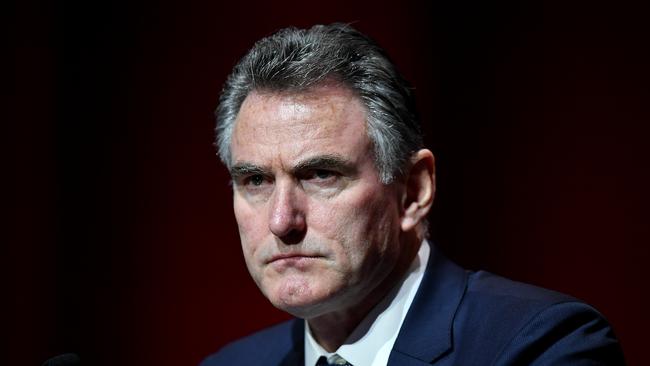

New National Australia Bank CEO Ross McEwan is clearly a past master at shocking the investment community in his first year in office, but he has gone much further than his Royal Bank of Scotland rescue - he is questioning Australia’s valuations of housing and other property areas.