NAB’s retail bank boss Rachel Slade tips bumper home loan applications before slowdown in 2022

NAB’s head of personal banking Rachel Slade expects mortgage applications will stay strong until the year’s end, ahead of regulatory measures starting to kick in.

National Australia Bank’s head of personal banking Rachel Slade expects mortgage applications will stay strong until the year’s end, ahead of more home listings and regulatory measures to cool the market starting to kick in.

Ms Slade also said while technology giants were now part of the financial services landscape, a “level playing field” on regulation was necessary to ensure the same rules of engagement in the payments sector and other areas such as buy now, pay later.

In home lending, she expects a bumper run into the end of 2021 before activity and prices start to moderate into next year.

“We are going to have a really really strong run right up to Christmas. What we are seeing is listings lift in the capital cities and a bit more stock coming onto the market, which I think is ultimately a good thing for house prices (growth to moderate),” Ms Slade said, ahead of speaking at a Trans Tasman Business Circle event on Tuesday.

“It’s a bit early yet to see the impacts of affordability changes, they only came on November 1. They won’t flow through to prices and settlements until well into the early part of next year, so it’s still very busy out there.

“We’re still seeing really really strong applications flows in our business, maybe just a pinch softer than last month, but compared to six months ago still really strong.”

The prudential regulator raised the buffer rate that banks have to add to a borrower’s interest rate to assess whether they can repay, to 3 per cent from November, from 2.5 per cent. Banks either use the buffer plus the prevailing interest rate on the mortgage, or a floor rate to assess a loan’s serviceability, whichever is higher.

Auction clearance rates are already starting to recede from very high levels across most capital cities, and NAB’s base-case scenario has house price growth slowing to 5.5 per cent in the year ended September 30, 2022. That would be down from growth in the 12 months ended October 31 this year of 20.6 per cent across all dwellings.

NAB tips housing credit growth will moderate from 6.5 per cent this year, to 5.1 per cent in 2022.

Ms Slade stopped short of providing any market share target for NAB in home loans, even while several rival banks are plagued with internal issues. ANZ is grappling with and trying to fix a blowout in mortgage turnaround times, while Westpac had to discount heavily to win back market share.

“In home lending you’ve got to get this balance between meeting your customer needs and meeting your shareholder returns … our focus there is really on safe growth,” Ms Slade said.

“We are not a price leader in the market, you have to be there certainly in the pack in pricing but where we are really getting great feedback is on that experience and our service.”

NAB’s market share in mortgages sits at 14.4 per cent, still well behind the nation’s largest home lender Commonwealth Bank.

Ms Slade also said technology giants and other players while part of the finance landscape needed to compete with banks on an equal footing, urging regulators to look more closely at the buy now, pay later and payments sector.

“If I was going to focus anywhere or have the regulators focus anywhere it would be in the payments world,” she said.

Last week, NAB chief executive Ross McEwan said he didn’t want to follow Westpac into providing banking-as-a-service to other financial services or retail players, allowing them to draw on NAB’s technology and services. But NAB will continue to provide loans to other players under their own brand.

NAB has acquired digital bank 86 400 to combine it with UBank and is also in the process of buying Citibank’s Australian retail operations, pending regulatory approval.

When NAB announced the Citibank deal it said the target had a residential mortgage book of $7.9bn, unsecured lending of $4.3bn and deposits of about $9.0 billion.

Asked about risks relating to NAB cannibalising its own customer base with its digital channels UBank and 86 400, Ms Slade said: “We are trying to give UBank the runway that it needs to be successful … there’s plenty of room in the market for us to compete in a healthy way.

“You’ll have customers in the market that are keen on a digital native proposition and then you’ll have customers that want more full service.”

Ms Slade also said the Covid-19 influence over working patterns and staff locations was spurring the bank to reassess where staff were based.

After hiring 150 remote-only employees in South Australia early this year, NAB is weighing that model for parts of its operations business, credit assessment and home lending.

Flexible work outside of traditional hours, such as evenings and weekends for particular employee groups, is also a theme NAB is giving more consideration to.

“Something that I think is going to be more prevalent over the next few years is going to be more flexible work,” Ms Slade said.

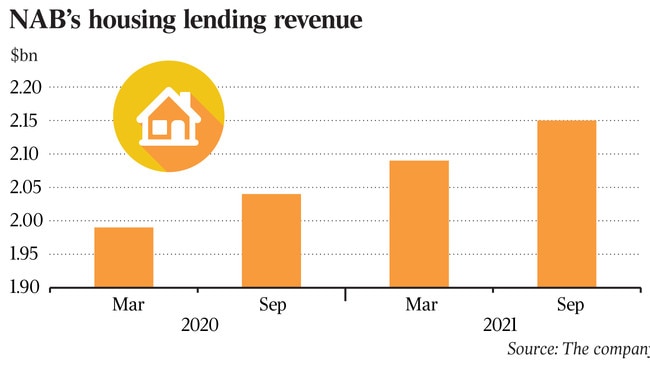

NAB last week reported annual profit soared 76.8 per cent to $6.56bn, underpinned by lending growth and an improved full-year performance in its personal banking and New Zealand divisions. But the latter six months ended September 30 saw the personal bank’s earnings drop versus the prior six months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout