ING Group drops out of contest for Citi banking business as NAB closes in

Dutch bank ING has left the competition to buy Citi’s $2bn Australia and New Zealand banking business, according to sources, in a move that could put National Australia Bank in the box seat to buy the unit.

Also said to be competing for the portfolio has been Macquarie Group, which has announced the purchase of AMP Capital’s Global Equities and Fixed Income from AMP for $185m in the past week.

However, sources say Macquarie is unlikely to pay top dollar for businesses and will probably be beaten at the post by NAB, which is being advised by Bank of America.

Market analysts also say that while the deposits and mortgages would fit well with Macquarie’s business, the credit card component would be less appealing, given Macquarie has been moving to distance itself from that part of the market.

A decision on the outcome is expected to be imminent. In recent days, sources say they believe NAB was out in front in the competition.

NAB has been competing strongly for the unit, as revealed by DataRoom on Sunday.

NAB late Tuesday confirmed its interest following the report of the ING retreat by this column saying “it regularly assesses opportunities to acquire businesses that support its growth strategy in core banking markets”.

“There is no certainty these discussions will lead to a transaction,” NAB said.

The understanding is that the acquisition will be an opportunity to gain scale in personal banking and create significant synergies as it aspires to grow its digital bank.

Market analysts believe that NAB is likely to fund a transaction with its surplus cash, rather than tap the market for an equity raising.

NAB has $5.4bn of surplus cash, based on proforma CET1 capital of 12.3 per cent.

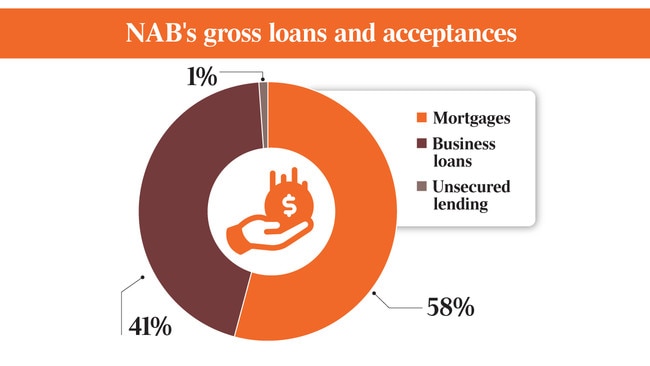

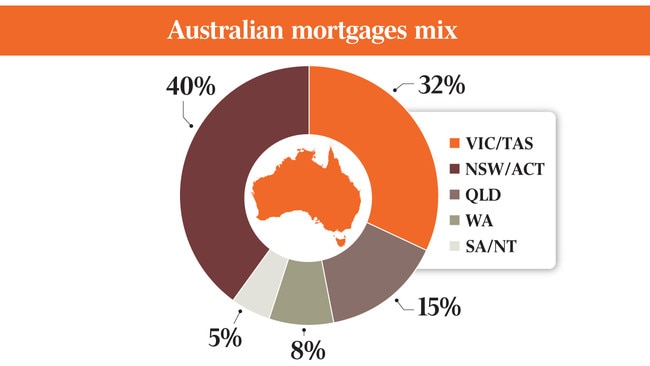

The bank is keen to buy the business at a time when the proportion of earnings from mortgages is lower at NAB than the other major three banks.

Observers say the Citi business provides white-label products for others, and NAB could originate home loans and credit cards from the Citi business digitally.

NAB recently bought 86 400 for its UBank digital business in a bid to secure its cutting-edge technology.

Citi’s Australia and New Zealand consumer banking operations offer deposits, mortgages and credit cards.

APRA figures show Citi’s Australian retail banking arm had a residential mortgage book of $4.1bn and investor housing book of $2.44bn. Its credit card business has $3.6bn in loans while the bank has a deposit book of $7.3bn.

ING was earlier seen as a strong contender that had been gunning for the Citi business, but was recently said to have fallen behind in the auction.

It has the greatest market share in Australia of all the foreign banks, with 12 per cent, according to IBISWorld, placing it ahead of HSBC with 8.5 per cent and Citi with 7.9.

ING’s business is largely the same as Citi’s Australia and New Zealand consumer banking operations, offering deposits, mortgages and credit cards, and buying the business would provide major cost savings.

Citi will now focus on investment banking in Australia.

In April, it said it was pursuing an exit from consumer banking businesses in 13 markets, including Australia, following a strategic review.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout