NAB to buy Citi’s Australian consumer business for $1.2bn

NAB has agreed to buy Citigroup’s Australian operations in a $1.2bn deal, but the ACCC has already flagged concerns.

National Australia Bank is pushing ahead with its growth ambitions for its personal banking business, buying out Citigroup’s Australian consumer operations in a $1.2bn deal that will see it become the nation’s second largest credit card issuer.

But the acquisition, announced on Monday, will first have to pass muster with regulators, including the ACCC, which has already flagged concerns over the impact on competition if Citi is scooped up by the big four lender.

It also comes as credit cards face their biggest test yet, with younger consumers turning their back on them and instead opting for lower cost buy now, pay later schemes.

The transaction, which includes Citi’s home lending portfolio, unsecured lending, retail deposits, and private wealth management business, will be funded by NAB’s existing balance sheet resources, with the parties agreeing on a $1.2bn price tag including a cash premium of $250m.

The deal, foreshadowed in The Australian’s DataRoom column last month, includes a $6.7bn mortgage book, $3.5bn in credit card portfolio and more than $9bn in deposits.

NAB chief executive Ross McEwan said the deal would bring scale and expertise in unsecured lending, particularly in credit cards, which he said was particularly attractive for the bank.

“The market for unsecured lending and payments more broadly is always evolving, and it’s very competitive,” Mr McEwan said.

“In this changing landscape, we are thinking more broadly about our customer proposition, and the value we can bring to our customer relationships. Personal banking, access to payments and transaction data will be critical tools to drive innovation and deliver market-leading customer experiences.”

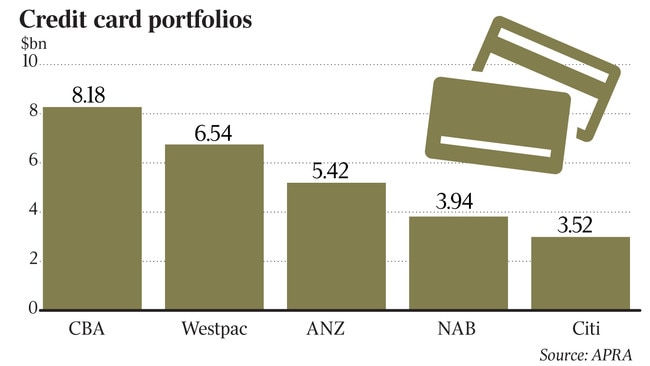

NAB is currently Australia’s fourth largest credit card issuer, while Citi sits just behind, in fifth place.

If the deal gets over the line, NAB will jump to the number two spot, when Citi’s “white label” credit cards for institutions such as Qantas, Bank of Queensland, Coles and Suncorp, among others, are included. Stripping out the white label products, NAB moves into third place.

The bank’s big push to capture more of the credit card market comes amid heightened competition from the booming buy now, pay later sector that has coincided with the steady decline of credit cards on issue.

But Mr McEwan expressed confidence in the credit card market.

“We don’t believe that the credit card business is in massive decline. We saw it drop because of Covid … but it’s starting to come back up again and we believe it will stay a very strong part of the payments structure,” Mr McEwan said.

The move by NAB comes after competition tsar Rod Sims earlier this year warned the big four not to pursue the acquisition.

Mr Sims laid out fresh criticism within minutes of Monday’s announcement.

“We are extremely concerned about protecting competition in the banking sector and we will look at this very closely,” Mr Sims said.

“Players outside the big four banks provide good competition and that is going to be lost with this transition. The big four don’t provide that competition between themselves, they more accommodate each other rather than compete with each other.

“So when you’ve got a big player like this being taken out, it concerns us very much.”

Mr McEwan played down the regulatory red flags in a call shortly after the market announcement, saying he didn’t believe the transaction would see any significant reduction in competition.

“We have to leave that to the ACCC but there are quite a few players that don’t sit within the APRA numbers. across the industry there are a lot of competitors today and there will be after this, so from that perspective even this acquisition doesn’t take us to a number one position,” he said.

If NAB is successful in acquiring Citi’s business, the big four banks will control over 90 per cent of the APRA-regulated credit card market.

Citi’s global CEO Jane Fraser said the deal was a “positive outcome” for clients and for Citi. “We are focusing our resources on businesses where we have scale and competitive advantages in order to deliver growth and improved returns over time,” Ms Fraser said.

The $1.2bn price implies a multiple of eight times earnings for Citi’s business and NAB is hoping to complete the deal by March 2022, subject to regulatory approvals.

Citi’s Australian institutional business is not included in the sale.

At the close of trade NAB’s stock was up 0.86 per cent at $26.92.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout