Magellan Financial moves to fortify funds as Hamish Douglass responds to poor performance

Magellan Financial has quietly begun offering significantly lower fees to wealth managers after resisting those demands for years.

Magellan Financial has quietly begun offering significantly lower fees to wealth managers after resisting those demands for years – with its poor performance pushing investors to withdraw their savings from its funds.

The pressure on Magellan’s funds comes at a difficult time for the company, which manages $116bn, with chairman Hamish Douglass forced to confirm he has separated from his wife.

But Mr Douglass – responding to market speculation about the reason for the abrupt departure of chief executive Brett Cairns – told the ASX that he and wife Alexandra remained “extremely close” and the family had no intension of selling their stake in the company.

A family vehicle – Midas Touch Investments – is the second largest Magellan Financial shareholder. Any split in the assets could create a liquidity event for Magellan.

Judith Nielsen in October sold about $300m in Platinum Asset Management shares only a fortnight after she took control of the stake in the company run by her former husband Kerr Nielsen.

Despite the turmoil, Magellan shares rose 4.3 per cent on Wednesday to close at $30.35. But they have fallen almost 50 per cent in the past six months, having traded above $50 as late as August, with the poor performance of Magellan’s main global equities fund raising concerns that investors will move their money elsewhere.

The Australian has confirmed that the fund has launched a new product for managed accounts operators with fees 50 basis points lower than the global fund. It will also not charge a performance fee.

But Magellan general manager of distributions Frank Casarotti denied that the lower fee structure was a discount, and said the company had decided there was growth in managed platforms.

“For some years we have been asked to drop fees for managed accounts,” Mr Casarotti said.

“We’ve been looking at this for years and the reticence around the retail investor is (unrelated and) very much around the relative underperformance.

“We are laser-like in its target market (which is) the true managed account operator.”

There were no funds currently being managed under the new arrangement, which began being offered in November, he said.

Magellan says the new offering is not at a discount, and is only offered once managed account operators reach a $20m threshold.

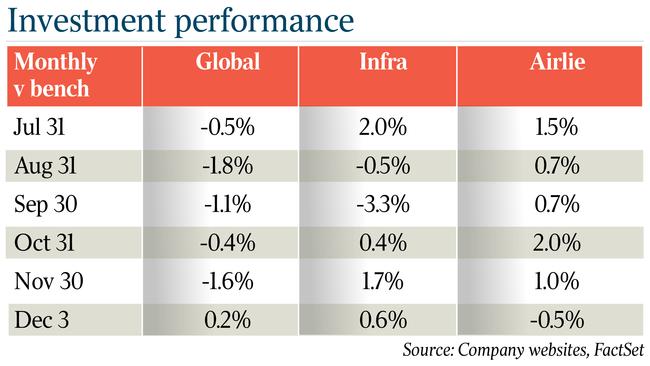

Magellan’s global equities fund over the year to September had underperformed its benchmark by 18.8 per cent. It underperformed by 1.1 per cent over five years – second only to a similar Platinum fund.

Analysis published by UBS this week estimates the fund had seen $560m in outflows between October and November – although this was offset by inflows of $780m.

One rival fund manager who spoke on condition of anonymity said Magellan would “be working hard to retain clients”, adding: “They are in outflows and the numbers have never been so bad.”

Dr Cairns quit the company on Monday afternoon, with Magellan issuing a terse statement about his resignation. A company spokeswoman told The Australian that Dr Cairns’s departure was not related to Mr Douglass.

But persistent speculation that the departure was related to Mr Douglass’s family situation led the company to issue a second statement on Wednesday confirming he and his wife had separated “some months ago”.

“We continue to spend considerable time together, and as a family,” the statement reads.

“There has been unfounded speculation in the media regarding our shareholding in Magellan … we can confirm we have no intention to sell any of our shares.”

“I remain totally committed to the business and its future,” Mr Douglass said in the statement.

“Alex and I would like to thank our family and friends for their incredible support and we would ask people to respect our family’s privacy moving forward.”

Midas Touch’s stake in Magellan is worth about $640m. Ms Douglass resigned from the family vehicle in March 2020, filings with the corporate regulator show.

The family’s home in Sydney remains a construction site, and Ms Douglass could not be reached for comment on Wednesday.

Dr Cairns, a former Merrill Lynch banker, joined Magellan in 2007 as a non-executive director and became the company’s executive chairman in 2015.

He swapped jobs with Mr Douglass in 2018, and will be temporarily replaced by chief financial officer Kirsten Morton.

Magellan declined to expand on the reasons behind the departure in a staff briefing on Tuesday.

Dr Cairns is also a director of Barrenjoey Capital Partners – 40 per cent-owned by Magellan – which has hired some of the country’s highest-profile investment bankers since it was established late last year. Many of those, including co-executive chairman Matthew Grounds, previously worked at UBS.

On Monday, UBS analysts Shreyas Patel and Scott Russell wrote to clients warning of “downside risks” to Magellan’s revenue outlook as “higher margin retail global equity outflows” were offset by “lumpy lower margin institutional inflows”.

The global equity fund’s largest holdings include e-commerce platform Alibaba, Microsoft, Netflix, Starbucks, Google owner Alphabet and Meta.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout