Budget should boost equality in retirement incomes

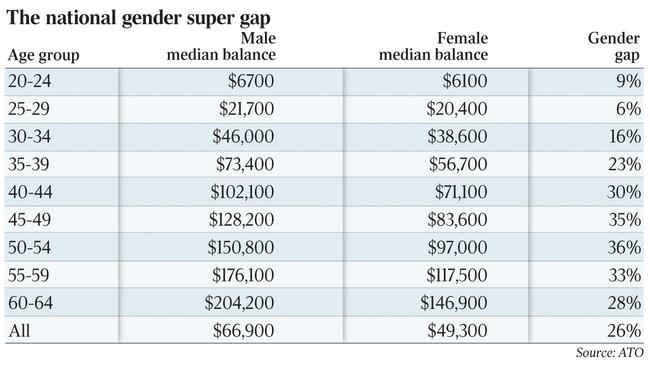

The median super balance for an average Australian woman is $49,300 — 26 per cent less than the average man’s median balance of $66,900.

Western Australia has the country’s largest superannuation gender imbalance, while the gap between men and women is at its widest point for middle aged workers, according to new data, prompting calls for the government to include measures in the budget to encourage equality in retirement incomes.

Figures from Industry Super seen by The Australian show that the median super balance for an average Australian woman is $49,300 — 26 per cent less than the average man’s median balance of $66,900.

Geographically, the gap is widest in WA, whose economy is dominated by traditionally male industries like mining and agriculture. Its median male balance of $72,800 is 38 per cent higher than the median female balance of $45,200.

The gap is smallest in NSW, South Australia and the ACT, where women have a median balance 22 per cent below that of men.

With the budget just a week away, Industry Super advocacy director Georgia Brumby said Superannuation Minister Jane Hume should take steps to help fix the gender imbalance.

“It is time we bridged the gender super gap; it’s not right that women retire with balances persistently lower than what they need for an adequate retirement,” she said.

“Politicians have a choice. They can fight for a super increase and to get super paid on every dollar earnt or turn their back as more women risk retiring into poverty.

“Jane Hume has an opportunity to show real leadership and recommit to boosting the super savings of women everywhere.”

The super gap is at its narrowest point for Australians aged 25 to 29, where the median female balance of $20,400 sits just 6 per cent below the median male balance of $21,700.

But that gap widens with age until it reaches its fullest extent at ages 50-54, where the median female balance of $97,000 is 36 per cent less than the median male balance of $150,800.

Grattan Institute household finances director Brendan Coates said the gap reached its widest among that demographic due to the structure of the system and the impact of the gender wage imbalance on women who have been in the workforce for decades.

“The gap is higher in part because by the age of 50 you are more likely to make voluntary contributions to your super — men have higher incomes and make more contributions,” he said.

“Then you have the compounding effect of tax concessions that favour men over women because men have higher super balances.

“Lower rates of female workforce participation and the gender pay gap especially impact women of this age group because when they entered the workforce 30 years ago these problems were worse than they are now.”

Bureau of Statistics data shows Australia recorded its highest ever level of female participation in the workforce, 61.8 per cent, in March.

The super gap between men and women narrows beyond the 50-54 age bracket: Among those aged 60 to 64, the male median balance of $204,200 is 28 per cent higher than the female median balance of $146,900.

Mr Coates said this could be attributed to men dying earlier than women.

“The gender gap with super shrinks with age because mortality starts to kick in and you start to see women inheriting more money from their spouses,” he said.

Senator Hume said the key to fixing the gender super imbalance was fixing wage disparities between men and women.

“Tipping ever increasing amounts of your hard earned money into super is not the answer, deferring more of your wages today comes at a trade-off to your standard of living in your working life,” she said.

“The Retirement Income Review found that the working-life earnings gap between men and women, rather than the retirement income system settings, is the main driver in the gender gap in superannuation balances at retirement.

“The good news is that we have made substantial progress on the pay gap and participation gap and that work continues,” she said.

“Increasing female participation in the workforce is key to enhancing women’s economic security.

“On super, our immediate focus is on making your super work harder for you — improving performance and lowering fees. It’s your money.”

Mr Coates said the Grattan Institute was advocating a number of policy changes to firm up retirement incomes for women.

“We shouldn’t be thinking about the gender balance just being in super — there is a gender imbalance between men and women in retirement income and lifetime earnings,” he said.

“The government should consider paying super on government funded paid parental leave and abolishing the $450 monthly income threshold below which employers don’t need to contribute to super.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout