Mega-funds set to dominate superannuation industry: KPMG

Superannuation industry mergers will see a rise in $100bn-plus mega-funds which will become major players in the financial system.

Superannuation industry mergers will see a rise in $100bn-plus mega-funds which will become major players in the financial system, according to a new report by KPMG.

The report, Super Insights 2021, says the superannuation sector will be dominated by 12 funds with assets of more than $50bn representing 77 per cent of all member accounts and 76 per cent of all super fund assets once the currently announced mergers are finalised.

By this time, 47 per cent of assets and 43 per cent of members accounts will be managed by five $100bn mega-funds — the merged QSuper, Sunsuper and Post Super, AustralianSuper, IOOF and MLC, Aware Super and AMP.

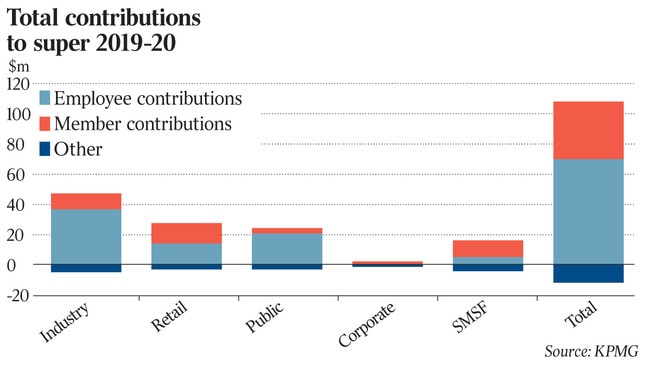

The report says five major super fund mergers were announced in the 2019/20 financial year involving total assets of almost $70bn.

Another seven mergers have been announced since then, with “many more in discussions”.

It says increased regulation, including the government’s Your Super, Your Future legislation, which is set to come into force on July 1, will increase pressure for funds to consolidate.

“The standout issue in the industry is consolidation,” KPMG head of asset and wealth management Linda Elkins said.

“We see an increase in ongoing merger activity. It kept up during COVID but will now accelerate, mostly in the industry fund sector.

“Over the next few years, we will see an increase in scale of the mega-funds with assets of more than $100bn and a widening gap between the ‘sub mega funds’, with assets of more than $50bn, and those lower down,” she said.

She said the emergence of mega-funds would see them subject to increased regulatory and community scrutiny.

“As we see continued consolidation across the industry, mega-funds will emerge as some of the largest, most important financial service organisations in Australia.

“With that will come challenges across every aspect of their business models, along with regulatory scrutiny and community expectation commensurate with their size and importance,” she said.

She said super fund trustees would be under pressure to make sure the mergers delivered better outcomes for members.

“Meeting merger expectations will be a key deliverable,” she said.

The biggest funds in the country include the $210bn AustralianSuper and the $140bn Aware Super, with the proposed merger of QSuper and Sunsuper set to produce a fund with $200bn in assets and two million members.

Ms Elkins said the emergence of mega-funds would put pressure on smaller funds which would need to sell their benefits to existing and prospective members.

“With mega-funds’ brand awareness and market share continuing to rise, smaller funds will need to find their niche and ensure they are effectively communicating their value proposition to members,” she said.

“We see maturing regulatory and government settings, business model sustainability, globalisation and rising member expectations as key drivers of change for the superannuation fund mergers,” she said.

The number of super funds regulated by the Australian Prudential Regulation Authority (which excludes self-managed super funds) fell from 171 to 154 in 2019-20.

The sector is also set to be challenged by new legislation which will see super funds “stapled” to an employee as they move from job to job unless they opt to change to a new fund.

This will also put pressure on funds to sell their benefits to new members.

“The potential effect of stapling a member to their existing super fund is expected to provide some funds a significant challenge in attracting new members,” Ms Elkins said.

“For many funds, meeting rising member expectations will lead to increased costs. The challenge is to find more sustainable ways to operate.”

She said increasing expectations and “the challenging regulatory environment”, including the impact of APRA’s MySuper “heat maps” would continue to drive mergers.

The report is predicting the total assets in super fund sector will rise from $2.5 trillion in June this year to $3.3 trillion by June 2025. It predicts the industry fund sector will overtake the size of the self-managed super fund sector by June this year and will make up 36 per cent of the total by June 2025.

The report says that the combination of more people moving into retirement, the government’s early release scheme announced in response to COVID and other regulatory changes saw a 12 per cent drop in the number of super funds accounts in 2019/20 with no growth in total funds under management in the sector.

It says that 61 per cent of all super funds were in net outflow over the year.

“Heavier outflow particularly impacted the industry funds, with pension payments from these funds increased by 14 per cent and the number of industry funds in net outflow rising from seven to 19 during 2019-2020.”

Flows from retail funds to industry funds were continuing but at a slower pace.

Ms Elkins said there was still a place for new entrants in the sector.

“We have witnessed new participants to the industry at multiple points throughout the value chain having a genuine impact on operational efficiencies, administration and technology platforms, in addition to new funds entering the market,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout