Mergers to shrink number of super funds: KPMG

The number of superannuation funds is set to fall by 60 per cent over the next 10 years, KPMG predicts.

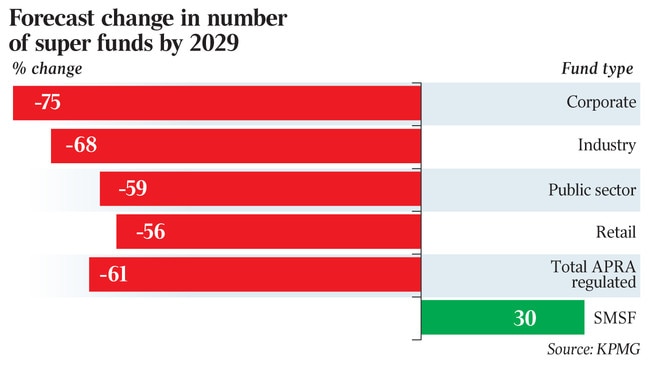

The number of superannuation funds in Australia is set to fall by 60 per cent over the next decade as the trend of fund mergers is accelerated by changing consumer preferences and greater regulatory oversight, advisory firm KPMG says.

In a report titled “Transformation in the Superannuation Industry”, KPMG estimates that by 2029 the number of APRA-regulated funds will shrink from 217 to 85, with industry funds predicted to disappear faster than their retail counterparts.

The current 38 industry funds will number 21 in five years’ time, the report predicts, and just 12 by 2029. Comparatively, the existing 118 retail funds will have shrunk to 74 in five years and 52 within a decade.

KPMG superannuation advisory partner David Bardsley said the industry’s consolidation was being driven by a need for greater scale to match regulatory and consumer demands.

“After the royal commission into misconduct in the financial services sector, the regulatory environment naturally tightened,” Mr Bardsley told The Australian. “I think the value for the fees and the costs incurred in taking up super products for advice were tested, found lacking, and needed attention.

“Scale is one of the mechanisms that allow the necessary investment to fix that to occur.”

Consumers are also becoming more aware of how the super system works, and more forthright in demanding certain outcomes from funds.

“Over the next 10 years we will start to transfer from an accumulation system to a pension system,” Mr Bardsley said.

“There is going to be a heightened awareness around the costs associated with retirement. But the consumer preferences go beyond that — they are being set by digital service offerings like Netflix and Amazon — consumers expect information to be elegantly provided, questions easily addressed … and quite frankly financial service providers, super specifically, have worked on the assumption their consumers are less engaged.

“Changing this requires middle and back office expansion, which requires scale.”

The pace of consolidation in the industry is accelerating at a rapid pace, with the report showing there was a steep increase in the size of announced mergers in 2019 compared with a year earlier. In 2019, the average assets under management of the funds being transferred was $22.3bn compared to just $1.5bn the previous year.

The number of members moving from smaller to larger funds was 2.1 million in 2019 compared with 200,000 in 2018, while the average size of the receiving fund was $57bn, compared to $27bn in 2018.

More Coverage

Read related topics:Superannuation