Macquarie tips less credit availability with stricter lending standards

APRA requirements to be ‘constraining factor’ in banks’ ability to increase lending capacity, says Macquarie.

Stricter lending standards will crimp credit availability in 2020, while lower interest rates and the narrowing gap between banks’ front and back books will heap more pressure on lender profitability, Macquarie analysts have warned.

It comes as the property market roars back to life following a two-year slump, with experts now predicting both Sydney and Melbourne will post fresh record highs in the early months of next year. It marks a sharp turnaround from the double-digit falls both cities experienced from their 2017 peak.

Sydney house prices surged at their fastest pace in more than 30 years in November, rising by 2.7 per cent in the month, according to CoreLogic, while Melbourne prices jumped 2.3 per cent. Perth’s property market, meanwhile, experienced its first monthly price rise in two years, climbing 0.4 per cent.

READ MORE: National housing market back in positive growth territory | House prices will keep rising ... and this is why

Sydney and Melbourne house prices have now bounced back to within 8 per cent and 4 per cent of their 2017 peaks.

The price rises come months after the Reserve Bank of Australia (RBA) cut the official cash rate by a cumulative 75 basis points and follow the prudential regulator relaxing the lending restrictions it had put in place to take the heat out of the market prior to the downturn.

“While the relaxation of APRA’s limits and rate cuts provided an uplift to maximum borrowing capacity, the impact on credit growth has been muted,” Macquarie analysts said in a note to clients.

The stunted credit growth was partly due to homeowners paying off their mortgages faster, the low level of turnover activity in the housing market and banks tightening their credit assessment criteria, the bank said.

“Furthermore, APRA’s requirement to incorporate debt-to-income serviceability limits, in our view, is increasingly likely to become the constraining factor in banks’ ability to increase lending capacity.

“As a result, we expect credit growth trends to remain subdued, albeit the gap between the majors and non-majors is likely to narrow throughout of 2020 as credit assessment rules become more (consistent),” it said.

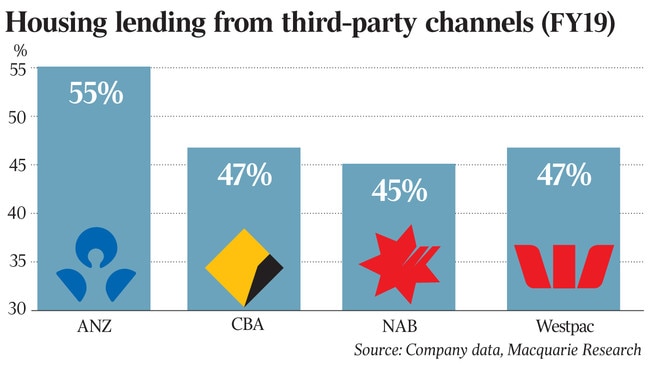

The tighter lending standards have already dented Westpac’s mortgage portfolio — it contracted by $2.3bn in October, to $408.9bn. NAB’s mortgage book also declined in the month, while ANZ’s rose $300m and CBA’s surged by $2bn.

“Westpac’s performance deteriorated further (in October), seeing its mortgage volumes decline by around 6 per cent (on an annualised basis). We understand that this was partly a result of Westpac’s implementation of tighter credit policies, which are expected to be phased in across peers,” Macquarie said.

“This may result in an overall tightening in credit availability and a more level playing field in 2020.”

Across the major banks, Macquarie sees further margin pressures as the gap between the rates it charges new borrowers and existing customers narrows.

“Pressure from lower interest rates (will) more than offset mortgage repricing benefits and we expect margins to contract by between four and seven basis points in the 2020 financial year,” they said.

“In addition to expected revenue headwinds … the second half of the financial year reporting season unveiled additional near-term headwinds related to cost pressures. We expect banks’ performance to be impacted by lower interest rates, narrowing in the front-to-back book gap and emerging cost pressures.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout