Magellan dives after exit of CEO Brett Cairns as chairman Hamish Douglass denies rift

Hamish Douglass’s funds management outfit says there’s no split between him and suddenly departed CEO Brett Cairns.

Hamish Douglass’s funds management outfit Magellan Financial says there is no split between the company’s chairman, Mr Douglass, and former chief executive Brett Cairns, who abruptly quit on Monday and immediately left the office.

Magellan did not explain the reasons for Dr Cairns’ exit after 13 years at the company, sending its share price into sharp decline.

Dr Cairns’ resignation heightened intense market speculation that the relationship between the two men had deteriorated – and that this was related to Mr Douglass’s family circumstances.

Magellan declined to expand on the reasons behind the departure in a staff briefing on Tuesday.

But a senior Magellan spokesman told The Australian that there had been “no falling out between Brett Cairns and Hamish Douglass” and “Brett Cairns’ departure from Magellan was in no way related to Hamish Douglass or their relationship”.

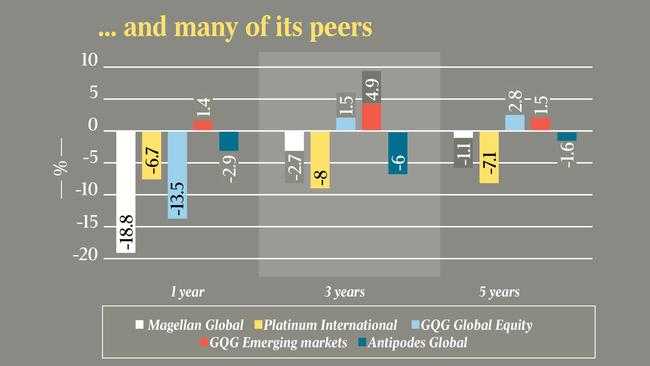

Magellan manages more than $116bn in funds, but has struggled with poor returns in recent years.

The company’s largest – the global equities fund – has underperformed its market benchmark by 5.3 per cent since June.

Research published by UBS on Monday estimated that the global equities fund had seen $560m in outflows between October and November. Overall, the investment bank’s analysts said, it was likely $496m had been pulled out of the various Magellan funds by retail investors, although this had been offset by an inflow of $780m from institutional investors between October and November.

“The quality appears low with lumpy lower margin institutional inflows offset by higher margin retail global equity outflows,” analysts Shreyas Patel and Scott Russell wrote in their note sent to clients on Monday evening.

“The flagship fund investment underperformance has persisted during November … (Magellan) has also announced the CEO has resigned,” they wrote. “We continue to see downside risks to the revenue outlook and retain our sell rating.”

The global equity fund’s largest holdings include e-commerce platform Alibaba, Microsoft, Netflix, Starbucks, Google owner Alphabet and Meta, the company previously known as Facebook.

Magellan shares fell 6.4 per cent on Tuesday to $29.10, its lowest point in two years. It has fallen almost 50 per cent since July.

Dr Cairns, a former Merrill Lynch banker, joined Magellan in 2007 as a non-executive director and became the company’s executive chairman in 2015. He swapped jobs with Mr Douglass in 2018, and will be replaced in an acting capacity by chief financial officer Kirsten Morton.

Dr Cairns is also a director of Barrenjoey Capital Partners – 40 per cent owned by Magellan – but is expected to leave the investment bank’s board.

Mr Douglass, who was photographed in late July on James Packer’s yacht in St Tropez, told the ASX on Monday he wished Dr Cairns “all the very best”.